Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

While investors display clear skill in buying, their selling decisions underperform substantially (Link)

"We present evidence consistent with limited attention as a key driver of this discrepancy, with investors devoting more resources to buy decisions than sell decisions. When attentional resources are more likely to be equally distributed between prospective purchases and sales, specifically around company earnings announcement days, stocks sold outperform counterfactual strategies similar to buys. We document managers' use of a heuristic that overweights a salient attribute of portfolio assets - past returns - when selling, whereas we do not observe similar heuristic use for buys. Assets with extreme returns are more than 50% more likely to be sold than those that just under- or over-performed. Finally, we document that the use of the heuristic appears to a mistake and is linked empirically with substantial overall underperformance in selling."

CPP ads on one of the most expensive TV spots for Canadian TV. (Link)

"Canadian viewers of this year’s NFL’s wild card weekend were startled to see a certain commercial in heavy rotation. No, not the Budweiser Clydesdales, or the burger and soft drink ads that are the pricey broadcasts’ usual fare. Rather, this important message was brought to you by the Canada Pension Plan Investment Board. “You don’t think about CPP Investment Board,” the announcer chirped, while the usual assortment of smiling Canadians went blissfully about their assorted business, “but we think about you every day.” Indeed, “while you may not think about it, you started saving for retirement with your first paycheque.” Cue the music (Great Big Sea’s “Ordinary Day”) and the slogan: “Investing today for your tomorrow.”

Canadian Equities

Friday, January 11, 2019

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Too busy during the week? Catch up with last week's charts and articles:

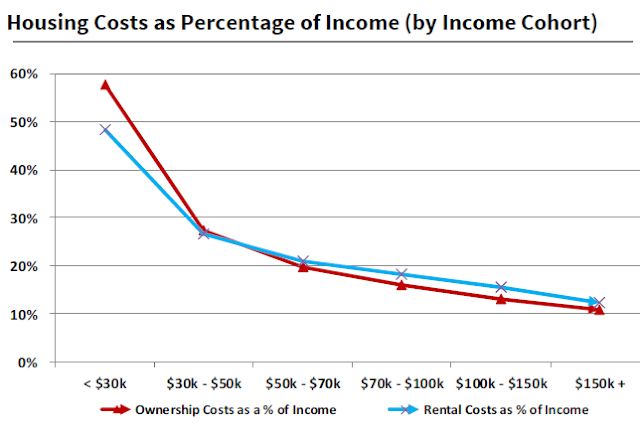

Housing

Markets

World

Looking back on the last 40 years of reforms in China by Ray Dalio (Link)

Wouldn't it be sad if Canada can't help displace coal in emerging markets? (Link)

Businesses

Apparently LEGO sets have outperformed equities over the long-term (Link)

How much of the internet is fake? Turns out, a lot of it, actually (Link)

Addiction to a language-learning app $(Link)

Industrial production

Millennials

Youth use of e-cigarettes has soared over the past year $(Link)

Millennials aren't the only ones struggling to find a home to buy. A shortage of houses in the entry-level price range is prompting institutional landlords to begin building new ones themselves. $(Link)

_________________

Too busy during the week? Catch up with last week's charts and articles:

Housing

Markets

World

Looking back on the last 40 years of reforms in China by Ray Dalio (Link)

Wouldn't it be sad if Canada can't help displace coal in emerging markets? (Link)

Businesses

Apparently LEGO sets have outperformed equities over the long-term (Link)

How much of the internet is fake? Turns out, a lot of it, actually (Link)

Addiction to a language-learning app $(Link)

Industrial production

Millennials

Youth use of e-cigarettes has soared over the past year $(Link)

Millennials aren't the only ones struggling to find a home to buy. A shortage of houses in the entry-level price range is prompting institutional landlords to begin building new ones themselves. $(Link)

Thursday, January 10, 2019

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Looking back on the last 40 years of reforms in China by Ray Dalio (Link)

"I believe while there will be trade wars and trade truces, they aren’t the most important things. The most important things are that 1) China has a culture and system that has worked well for it for a long time so it shouldn’t be expected to change much, 2) the U.S. has the same, 3) these systems (and those of other countries) will be both competing and cooperating, and how well they do that will be an important influence on global conditions, 4) how well each system works in practice will have a far greater influence on where each country stands in the future than the terms of the deals that they strike with each other, so each would do well to examine its own weaknesses and come up with reforms to rectify them, and 5) there is a lot to respect about the Chinese culture and approach that led to its remarkable accomplishments, 6) we would do well to learn from each other, cooperate and compete to bring each other up rather than to tear each other down, and 7) China is a place we need to continue to evolve with and invest in."

