EdgePoint’s inaugural responsible investing report

Since the inception of EdgePoint, ESG considerations and compounding wealth for our investors have been intertwined. Building on our history, we took steps to formalize our approach of ESG integration.

We hope you enjoy the read!

Talk is cheap…but making the wrong decision can be expensive

You can't choose your family, but you can choose to work with someone who has your best interests in mind. Strong relationships, no matter who they're with, are built during difficult times. The right financial advisor is the one who can help you select the investments that are the best fit for your long-term goals AND keep you committed to them during periods when your emotions can be your biggest enemy. Don't turn DIY investing into "D-I-Why?!?"

Although we’ve not spent a dollar on traditional marketing since inception, that doesn’t mean we can’t have some fun and wonder what an EdgePoint commercial would look like.

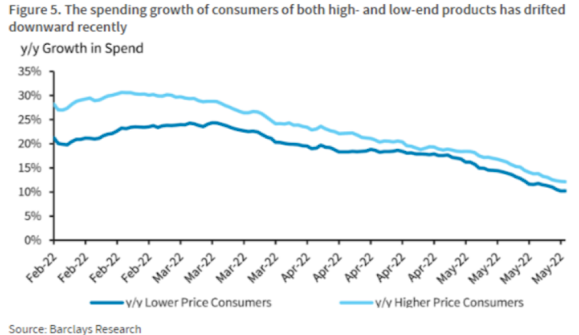

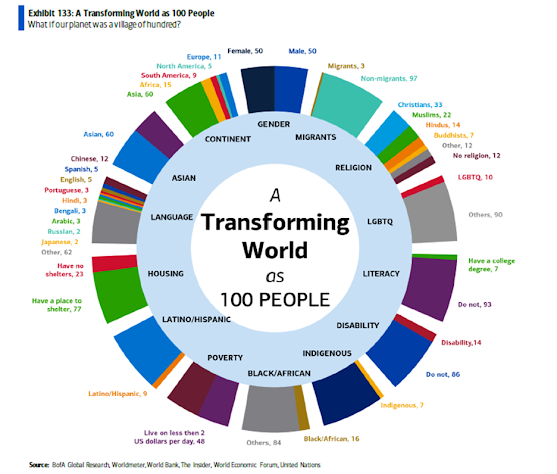

This week in charts

Greed & fear: history of asset bubbles in one chart

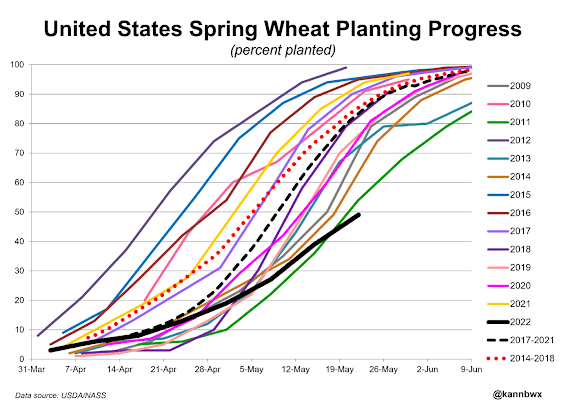

U.S. wheat planting advancing at the lowest rate in 20 years and only at 49% complete relative to 83% average

Howard Marks Memo: Bull market rhymes

The Lessons As always for students of investing, what matters most isn’t what events transpired in a given period of time, but what we can learn from these events. And there’s a lot to be learned from the trends in 2020-21 that rhymed with those in previous cycles.

In bull markets:

- Optimism builds around the things that are doing spectacularly well.

- The impact is strongest when the upswing arises from a particularly depressed base in terms of psychology and prices.

- Bull market psychology is accompanied by a lack of worry and a high level of risk tolerance, and thus highly aggressive behavior. Risk-bearing is rewarded, and the need for thorough diligence is ignored.

- High returns reinforce belief in the new, the unlikely, and the optimistic. When the crowd becomes convinced of those things’ merit, they tend to conclude “there’s no price too high.”

- These influences cool eventually, after they (and prices) have reached unsustainable levels.

- Elevated markets are vulnerable to exogenous events, like Russia’s invasion of Ukraine.

- The assets that rose the most – and the investors who over-weighted them – often experience painful reversals.

These are themes I’ve seen play out numerous times during my career. None of them relates exclusively to fundamental developments. Rather, their causes are largely psychological, and the way psychology works is unlikely to change. That’s why I’m sure that as long as humans are involved in the investment process, we’ll see them recur time and time again.And, as a reminder, since the major ups and downs of the markets are primarily driven by psychology, it’s clear that market movements can only be predicted, if ever, when prices are at absurd highs or lows.

Amazon Aims to Sublet, End Warehouse Leases as Online Sales Cool

Amazon.com Inc., stuck with too much warehouse capacity now that the surge in pandemic-era shopping has faded, is looking to sublet at least 10 million square feet of space and could vacate even more by ending leases with landlords, according to people familiar with the situation.

The excess capacity includes warehouses in New York, New Jersey, Southern California and Atlanta, said the people, who requested anonymity because they’re not authorized to speak about the deals. The surfeit of space could far exceed 10 million square feet, two of the people said, with one saying it could be triple that. Another person close to the deliberations said a final estimate on the square footage to be vacated hasn’t been reached and that the figure remains in flux.

Amazon could try to negotiate lease terminations with existing landlords, including Prologis Inc., an industrial real estate developer that counts the e-commerce giant as its biggest tenant, two of the people said.

