This week in charts

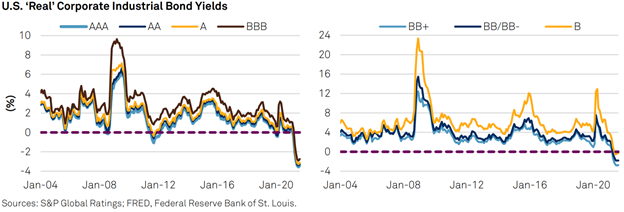

Money has never been this cheap

Citing “inflation” on Earnings Calls

Container shipping by vessels

The recent synchronized selloff in U.S. equities and Treasuries

was likely just the beginning of what’s to come for the popular 60/40

stock-bond portfolio strategy, a growing chorus of Wall Street strategists

warn.

Underpinning all these warnings is an economy that’s now facing

mounting inflationary pressures after spending years warding off the threat of

deflation. During the last two decades, subdued growth boosted the allure of

the 60/40 strategy, one that’s built on a negative stock/bond correlation where

one serves as buffers for the other.

With inflation fears raging, the worry is the Federal Reserve will seek to slow down the economy and rising rates will spell trouble for both bonds and stocks. September offered a taste of the pain, with a Bloomberg model tracking a portfolio of 60 per cent stocks and 40 per cent fixed-income securities suffering the worst monthly drop since the pandemic started in early 2020.

Do you have a

Financial Therapist?

The Financial Therapy Association, founded in 2009, now has 317

members, a 51% increase in just four years. This spring the CFP (Certified

Financial Planner ) Board broke precedent by adding the psychology of financial

planning as a new “principle knowledge topic” required for study and continuing

education to be a certified financial planner.

The Financial Therapy Association defines this approach as a

process “informed by both therapeutic and financial competencies that helps

people think, feel, communicate and behave differently with money to improve

overall well-being through evidence-based practices and interventions.”

Its founding president, Sonya Lutter, believes that RIAs and wealth managers will inevitably either have financial therapists on staff or routinely refer clients to therapists just as they refer clients to estate planning specialists or accountants.

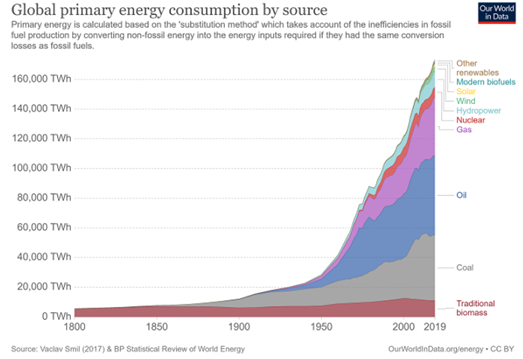

Hedge funds cash

in on energy stocks

Hedge funds have been quietly scooping up the shares of unloved

oil and gas companies discarded by environmentally minded institutional

investors and are now reaping big gains as energy prices surge.

Hedge fund managers in the US and UK have been betting that the

eagerness of many big institutions to be seen to embrace environmental, social

and governance (ESG) standards means they are selling wholesale out of fossil

fuel stocks, even though demand for some of these products remains high.

“It’s such a great and easy idea,” Crispin Odey, founder of

London-based Odey Asset Management, told the Financial Times.

“They [big institutional investors] are all so keen to get rid of

oil assets, they’re leaving fantastic returns on the table,” added Odey, whose

European fund is up more than 100 per cent so far this year.

Alongside Odey’s fund, Goldman Sachs’s prime brokerage division,

which provides a range of services such as stock lending and execution,

recently told clients that energy stocks had had their biggest net buying by

hedge funds since late February, according to a note seen by the FT.