Wouldn't it be sad if Canada can't help displace coal in emerging markets? (Link)

"At present, Chinese LNG demand is surging. For the first nine months of the year, Chinese imports are up an incredible 50% year-on-year. However, it’s not just China that will drive LNG demand going forward. Using our same methodology, we expect India, Turkey, Pakistan, and Thailand will all see sharply higher demand for LNG volumes between now and 2025. Furthermore, as domestic demand comes in stronger than expected, several LNG exporting countries are facing feed gas shortages. Indonesia, Egypt, and Brazil have all run into problems and limited exports since we first identified this potential bottleneck several years ago. Indonesia’s new large-scale export terminal on Papua is now expected to entirely serve domestic gas demand, and as a result, no volumes are expected to reach the export market."

Investor behaviour - investors remain their own worst enemy

_________________

Looking back on the last 40 years of reforms in China by Ray Dalio (Link)

"I believe while there will be trade wars and trade truces, they aren’t the most important things. The most important things are that 1) China has a culture and system that has worked well for it for a long time so it shouldn’t be expected to change much, 2) the U.S. has the same, 3) these systems (and those of other countries) will be both competing and cooperating, and how well they do that will be an important influence on global conditions, 4) how well each system works in practice will have a far greater influence on where each country stands in the future than the terms of the deals that they strike with each other, so each would do well to examine its own weaknesses and come up with reforms to rectify them, and 5) there is a lot to respect about the Chinese culture and approach that led to its remarkable accomplishments, 6) we would do well to learn from each other, cooperate and compete to bring each other up rather than to tear each other down, and 7) China is a place we need to continue to evolve with and invest in."

Wouldn't it be sad if Canada can't help displace coal in emerging markets? (Link)

"At present, Chinese LNG demand is surging. For the first nine months of the year, Chinese imports are up an incredible 50% year-on-year. However, it’s not just China that will drive LNG demand going forward. Using our same methodology, we expect India, Turkey, Pakistan, and Thailand will all see sharply higher demand for LNG volumes between now and 2025. Furthermore, as domestic demand comes in stronger than expected, several LNG exporting countries are facing feed gas shortages. Indonesia, Egypt, and Brazil have all run into problems and limited exports since we first identified this potential bottleneck several years ago. Indonesia’s new large-scale export terminal on Papua is now expected to entirely serve domestic gas demand, and as a result, no volumes are expected to reach the export market."

Investor behaviour - investors remain their own worst enemy

Wednesday, January 9, 2019

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Millennials aren't the only ones struggling to find a home to buy. A shortage of houses in the entry-level price range is prompting institutional landlords to begin building new ones themselves. $(Link)

"California-based American Homes 4 Rent has been building houses throughout the Southeast to add to its pool of more than 52,000 rental homes across the country. Chief Executive David Singelyn told a recent gathering of rental investors that in some places the company can build houses for about the same price that it costs to buy existing ones. By building houses, American Homes avoids sales commissions and renovation costs. It can outfit homes with its preferred fixtures and finishes at the onset, and charge higher rents than it can fetch for its older homes, Mr. Singelyn said."

U.S. millennial stats

Source: Raymond James Report on 2019 outlook

_________________

Millennials aren't the only ones struggling to find a home to buy. A shortage of houses in the entry-level price range is prompting institutional landlords to begin building new ones themselves. $(Link)

"California-based American Homes 4 Rent has been building houses throughout the Southeast to add to its pool of more than 52,000 rental homes across the country. Chief Executive David Singelyn told a recent gathering of rental investors that in some places the company can build houses for about the same price that it costs to buy existing ones. By building houses, American Homes avoids sales commissions and renovation costs. It can outfit homes with its preferred fixtures and finishes at the onset, and charge higher rents than it can fetch for its older homes, Mr. Singelyn said."

U.S. millennial stats

Source: Raymond James Report on 2019 outlook

Monday, January 7, 2019

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Youth use of e-cigarettes has soared over the past year $(Link)

"Youth use of e-cigarettes has soared over the past year, thanks largely to Juul, whose sales have skyrocketed since mid-2017. One out of every five high school students—more than three million teens—reported using e-cigarettes recently, according to a federal survey conducted this past spring. Some, like Mr. Kinard, have become addicted to the powerful doses of nicotine that Juuls and similar e-cigarettes pack."

