Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

This $358 billion pension fund bets on private equity (Link)

With everyone diving in to private equity, future returns may not be as attractive as in the past. Yet the $358 billion California Public Employees’ Retirement system fund (CalPERS) believes it has a competitive advantage. Today, CalPERS has nearly $28 billion, or 8% of assets, in private equity holdings and over the last 10 years, private equity was CalPERS best-performing asset, returning an average of 9% annually, compared with 6.7% on public stocks. CalPERS now believes it may be able to continue this success and on March 18 voted to funnel up to $20 billion more into private equity over the next 10 years.

CalPERS plans to partner with elite private-equity managers, that will make them their sole client. That way, CalPERS would have better control and more transparency to make better investment decisions. The chief investment officer (CIO) of CalPERS believes more private equity is needed to increase the fund's probability of success.

Private equity firms are flocking to Mexico? (Link)

In January of 2018, Mexican regulators eased restrictions on how Mexican pension funds invest their assets. This change allowed foreign private equity managers to tap into the $179 billion worth of pension fund assets for the first time in Mexico. Over the last year many of the world’s top private equity managers have quietly raised billions of dollars from Mexican pension funds.

Well-known names like BlackRock was one of the first foreign asset managers to expand into Mexico, raising $615 million for two funds. Blackstone Group has now also raised $695 million from Mexican pension funds for its first two local private equity funds.

The majority of private equity sales are now to other private equity firms (SBO)

Sunday, March 31, 2019

Friday, March 29, 2019

Weekend catch up

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Saudi oil production to peak......in just over a decade? (Link)

Saudi Arabia has produced 160 billion barrels of its 430 billion barrels of ultimate recoverable reserves, or nearly 40%. If Saudi Arabia produces at 10.5 million barrels a day, it would hit the 50% mark in approximately 14 years. After this point, according to the Hubbert curve, production would enter its period of structural decline.

Barbers are cashing in on this West Texas oil boom (Link)

A gusher of crude production has transformed the Permian Basin into America’s hottest oilfield. The Permian produced 3.9 million barrels per day as of January and could top 5 million barrels a day by 2023, surpassing Iraq. Fortunes are being made in this fracking-related gold rush, and money and workers are flooding in. Finding a haircut or grabbing a plate of good Texas barbecue is hard because demand outstrips supply.

Pete McGarity opened Headlines Barber Shop in Odessa in 1998 and has ridden the boom-bust cycle before. In this latest boom he decided to capitalize on it and spent about $25,000 to retrofit a trailer into a custom, mobile barber shop. He drove it about an hour west to Pecos, Texas, and parked in front of the town’s only grocery store, hoping to catch oil field workers between shifts. It was an instant success. A cut costs as much as $40, more than the $25 he charged before the boom. There is usually a long waiting list, but patrons can cut the line if they pay $60, or $75 with a shave. Mr. McGarity’s barbers are raking it in making anywhere from $130,000 to $180,000 per year. He is considering investing in additional trailers to send to farther-flung towns in the oil patch and says the additional revenue may allow him to retire soon.

More global energy demand predictions (Link)

Oil demand peaking in the 2030’s, 2 billion electric cars on the road by 2050, 50% of power generation by renewables by 2035, and many other predictions which may or may not be accurate.

Behavioral coaching ranks last on what investors value most from their advisors. (Link)

On a list of 15 attributes, “helps me stay in control of my emotions” was ranked dead last by the 693 investors surveyed about what they value most from their financial advisors.

Many advisors believe that helping to control investor emotions is one the most valuable things they bring to the table making it clear that there is a disconnect between what advisors believe investors want and what investors are looking for. Could the perception of behavioral coaching’s stem from ego? Behavioral coaching has the opposite impact on advisor and client egos. As the purveyor of behavioral coaching, the advisors ego is boosted. Advisors get to be the “responsible adult” in the relationship, which feels gratifying. Conversely, the client’s ego must seemingly be checked to admit that behavioral coaching is necessary.

Gradual improvements go unnoticed (Link)

Since stocks bottomed in 2009, there have been so many potential reasons to sell, making it very easy to fill this chart in. The hard part was choosing what to leave off.

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. This was a much harder task as bad news makes headlines while gradual improvements go unnoticed. The fact that bad news is disseminated 10x as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns for the average investor.

Stop feeding them cheese!

There are still over 3 million "extra" young adults living at home. If they all enter the housing market over the next 15 years, that would boost housing demand by 200 thousand per year. A reason to be secular bullish on housing. But again, the pace is likely to remain slow to moderate.

Who owns US government debt?

China, the world’s second largest economy, is the world’s biggest single country foreign owner of US government debt. Pensions & Insurers (17.4%), mutual funds & ETFs (12.7%) and the Federal Reserve (12.6%) hold the most securities outright.