Western Canada apartment rents to continue to rise

Economic and population growth will push apartment rents higher in all three major Western Canada markets, Vancouver, Edmonton and Calgary, during the coming year.

However, the three cities start at different baselines and face different challenges, according to speakers at this week’s Western Canada Apartment Investment Conference in Edmonton.

Shenoor Jadavji, founder and president of Vancouver-based Lotus Capital Corp., suggested apartment supply will be a major factor for the city as 40,000 students and up to 52,000 new people come into the market.

Vancouver developers say slow approvals and bureaucracy at the municipal level are a major challenge in getting projects off the ground. “We have three projects on the way that are all at the city or municipality level. They’ve been there for four or five years,” said Jadavji. Meanwhile construction costs and the cost of borrowing have increased.

Calgary and Edmonton aren’t struggling with delays in municipal approvals and land costs. However, inflation, supply chain issues, rising borrowing rates and a shortage of skilled construction labour all apply to the Alberta cities as they do across the country.

“In Vancouver, an average person pays 75 per cent of their income on accommodation,” said Jadavji. “In Alberta, it’s 20 to 30 per cent.”

Calgary experienced a drop in vacancy rates between 2021 and Q1 2022, said Ferreira. The rates are running at 2.9 per cent for stabilized properties and 5.7 per cent when new projects are factored in. Zonda Urban figures show average rent per unit for concrete properties at $2,076 or $2.41 per square foot and $1,725, or $2.36 per square foot for wood-frame buildings. Ferreira says Calgary has had plenty of new product coming into the market but it has been steadily absorbed. “As a result, we don’t see the market as oversupplied and we can’t foresee it as oversupplied.”

This week’s fun find

“Most big, deeply satisfying accomplishments in life take at least five years to achieve. This can include building a business, cultivating a loving relationship, writing a book, getting in the best shape of your life, raising a family, and more.

Five years is a long time. It is much slower than most of us would like. If you accept the reality of slow progress, you have every reason to take action today. If you resist the reality of slow progress, five years from now you'll simply be five years older and still looking for a shortcut.” – James Clear, weekly newsletter.

The medical power of hypnosis

When David Spiegel was told his next patient was waiting for him, he didn't need to ask the room number. He could hear her wheezing from halfway down the hall.

Entering the patient's room, he saw a 16-year-old girl with red hair sitting bolt upright in bed, knuckles white, in the midst of an asthma attack. By her side, her mother was crying. It was the third time the girl had been hospitalised for asthma in as many months.

Spiegel was a medical student on a paediatric rotation at Boston Children's Hospital in Massachusetts, US, in 1970. As part of his training, he was also taking a class in clinical hypnosis.

The young asthma patient's medical team had already tried to dilate her airways with injections of adrenaline. After two shots, the girl's attack was not subsiding. Spiegel didn't know what else to do. "Do you want to learn a breathing exercise?" he asked her.

She nodded, and so Spiegel hypnotised his first patient. Once the girl had entered the trance-like state characteristic of hypnosis, Spiegel was ready to make a suggestion – the "active ingredient" of hypnotic treatment, typically a carefully worded statement that will produce an involuntary response. But as the girl sat in bed, calm and focused, Spiegel wondered what suggestion he should make. They hadn't got to asthma in his hypnosis class yet.

"So I came up with something," Spiegel tells me, as he recalls the case. "I said, 'Each breath you take will be a little deeper and a little easier.'"

The improvisation worked. Within five minutes, the patient's wheezing had stopped and she was lying back in her bed, breathing comfortably. Her mother was no longer crying.

It was a formative encounter for doctor and patient. The girl grew up to train as a respiratory therapist, while Spiegel embarked on a career in clinical hypnosis. Over the next 50 years, he would go on to found the Center for Integrative Medicine at Stanford University and, by his reckoning, hypnotise more than 7,000 patients.

The Weirdest Coaching Staff in Baseball Has Made the Giants a Powerhouse

Fernando Perez studied creative writing at Columbia University and is the author of essays that have been published in prominent literary magazines. Mark Hallberg spent years working as a teacher and administrator at schools in Saudi Arabia and the United Arab Emirates. Dustin Lind has a doctorate in physical therapy.

These are a few of the people on the unconventional coaching staff who have helped transform the San Francisco Giants into a powerhouse and disrupted a sport that traditionally hasn’t taken well to outsiders. The Giants were the surprise of the National League last season, winning 107 games and ending the Los Angeles Dodgers’ streak of eight consecutive division titles. It’s been more of the same early in 2022, with San Francisco again looking like a serious World Series contender.

The Giants accomplished all of this while being guided by a group of coaches unlike any other in the history of baseball—and their unexpected success is forcing the industry to rethink just who is qualified to wear a major-league uniform.

“We hire a staff with the mind-set that a more diverse coaching staff gives us a better chance to win,” Giants manager Gabe Kapler said. “If you want to have a wide variety of human beings for players to connect with, you can’t have them all cut from the same cloth.”

That way of thinking would’ve been considered radical for much of the last 150 years. Conventional wisdom has long dictated that in order for a coach to gain the respect of players, he needed to have professional playing experience. “The longer you were around,” veteran pitcher Alex Wood said, “the more credibility you had.”

To Kapler, that attitude never made much sense, especially in the era of analytics. The data revolution that has changed the game has largely been driven by outsiders in the front office, so bringing people with unorthodox backgrounds into the clubhouse seemed like a natural progression.