How much of the internet is fake? Turns out, a lot of it, actually (Link)

"Take something as seemingly simple as how we measure web traffic. Metrics should be the most real thing on the internet: They are countable, trackable, and verifiable, and their existence undergirds the advertising business that drives our biggest social and search platforms. Yet not even Facebook, the world’s greatest data–gathering organization, seems able to produce genuine figures. In October, small advertisers filed suit against the social-media giant, accusing it of covering up, for a year, its significant overstatements of the time users spent watching videos on the platform (by 60 to 80 percent, Facebook says; by 150 to 900 percent, the plaintiffs say)."

Addiction to a language-learning app $(Link)

"Von Ahn set out with his developers to make the app as addictive as Candy Crush and other popular games—in a good way. Good or bad, Duolingo’s addiction rate is way up. Next-day retention is 55 percent, up from 13 percent in 2012. And with about 300 million users, Duolingo is the largest language-teaching company in the world, by user base. The company has tapped into the latest research from behavioral scientists such as Angela Duckworth, an expert on self-control, and cadged ideas from game makers, who, von Ahn says, “have nailed down behavioral addiction really well.” One copied technique, “appointment mechanics,” encourages users to keep returning by rewarding streaks of uninterrupted daily practice with jewels that can be traded for in-game rewards."

_________________

Youth use of e-cigarettes has soared over the past year $(Link)

"Youth use of e-cigarettes has soared over the past year, thanks largely to Juul, whose sales have skyrocketed since mid-2017. One out of every five high school students—more than three million teens—reported using e-cigarettes recently, according to a federal survey conducted this past spring. Some, like Mr. Kinard, have become addicted to the powerful doses of nicotine that Juuls and similar e-cigarettes pack."

How much of the internet is fake? Turns out, a lot of it, actually (Link)

"Take something as seemingly simple as how we measure web traffic. Metrics should be the most real thing on the internet: They are countable, trackable, and verifiable, and their existence undergirds the advertising business that drives our biggest social and search platforms. Yet not even Facebook, the world’s greatest data–gathering organization, seems able to produce genuine figures. In October, small advertisers filed suit against the social-media giant, accusing it of covering up, for a year, its significant overstatements of the time users spent watching videos on the platform (by 60 to 80 percent, Facebook says; by 150 to 900 percent, the plaintiffs say)."

Addiction to a language-learning app $(Link)

"Von Ahn set out with his developers to make the app as addictive as Candy Crush and other popular games—in a good way. Good or bad, Duolingo’s addiction rate is way up. Next-day retention is 55 percent, up from 13 percent in 2012. And with about 300 million users, Duolingo is the largest language-teaching company in the world, by user base. The company has tapped into the latest research from behavioral scientists such as Angela Duckworth, an expert on self-control, and cadged ideas from game makers, who, von Ahn says, “have nailed down behavioral addiction really well.” One copied technique, “appointment mechanics,” encourages users to keep returning by rewarding streaks of uninterrupted daily practice with jewels that can be traded for in-game rewards."

Thursday, January 3, 2019

Get the Edge

Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

How not to be stupid (Link)

"Stupidity is the cost of intelligence operating in a complex environment. It’s almost inevitable. Seven factors that lead to stupidity: being outside your normal environment or changing your routines, being in the presence of a group, being in the presence of an expert or if you, yourself, are an expert, doing any task that requires intense focus, information overload, physical or emotional stress, fatigue. All seven factors are present in U.S. hospitals. All seven factors. This will astonish you. In the United States every year, there are roughly 30,000 fatalities from automobile accidents. That is a benchmark. How many deaths accidentally occur, accidentally, in hospitals every year? In other words, you go in with a broken arm and you don’t come out. Not, you died as a result of what you went in for. You died because of error, human error. I would tell you the current best estimate—this is deaths, mind you, not injuries—is 210,000 to 440,000 people die every year in the United States from hospital error."

Canada can and should be a leader in managing the impacts of climate change (Link)

"Canada's responsibly produced oil and natural gas can mitigate the impact of climate change globally. The Trans Mountain pipeline, if constructed, would transport roughly 590,000 b/d of oil, produced with leading environmental and social standards, to global markets. If Canadian standards were recognized and applied worldwide, the amount of GHG emissions from producing a barrel of oil would fall by 23%, the equivalent of removing approximately 100 million cars from the road. By approving and constructing the Trans Mountain pipeline, Canada will be reducing global GHG emissions."