Commercialized building sales continue to decline in China

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Saudi oil production to peak......in just over a decade? (Link)

Saudi Arabia has produced 160 billion barrels of its 430 billion barrels of ultimate recoverable reserves, or nearly 40%. If Saudi Arabia produces at 10.5 million barrels a day, it would hit the 50% mark in approximately 14 years. After this point, according to the Hubbert curve, production would enter its period of structural decline.

Barbers are cashing in on this West Texas oil boom (Link)

A gusher of crude production has transformed the Permian Basin into America’s hottest oilfield. The Permian produced 3.9 million barrels per day as of January and could top 5 million barrels a day by 2023, surpassing Iraq. Fortunes are being made in this fracking-related gold rush, and money and workers are flooding in. Finding a haircut or grabbing a plate of good Texas barbecue is hard because demand outstrips supply.

Pete McGarity opened Headlines Barber Shop in Odessa in 1998 and has ridden the boom-bust cycle before. In this latest boom he decided to capitalize on it and spent about $25,000 to retrofit a trailer into a custom, mobile barber shop. He drove it about an hour west to Pecos, Texas, and parked in front of the town’s only grocery store, hoping to catch oil field workers between shifts. It was an instant success. A cut costs as much as $40, more than the $25 he charged before the boom. There is usually a long waiting list, but patrons can cut the line if they pay $60, or $75 with a shave. Mr. McGarity’s barbers are raking it in making anywhere from $130,000 to $180,000 per year. He is considering investing in additional trailers to send to farther-flung towns in the oil patch and says the additional revenue may allow him to retire soon.

More global energy demand predictions (Link)

Oil demand peaking in the 2030’s, 2 billion electric cars on the road by 2050, 50% of power generation by renewables by 2035, and many other predictions which may or may not be accurate.

Behavioral coaching ranks last on what investors value most from their advisors. (Link)

On a list of 15 attributes, “helps me stay in control of my emotions” was ranked dead last by the 693 investors surveyed about what they value most from their financial advisors.

Many advisors believe that helping to control investor emotions is one the most valuable things they bring to the table making it clear that there is a disconnect between what advisors believe investors want and what investors are looking for. Could the perception of behavioral coaching’s stem from ego? Behavioral coaching has the opposite impact on advisor and client egos. As the purveyor of behavioral coaching, the advisors ego is boosted. Advisors get to be the “responsible adult” in the relationship, which feels gratifying. Conversely, the client’s ego must seemingly be checked to admit that behavioral coaching is necessary.

Gradual improvements go unnoticed (Link)

Since stocks bottomed in 2009, there have been so many potential reasons to sell, making it very easy to fill this chart in. The hard part was choosing what to leave off.

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. This was a much harder task as bad news makes headlines while gradual improvements go unnoticed. The fact that bad news is disseminated 10x as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns for the average investor.

Stop feeding them cheese!

There are still over 3 million "extra" young adults living at home. If they all enter the housing market over the next 15 years, that would boost housing demand by 200 thousand per year. A reason to be secular bullish on housing. But again, the pace is likely to remain slow to moderate.

Who owns US government debt?

China, the world’s second largest economy, is the world’s biggest single country foreign owner of US government debt. Pensions & Insurers (17.4%), mutual funds & ETFs (12.7%) and the Federal Reserve (12.6%) hold the most securities outright.

Commercialized building sales continue to decline in China

Thursday, March 28, 2019

Investing psychology

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Behavioral coaching ranks last on what investors value most from their advisors. (Link)

On a list of 15 attributes, “helps me stay in control of my emotions” was ranked dead last by the 693 investors surveyed about what they value most from their financial advisors.

Many advisors believe that helping to control investor emotions is one the most valuable things they bring to the table making it clear that there is a disconnect between what advisors believe investors want and what investors are looking for. Could the perception of behavioral coaching’s stem from ego? Behavioral coaching has the opposite impact on advisor and client egos. As the purveyor of behavioral coaching, the advisors ego is boosted. Advisors get to be the “responsible adult” in the relationship, which feels gratifying. Conversely, the client’s ego must seemingly be checked to admit that behavioral coaching is necessary.

Gradual improvements go unnoticed (Link)

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. This was a much harder task as bad news makes headlines while gradual improvements go unnoticed. The fact that bad news is disseminated 10x as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns for the average investor.

Zach celebrating his 1st and Tracey celebrating her 2nd work anniversaries!

_________________

Behavioral coaching ranks last on what investors value most from their advisors. (Link)

On a list of 15 attributes, “helps me stay in control of my emotions” was ranked dead last by the 693 investors surveyed about what they value most from their financial advisors.

Many advisors believe that helping to control investor emotions is one the most valuable things they bring to the table making it clear that there is a disconnect between what advisors believe investors want and what investors are looking for. Could the perception of behavioral coaching’s stem from ego? Behavioral coaching has the opposite impact on advisor and client egos. As the purveyor of behavioral coaching, the advisors ego is boosted. Advisors get to be the “responsible adult” in the relationship, which feels gratifying. Conversely, the client’s ego must seemingly be checked to admit that behavioral coaching is necessary.

