In the fourth installment of our retirement series, we talk about the sequence of returns risk and how to structure your investments so that you give your portfolio a chance to handle any short-term volatility.

As of August 10th, 1 in 5 small and mid-cap stocks are still down more than 30% since the beginning of the coronavirus crisis. According to JPM’s Head of Small and Midcap Equities, many of these businesses have solid balance sheets, all-time low valuations, and are not structurally damaged.

This brings opportunity for active investors who use fundamental analysis and expertise to pick specific investments in an effort to beat the market over the long-term. For every dollar that is managed actively today, there is 80 cents managed passively with no regards for fundamentals. Passive investors are simply tracking an index which today is exacerbating the gap between fundamentals and valuations.

Investors, cooped up and eager for normality’s return, are mistakenly bidding up share prices, Seth Klarman contends—and it won’t end well.

One of the culprits: deluded investors. His assessment, is a nuanced reading of mass psychology amid virus anxieties and isolation. Impatience for a return to a regular, epidemic-free life has made them eager for quick riches through stocks, he believes.

“There is little evidence of thought as to whether the price of a security already reflects current and projected future news flow or whether the opening up of the economy might be premature, a sign not of strength, but of impatience, lack of resolve, and poor judgment.”

A devotee of value guru Benjamin Graham, Klarman has long preached that investors should be patient.

The shutdown impacted businesses of all sizes. Many proclaimed our old way of life would be changed forever. It would be “the end of commuting,” “the demise of retail,” or “the collapse of globalization”.

The reality of how companies are dealing with the crisis and preparing for the recovery tells a very different story, one of pivoting to business models conducive to short-term survival along with long-term resilience and growth.

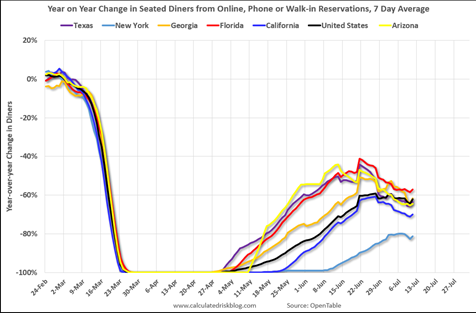

Let’s examine the world of restaurants. They have been battered by the lockdown, with many owners pondering whether to close for good. The usual way to think about restaurants includes envisioning a seating area next to a kitchen. However, restaurants are kitchens whose output can be delivered to customers in a number of ways and using various kinds of business models. Eat-in, take-out, delivery, and catering are just the tip of the iceberg.

One pivot would be to offer a flat rate for a set number of meals per week or per month, with limited menu choices. Restaurants could increase their margins as they learned how to manage captive demand. Another pivot would be to offer a combination of precooked dishes with sides or additions that could be prepared at home using ingredients supplied by the restaurant. The restaurant could send a link to a video that walks the customer through preparation, thus incorporating an experiential and learning element. Deliveries could be in amounts large enough for several meals in a given week. Both pivots would lead to a greater variety of business models, which could become a permanent feature of the restaurant landscape, especially if the trend toward remote work from home consolidates over the long run.

The crisis has also led to broken supply chains, as reflected in the ominous images of empty supermarket shelves — a void that presented small farmers with a unique opening. After seeing their sales to restaurants and specialty stores plummet during the lockdown, many small-scale farms have set their sights on the needs of the homebound consumer. This pivot requires investments in information technology, marketing, and logistics that could prove profitable over the long run if the trend toward shorter supply chains gains momentum.

Warren Buffett appears to have bought back more than $7 billion of Berkshire Hathaway stock over the past three months, underlining the famed investor's willingness to deploy significant amounts of cash and his view that Berkshire shares are a bargain.

Moreover, the buybacks indicate that Buffett views Berkshire stock as undervalued, given his policy is to only repurchase it when it trades below a conservative estimate of Berkshire's intrinsic value. Berkshire's shares are down about 7% this year, lagging the benchmark S&P 500 index's 3% gain.

The company's market capitalization is also about 1.3 times its net assets of $397 billion at the end of June — not far off the 1.2 multiple Buffett has previously quoted as an enticing level to buy back shares.

BRK is a holding in EdgePoint and Cymbria portfolios.

This graph shows the % of light vehicle sales between passenger cars vs trucks/ SUVs through July 2020. Light trucks/SUVs accounted for 76% total light vehicle sales in July 2020.