Japan's return on equity and price to book value discount vs. world

Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

How not to be stupid (Link)

"Stupidity is the cost of intelligence operating in a complex environment. It’s almost inevitable. Seven factors that lead to stupidity: being outside your normal environment or changing your routines, being in the presence of a group, being in the presence of an expert or if you, yourself, are an expert, doing any task that requires intense focus, information overload, physical or emotional stress, fatigue. All seven factors are present in U.S. hospitals. All seven factors. This will astonish you. In the United States every year, there are roughly 30,000 fatalities from automobile accidents. That is a benchmark. How many deaths accidentally occur, accidentally, in hospitals every year? In other words, you go in with a broken arm and you don’t come out. Not, you died as a result of what you went in for. You died because of error, human error. I would tell you the current best estimate—this is deaths, mind you, not injuries—is 210,000 to 440,000 people die every year in the United States from hospital error."

Canada can and should be a leader in managing the impacts of climate change (Link)

"Canada's responsibly produced oil and natural gas can mitigate the impact of climate change globally. The Trans Mountain pipeline, if constructed, would transport roughly 590,000 b/d of oil, produced with leading environmental and social standards, to global markets. If Canadian standards were recognized and applied worldwide, the amount of GHG emissions from producing a barrel of oil would fall by 23%, the equivalent of removing approximately 100 million cars from the road. By approving and constructing the Trans Mountain pipeline, Canada will be reducing global GHG emissions."

Japan's return on equity and price to book value discount vs. world

Wednesday, January 2, 2019

Get the Edge

Click here to view an archive of:

Investment Education

Book Recommendations

Food for thought

Glimpses into EdgePointers' lives

...and Daily Musings

__________________________

Joel Greenblatt on passive investing

"The shift to passive management is a powerful trend dominating the investment industry. The liquidity, lack of tracking error, and low costs associated with passive investing are clearly attractive. However, active management is the only way to truly outperform the market as a whole over time. Gotham Asset Management founder and co-CIO Joel Greenblatt shares his thoughts on the debate and provide insights on ways to navigate the changing landscape".

What's an unusual year for the stock market? (Link)

"Very roughly, the stock market gains, on average, about 1/40th of a percent each trading day. In other words, a $40 stock gains about one penny each day. Yet the standard deviation, meaning the average daily swing, is about 1% each day. That means the daily “noise” is about 40 times the true value each day, again, on average. On average, the stock market gains about 6% to 7% each year, and the standard deviation is around 15%. So right now, we’re tracking about one standard deviation below the mean. That’s perfectly normal."

Rewards credit cards gained a fanatic following - now banks are pulling back $(Link)

"Big banks calculated that giant rewards would make consumers spend more, earning the banks more interest and boosting their returns. They calculated wrong. Consumers have figured out how to game the system, spending just enough to earn generous sign-up bonuses—then abandoning the cards in a drawer. Others pay their bills in full and avoid interest charges and late fees. This has pressured credit card profitability for banks. Once the crown jewel of their lending portfolios, credit cards are estimated to only deliver a return on assets of 3% in 2019, down from nearly 5% in 2014."

Click here to view an archive of:

Investment Education

Book Recommendations

Food for thought

Glimpses into EdgePointers' lives

...and Daily Musings

__________________________

Joel Greenblatt on passive investing

"The shift to passive management is a powerful trend dominating the investment industry. The liquidity, lack of tracking error, and low costs associated with passive investing are clearly attractive. However, active management is the only way to truly outperform the market as a whole over time. Gotham Asset Management founder and co-CIO Joel Greenblatt shares his thoughts on the debate and provide insights on ways to navigate the changing landscape".

What's an unusual year for the stock market? (Link)

"Very roughly, the stock market gains, on average, about 1/40th of a percent each trading day. In other words, a $40 stock gains about one penny each day. Yet the standard deviation, meaning the average daily swing, is about 1% each day. That means the daily “noise” is about 40 times the true value each day, again, on average. On average, the stock market gains about 6% to 7% each year, and the standard deviation is around 15%. So right now, we’re tracking about one standard deviation below the mean. That’s perfectly normal."

"Big banks calculated that giant rewards would make consumers spend more, earning the banks more interest and boosting their returns. They calculated wrong. Consumers have figured out how to game the system, spending just enough to earn generous sign-up bonuses—then abandoning the cards in a drawer. Others pay their bills in full and avoid interest charges and late fees. This has pressured credit card profitability for banks. Once the crown jewel of their lending portfolios, credit cards are estimated to only deliver a return on assets of 3% in 2019, down from nearly 5% in 2014."

Subscribe to:

Comments (Atom)