New EdgePoint swag - EdgePoint ornament

Spread some joy with the Edge-iest ornament around. Perfect for hanging from whatever holiday fixture you want. As always, you can shop guilt-free since all profits will go towards lowering our investors' fees.

Demographics

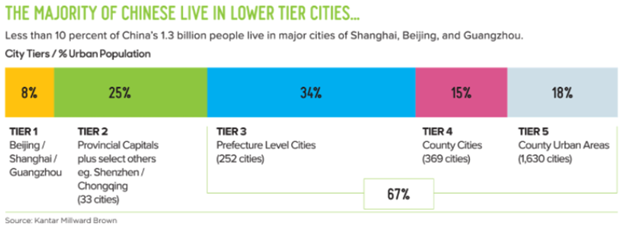

In need of a baby boom, China clamps down on vasectomies

Zhao Zihuan, a first-time mother in the Chinese city of Jinan, had two miscarriages before giving birth to a son last year. The seven-hour labor ended in an emergency Caesarean section.

Exhausted by child care, the 32-year-old and her husband decided one kid was enough — so in April they began to inquire about a vasectomy. Yet they were turned down by two hospitals. One doctor told Zhao’s husband that the surgery was no longer allowed under the country’s new family-planning rules.

For more than three decades, Chinese authorities forced men and women to undergo sterilization to control population growth. Now, as the government tries to reverse a plummeting birthrate that it fears could threaten social stability and the economy, hospitals are turning away men seeking vasectomies

Couples and single men who sought the procedure said doctors and hospital staff refused, telling them they would regret the decision later. Some asked for documentary proof of marriage and evidence that couples had already had children before going ahead with the surgery.

Chinese weddings fall to 13-year low as demographic crisis brews

China’s efforts to lower the cost of marriage and boost birth rates have failed to lead to more weddings, dealing a blow to a crucial policy intended to combat a rapidly ageing society. The world’s most populous country faces a demographic crisis as authorities grapple with the economic challenges caused by a shrinking population. Chinese census data released this year showed the population had increased at its slowest pace in decades.

“A drop in marriage will affect birth rates and in turn economic and social development,” said Yang Zongtao, a senior official at the MCA last year. “We are hoping to . . . actively create favourable conditions for more people of suitable ages to walk into marriage.

A big challenge has been the country’s gender imbalance, with young men outnumbering women of similar age by a considerable margin after decades of China’s one-child policy. “The space for new policy is limited when you have more young men than women,” said a Beijing-based government adviser. “It is inevitable that a lot of men will remain single in their lifetime.”

The adviser said China’s gender imbalance had barely improved from the 2010 census, which reported 2.2m single men aged 25-34 and 1.2m single women in the same age group.

ARK ETFs returns from their peak in 2021

Ark's Cathie Wood: 'Queen of the bull market' faces her toughest test

Ark Invest, the investment company the Californian native founded in 2014, was made for those who fancy a version of the tech-driven bull market on steroids. Harnessing social media with a skill rarely seen on Wall Street, Wood has attracted legions of retail investors and billions of dollars by pitching aggressive bets on companies and technologies she says will reshape the world, most famously Tesla. The results have been spectacular — until now.

Based in newly established offices in St Petersburg, Florida, Ark has been one of the biggest winners from the market’s embrace of moonshot bets on disruptive companies, an approach whose risks the Federal Reserve has helped gloss over with waves of monetary stimulus.

But with Fed chair Jay Powell last month signalling a determination to scale back support, Ark now faces the toughest test in its short history as sentiment turns against the hot but often unprofitable technology stocks that have powered its rise.

While ARKK’s record of average annual gains is stellar, many came when it had a much smaller asset base. Amundi, one of Europe’s largest asset managers, estimates that the average investor in the ETF is now underwater.

By December 7, all 44 of its holdings were off their peak, and just six have escaped sliding into a bear market, according to data from Ramin Nakisa, a former UBS analyst who now runs consultancy PensionCraft. About half have fallen at least 50 per cent from their 2021 peaks, with five slumping more than 70 per cent or more.

Unprofitable Companies Are Winning in 2020, or, Are These Companies Ponzi Schemes? (Youtube Video, 15 min)

So why is it that some of the biggest companies in the world are not turning profits? Why is it that they don’t even plan to?

The rise of so-called zombie companies or companies that have not and have never run at a profit are raising more and more eyebrows in the investing world.

These businesses are getting too big to ignore as by some estimates over 10% of the s&p500 (an index of the largest companies in America), is now made up of these companies that don’t serve the one central goal of being in businesses.

What’s more, is that this issue is not just endemic to a particular industry, dozens of major companies and countless smaller businesses in every sector of the economy from energy, retail, medical, telecommunications, and of course technology are in this profitless boat together.

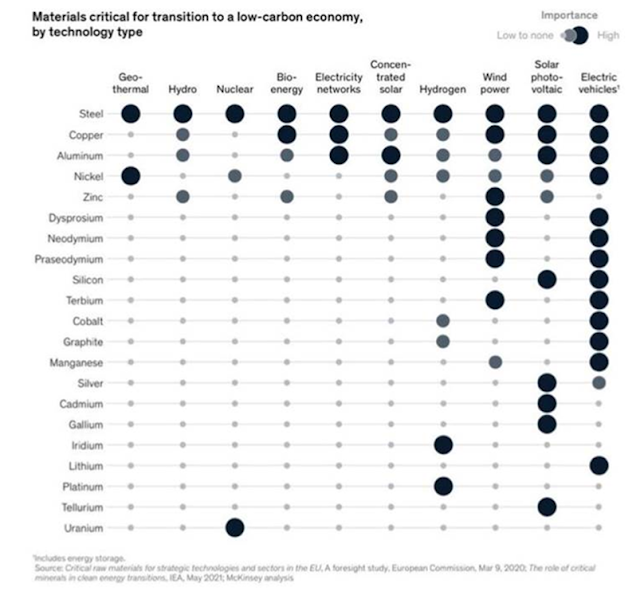

Global Banks Hold Fast to Fossil Fuels as Climate Pressure Grows

With the ink hardly dry on a landmark pledge by the finance industry to fight climate change, the world’s biggest banks are making clear they plan to stand by their fossil-fuel clients.

In total, global banks led by the Wall Street titans have helped fossil-fuel companies issue almost $250 billion in bonds so far in 2021, a figure that also broadly matches average annual fundraising for the industry since 2016. And while the International Energy Agency argues that funding for new oil and gas needs to stop now to avoid catastrophic climate change, bankers counter that polluters need help to transition to new sources of energy.

“You can’t just walk away, because the world is still heavily reliant on fossil fuels for the vast majority of our energy demand,” said Marisa Buchanan, global head of sustainability at JPMorgan in New York. “It is really important that our clients take steps to innovate and decarbonize, but we also need to bring capital to the table for the commercialization of those solutions.”