This week in charts

A tale of two pandemics

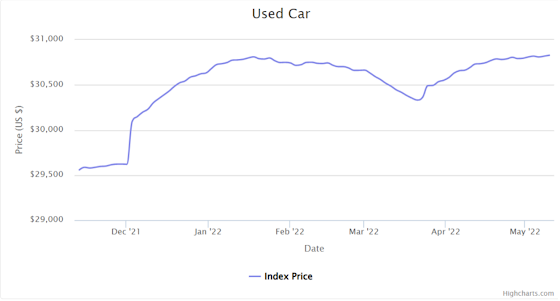

Inflation’s room to grow

Highflying Tiger Global Humbled by Unraveling of Giant Tech Bet

Tiger Global Management rode the tech boom like no other investment firm. It was funding more startups than any other U.S. investor when the market peaked last year, and had tens of billions of dollars from pensions, endowments and rich clients riding on some of Silicon Valley’s hottest stocks.

Fueling Tiger’s rise was a double-barreled business: A stock-picking arm put money mostly into public companies, while its venture-capital funds invested in startups throughout the world. Both bet bigger on tech as the market crested, leaving the firm exposed on both fronts.

At the end of April, the rout had wiped out roughly two-thirds of the gains Tiger had made in those stock funds since its founding, estimates money manager LCH Investments.

Tiger, led by 46-year-old founder Charles “Chase” Coleman, stood out in the frenzy. Its venture-capital business in March raised a $12.7 billion fund, one of the industry’s largest ever. Tiger overall invested in 361 deals in 2021, up from 16 deals for all of 2017, more than any other U.S. manager, according to research firm PitchBook Data Inc. It often outflanked longstanding venture firms by moving faster and agreeing to more generous terms with startups—sometimes offering money to companies hours after meeting, some startup founders say.

The holes in holistic ESG indices

ESG investing has, of course, taken Wall Street by storm. Well over $2tn has been invested in funds offered by a host of firms purporting to promote the environment, social good and enlightened governance.

Many ESG funds are narrowly targeted. There are funds comprised of low-carbon stocks, funds that exclude tobacco, funds adhering to Catholic values and to Sharia law. They telegraph their mission plainly just as do traditional ones specializing in high-tech stocks or banking.

But this is not where the ESG industry is headed. The action now is in so-called holistic indices that attempt to assess corporations’ every attitude or behavior and boil it down to a single metric. Call it the goodness standard.

One issue with holistic indices is the sheer number of categories. S&P Global’s Corporate Sustainability Assessment, a road map of what it assesses, runs to 253 pages, little of it reading like an Ian McEwan. “We just implemented [a new screen] in the last two months,” Reid Steadman, global head of ESG and innovation, noted. “Views of sustainability are evolving.”

The challenge is magnified by the incoherence of weighing so many disparate qualitative factors against each other. There is simply no objective way to balance an exemplary record on labor relations or gender pay equity against a high carbon footprint (the trees don’t care).

A further problem is the subjective nature of assessments. S&P determined that nuclear power was not “renewable”; some would disagree. It pays attention to human rights but did not exclude Apple, which counts China as a major supplier. It considers not just corporate deeds but reputations.

‘Liquidity is terrible’: poor trading conditions fuel Wall Street tumult

Liquidity across US markets is now at its worst level since the early days of the pandemic in 2020, according to investors and big US banks who say money managers are struggling to execute trades without affecting prices.

Relatively small deals worth just $50mn could knock the price or prompt a rally in exchange traded funds and index futures contracts that typically trade hands without causing major ripples, said Michael Edwards, deputy chief investment officer of hedge fund Weiss Multi-Strategy Advisers.

This week’s fun finds

By the numbers – population

- According to the Population Research Bureau in 2020, about 117 billion Homo sapiens have ever lived. This means that 7.8 billion alive at the time accounted for 7% of all humans.

- If everyone alive ignored staying six feet apart and stood shoulder-to-shoulder, they could all fit within the 500 square miles of Los Angeles.

- % of the population that has access to the internet (63%), electricity (90.5%) or basic sanitation (59%).

EdgePointer of the month – June 2022

Our recent website refresh inspired us to update our internal partner bios to reflect who they are today. First up is one of our longest-tenured EdgePointers (and our unofficial Chief Cultural Officer), Sandro.

Sandro is responsible for client administration support for our private client group (PCG). He ensures a smooth on-boarding process for new clients.

If there's anything that could make Sandro speechless, we haven't found it yet. Our cultural Renaissance man can converse about cinema, shows, music, books and sports. When the " Sandman" isn't at his desk, he can be found at stadiums, concert halls or taking part in wide-ranging discussions in the lunchroom. Words can be cheap (no matter how many Sandro uses). Fortunately for the rest of us, he often leads by example by doing things like organizing group outings during the Toronto International Film Festival or hitting lead off for our softball team. He's been a part of EdgePoint since almost the beginning and met several of the early partners working alongside them at the "old shop". Sandro is proof that our culture is something that develops over time not overnight, and we're thankful that he keeps spreading it to both our internal and external partners.

For those who haven’t had the chance to hear his latest recommendations, here are some of his past favourites (in no particular order) direct from the Sandman himself:

Revolver (The Beatles): I was a late comer to understanding the greatness of the Beatles but once I did, they blew me away. Such creativity – musically and lyrically!

London Calling (The Clash): Love their attitude and the way they combined reggae, ska and punk into their own style. “Train in Vain” not originally listed on the sleeve might be my favourite song of all time.

OK Computer (Radiohead): I listened to this album endlessly in the late 90s on my drives up to my sister’s cottage. Every song on the record is amazing. “Let Down” and “No Surprises” are my personal favourites.

Is This It? (The Strokes): Every song is under four minutes of pure rock heaven. They reinvented the sights and sounds of music in NYC before the streets were cleaned up by Mayor Rudy G.

Sandro's other unofficial jobs include tour guide, political junkie and, unsurprisingly, movie critic. He earned his BA in Political Science from York University.