Adam Young and Sydney Campbell – Partners since 2019 and 2020 (Yonge-Dundas Square – Toronto, ON)

Our holiday gift guide – 2022 edition

For those fearing winter (and those looking forward to it), we have a new list of gift recommendations tested by EdgePointers. As always, they’re as varied as the partners who recommended them. From digital to analog, there are things for the home and even something in outer space. We hope they help inspire your presents for those closest to you these holidays. Just like last year, we’re also featuring some items made by some of our Portfolio companies (although this isn’t a recommendation to by a company’s securities).

EdgePointer of the Month

The latest EdgePointer of the Month is Nataliya Goreva, head of Trading Operations.

Read more about our multilingual, world traveler Nataliya.

This week in charts

Returns by asset class since 2011

About 670,000 variable-rate mortgages have been issued since the start of the pandemic, according to the Bank of Canada. Variable-rate mortgages accounted for around 50 per cent of all mortgages issued since mid-2021, compared to an average of 20 per cent in the years before the pandemic.

Borrowers have sought the variable-rate products because borrowing costs have typically been cheaper

Financial markets expect the bank’s benchmark interest rate to reach 4.25 per cent by early 2023, up from 3.75 per cent today.

“This is not a large share of households, but it is larger than it would have been based on historical trends,” [Bank of Canada Senior Deputy Governor Carolyn] Rogers said.

than fixed-rate mortgages. Part of the motivation was that federal banking rules require borrowers to prove they can make their monthly mortgage payments at an interest rate at least two percentage points higher than their actual mortgage contract.

Problems in the mortgage market can infect the broader financial system if borrowers default on payments. Ms. Rogers said Canada’s banking system is in a good position to handle potential shocks, thanks to reforms following the 2008-09 financial crisis that increased capital and liquidity requirements for lenders and bolstered mortgage stress tests.

Moreover, the central bank is “not expecting a severe economic downturn with the kind of large job losses typical of past recessions,” she said.

But tens of thousands of homeowners will be pinched as interest rates continue to rise. The Bank of Canada is widely expected to raise interest rates again on Dec. 7, either by a quarter-point or half-point.

What Really Matters? (Howard Marks memo)

“What really matters is the performance of your holdings over the next five or ten years (or more) and how the value at the end of the period compares to the amount you invested and to your needs. Some people say the long run is a series of short runs, and if you get those right, you’ll enjoy success in the long run. They might think the route to success consists of trading often in order to capitalize on relative value assessments, predictions regarding swings in popularity, and forecasts of macro events. I obviously do not.

“I think most people would be more successful if they focused less on the short run or macro trends and instead worked hard to gain superior insight concerning the outlook for fundamentals over multi-year periods in the future. They should:

• “study companies and securities, assessing things such as their earnings potential;

• “buy the ones that can be purchased at attractive prices relative to their potential;

• “hold onto them as long as the company’s earnings outlook and the attractiveness of the price remain intact; and

• “make changes only when those things can’t be reconfirmed, or when something better comes along.

This week’s fun finds

Walk this number of steps each day to cut your risk of dementia

People between the ages of 40 and 79 who took 9,826 steps per day were 50% less likely to develop dementia within seven years, the study found. Furthermore, people who walked with “purpose” – at a pace over 40 steps a minute – were able to cut their risk of dementia by 57% with just 6,315 steps a day.

“It is a brisk walking activity, like a power walk,” said study coauthor Borja del Pozo Cruz, an adjunct associate professor at the University of Southern Denmark in Odense, Denmark, and senior researcher in health sciences for the University of Cadiz in Spain.

Even people who walked approximately 3,800 steps a day at any speed cut their risk of dementia by 25%, the study found.

The largest reduction in dementia risk – 62% – was achieved by people who walked at a very brisk pace of 112 steps per minute for 30 minutes a day, the study found. Prior research has labeled 100 steps a minute (2.7 miles per hour) as a “brisk” or moderate level of intensity.

The editorial argued that individuals looking to reduce their risk of dementia focus on their walking pace over their walked distance.

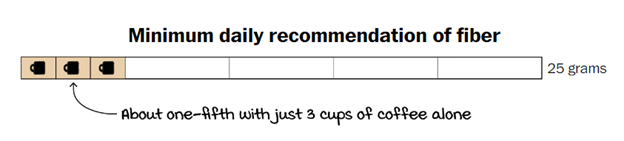

Do you start your mornings with a potent dose of caffeine from a freshly brewed cup of Joe? Or do you prefer a slightly less caffeinated nudge from a warm and gentle cup of tea?

Whatever your preference, scientists have found that regularly drinking coffee or tea can provide a variety of health benefits. But how do coffee and tea compare in a head-to-head matchup? We took a look at the research, and here’s what we found.

Pearl is the mascot of the Halifax Oyster Festival — a giant oyster with over a dozen eyes, luscious lips and long legs.

The Coast, a digital-first news outlet in Halifax, puts on the Halifax Oyster Festival every year. They created Pearl six years ago to represent the festival.

Note: OysterFest is this weekend, November 25 and 26.