Click here to view an archive of interesting reads, fundamental investment topics, insights and more

___________________________

Today's links:

Markel's Tom Gayner on how he became a successful investor (Link)

___________________________

The surprising power of the long game (Link)

___________________________

The psychology of sitting in cash (Link)

___________________________

When the great alpaca bubble burst (Link)

__________________________

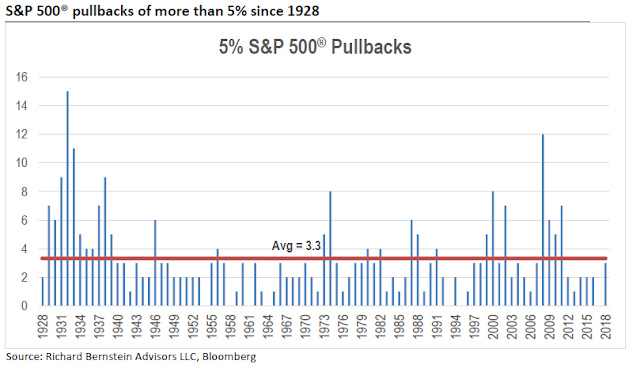

Nothing's scarier than...

(Source)

Stay spooky. Happy Halloween from the EdgePoint Team.