This week in charts…and photos

Alan Lynam – EdgePoint Partner since 2011 (Toronto, ON – Bloor & Bay)

Inspired by Dude With Sign.

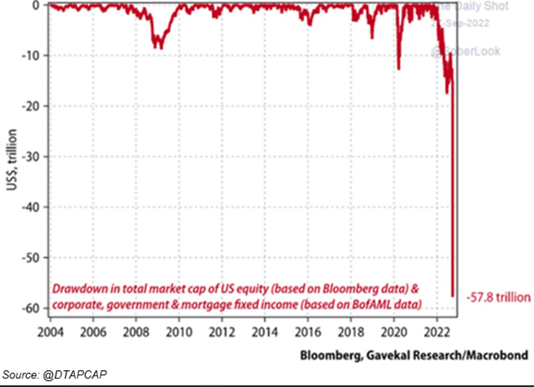

U.S. equity and fixed income market capitalization drawdown

Jerome Powell’s Inflation Whisperer: Paul Volcker

Without explicitly predicting a recession, officials have made clear their willingness to tolerate one. Mr. Powell has stopped talking about a so-called soft landing, in which the Fed slows growth enough to bring down inflation without causing a recession, except when asked. Instead, he has framed the Fed’s objective of bringing down high prices as an “unconditional” obligation and warned of even worse consequences for employment later if the Fed does not defeat inflation now. “We can’t fail on this,” Mr. Powell told lawmakers this summer.

The upshot is that Fed officials, while reluctant to say it bluntly, could raise rates until they force unemployment higher and slow wage growth, the mirror image of their strategy through the end of last year.

One Fed official, governor Christopher Waller, suggested this month the central bank would be comfortable with the jobless rate rising to around 5%, from its current 3.7%. That magnitude of increase has never occurred outside a recession.

“If unemployment were to stay under, say, 5%, I think we could really be aggressive on inflation,” he said. After it goes above 5%, the Fed will face “obvious pressure to start making tradeoffs” between employment and inflation.

The seven economic wonders of a worried world

In periods of gloom like this one, when commentators see nothing but faults in most countries, it is worth highlighting the few that defy the prevailing pessimism. Here are seven that stand out in a world tipping towards recession and higher inflation: Vietnam, Indonesia, India, Greece, Portugal, Saudi Arabia and Japan.

They share some combination of relatively strong growth, moderate inflation or strong stock market returns — compared with other countries. By fascinating coincidence, most of them also defy deep biases about the supposedly dim prospects of certain countries, cultures and systems.

Any of these economies could, of course, falter, undone by a turn in leadership, policy or by complacency. Still, these nations are already among the top performing stock markets this year. Amid well-founded worry about global prospects, a new set of winners is emerging.

Private Equity Giants Are Having Cash Flow Problems

At the core of the issue is that neither private equity powerhouse can generate enough cash to cover even its monthly interest repayments, not to mention operating costs such as staff compensation. At SoftBank, the largest recurring income is the dividend from its domestic telecommunications unit. Yet that can pay for only about 60% of its interest expense. The situation is similar at Fosun, with the added uncertainty that its cash on hand isn’t enough to cover its short-term debt and that about 45% of its debt will mature within a year, according to Moody’s.

SoftBank says it’s always managed to keep a simple cash position, while Fosun says it remains the controlling shareholder of its pharma unit.

With a private equity house, outside investors would normally look at the loan-to-value ratio as the main gauge of its liquidity. At only 14.8% and 41.5%, neither SoftBank nor Fosun seems troubled. But these are not normal times. Selling crown jewel assets now, even before a recession lands, smells of desperation. Neither house has proper liquidity management in order.

This week’s fun finds

EdgePointer of the month

Launching a new company usually means having to make tough decisions. But as she often does, Diane made things easy for Tye, Geoff and Pat when it came to choosing someone to head the Operations team. Her “can do” attitude, seemingly endless positive energy and the now-more-than three decades of experience with almost every facet of operations made Diane the obvious pick.

From the start, she’s had a focus for finding improvements and efficiencies to help things run smoother. Her wisdom, “roll up your sleeves” approach and quest to always be better keeps everyone on their toes. This holds true outside of the office as Diane often offers lifts home to partners who live nearby. But there’s a price as her productive nature turns the ride into a status update on current projects and other things on your “to do” list. It’s not all business though! Diane takes the time to enjoy life – whether it’s a glass or two of prosecco with friends and family or being up for a travel adventure at a moment’s notice!

Before joining EdgePoint, Diane started her operations journey at Invesco Ltd. (previously Trimark). She was at the company for 14 years, serving as assistant vice president of operations and was instrumental in establishing its back-office administration team. Diane then continued to make an impact when she joined Burgundy Asset Management as head of client administration, transforming operations and cultivating a culture focused on providing superior service.

Speaking of trips, here are some of Diane’s favourite travel destinations:

• Italy (all of it) – History, wine, landscapes, great food everywhere. It has it all! While driving through Italy, you can enjoy amazing pasta for 10€ from Autogrill (a chain that’s the country’s version of a North American truck stop).

• Denmark (Copenhagen) – Everyone’s happy there. Tivoli Gardens, their version of Disneyland, is a must-see and CopenHill, the world's cleanest waste-to-energy plant that also doubles as a ski hill. Who knew open-faced sandwiches (smørrebrød) were so delicious?

• Czech Republic (Prague) – A combination of rich history with a medieval feel. You can hear live music everywhere and it’s only a 4-hour train ride from Vienna!

• Thailand (Phuket) – The friendliest and most peaceful people you’ll ever come across, along with the finest white beaches.

Bonus – the book that changed Diane’s life:

This book got me to EdgePoint. It will change your thoughts on the laws of attraction and can help you manifest what you want.

EdgePoint Football Club returns

EFC had another intra-company match before the weather gets too cold. Several people had to leave before the photo, but we’re happy to report no injuries other than a few bruised egos on the pitch.

Off the Road Again: A Tour Bus Shortage Is Pricing Some Acts Out of Touring

Demand for tour buses has been unusually high since early last year, when artists returned to the road after nearly a year of pandemic lockdown — and this year, top promoters report more touring stars and higher attendance than in pre-COVID 2019. Yet bus supply remains low. Experienced drivers have left the concert business for more stable trucking jobs, and tour bus companies have to wait longer than ever for repair parts due to international supply-chain problems. So many top bus companies, like restaurants and grocery stores, have raised their rates.

“It’s worse than ever before. There’s just a shortage all the way around,” says Jamie Streetman, operations manager for Nashville-based Coach Quarters, which leases 20 buses, adding that industry prices have recently increased from $550 a day to $750 or $800. “There are tours being canceled left and right, because they simply have no way to get there.”

Top acts can absorb the higher costs, or pass them along to consumers by raising ticket prices, but club-level acts often have no means to do so. Gas prices – although they’ve come down recently – have added to artists’ budgetary stresses all year. Buses are “much more expensive than prior to Covid,” says Lahteefah “Lah” Parramore, a partner with business-management firm Prager Metis, adding that artists are cutting budgets elsewhere to make up the difference.

“Buses are raising their prices, and bands have to either pay it or lose the bus,” says singer-guitarist Michael Sweet of hard rockers Stryper, who recently postponed half their fall dates due to bus prices. “You budgeted $15,000-20,000 for fuel, and you look at the potential of that being doubled.”

Home ownership leads to less happiness than expected, study finds

A big yard, more space, or admiration from family and friends; the reasons for home ownership may vary, but the goal is the same: ultimately, it's intended as an investment in happiness. Prof. Dr. Alois Stutzer and Dr. Reto Odermatt of the University of Basel's Faculty of Business and Economics examined whether home-buyers' expected increase in life satisfaction actually materialized following their move into their own four walls. Their results are outlined in the Journal of Happiness Studies.

The authors evaluated the statements of over 800 future home owners in Germany as recorded in the German Socio-Economic Pales (GSOEP). The dataset contains information about people's expected and actual life satisfaction. On a scale of 0 to 10, respondents were asked to evaluate their current level of happiness and to predict where they would fall on the scale in five years. Results indicated that homeownership does, in fact, result in increased happiness, but not to the extent predicted by the future homeowners themselves.