Gradual improvements go unnoticed (Link)

Since stocks bottomed in 2009, there have been so many potential reason to sell, making it very easy to fill this chart in. The hard part was choosing what to leave off.

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. This was a much harder task as bad news makes headlines while gradual improvements go unnoticed. The fact that bad news is disseminated 10x as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns for the average investor.

Zach celebrating his 1st and Tracey celebrating her 2nd work anniversaries!

Tuesday, March 26, 2019

Wednesday charts

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Stop feeding them cheese!

There are still over 3 million "extra" young adults living at home. If they all enter the housing market over the next 15 years, that would boost housing demand by 200 thousand per year. A reason to be secular bullish on housing. But again the pace is likely to remain slow to moderate.

Who owns US government debt?

China, the world’s second largest economy, is the world’s biggest single country foreign owner of US government debt. Pensions & Insurers (17.4%), mutual funds & ETFs (12.7%) and the Federal Reserve (12.6%) hold the most securities outright.

Commercialized building sales continue to decline in China

Source: Bloomberg

_________________

Stop feeding them cheese!

There are still over 3 million "extra" young adults living at home. If they all enter the housing market over the next 15 years, that would boost housing demand by 200 thousand per year. A reason to be secular bullish on housing. But again the pace is likely to remain slow to moderate.

Who owns US government debt?

China, the world’s second largest economy, is the world’s biggest single country foreign owner of US government debt. Pensions & Insurers (17.4%), mutual funds & ETFs (12.7%) and the Federal Reserve (12.6%) hold the most securities outright.

Commercialized building sales continue to decline in China

Source: Bloomberg

Sunday, March 24, 2019

All things energy

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Saudi oil production to peak......in just over a decade? (Link)

Saudi Arabia has produced 160 billion barrels of its 430 billion barrels of ultimate recoverable reserves, or nearly 40%. If Saudi Arabia produces at 10.5 million barrels a day, it would hit the 50% mark in approximately 14 years. After this point, according to the Hubbert curve, production would enter its period of structural decline.

Barbers are cashing in on this West Texas oil boom (Link)

A gusher of crude production has transformed the Permian Basin into America’s hottest oilfield. The Permian produced 3.9 million barrels per day as of January and could top 5 million barrels a day by 2023, surpassing Iraq. Fortunes are being made in this fracking-related gold rush, and money and workers are flooding in. Finding a haircut or grabbing a plate of good Texas barbecue is hard because demand outstrips supply.

Pete McGarity opened Headlines Barber Shop in Odessa in 1998 and has ridden the boom-bust cycle before. In this latest boom he decided to capitalize on it and spent about $25,000 to retrofit a trailer into a custom, mobile barber shop. He drove it about an hour west to Pecos, Texas, and parked in front of the town’s only grocery store, hoping to catch oil field workers between shifts. It was an instant success. A cut costs as much as $40, more than the $25 he charged before the boom. There is usually a long waiting list, but patrons can cut the line if they pay $60, or $75 with a shave. Mr. McGarity’s barbers are raking it in making anywhere from $130,000 to $180,000 per year. He is considering investing in additional trailers to send to farther-flung towns in the oil patch and says the additional revenue may allow him to retire soon.

More global energy demand predictions (Link)

Oil demand peaking in the 2030’s, 2 billion electric cars on the road by 2050, 50% of power generation by renewables by 2035, and many other predictions which may or may not be accurate.

_________________

Saudi oil production to peak......in just over a decade? (Link)

Saudi Arabia has produced 160 billion barrels of its 430 billion barrels of ultimate recoverable reserves, or nearly 40%. If Saudi Arabia produces at 10.5 million barrels a day, it would hit the 50% mark in approximately 14 years. After this point, according to the Hubbert curve, production would enter its period of structural decline.

Barbers are cashing in on this West Texas oil boom (Link)

A gusher of crude production has transformed the Permian Basin into America’s hottest oilfield. The Permian produced 3.9 million barrels per day as of January and could top 5 million barrels a day by 2023, surpassing Iraq. Fortunes are being made in this fracking-related gold rush, and money and workers are flooding in. Finding a haircut or grabbing a plate of good Texas barbecue is hard because demand outstrips supply.

Pete McGarity opened Headlines Barber Shop in Odessa in 1998 and has ridden the boom-bust cycle before. In this latest boom he decided to capitalize on it and spent about $25,000 to retrofit a trailer into a custom, mobile barber shop. He drove it about an hour west to Pecos, Texas, and parked in front of the town’s only grocery store, hoping to catch oil field workers between shifts. It was an instant success. A cut costs as much as $40, more than the $25 he charged before the boom. There is usually a long waiting list, but patrons can cut the line if they pay $60, or $75 with a shave. Mr. McGarity’s barbers are raking it in making anywhere from $130,000 to $180,000 per year. He is considering investing in additional trailers to send to farther-flung towns in the oil patch and says the additional revenue may allow him to retire soon.

More global energy demand predictions (Link)

Oil demand peaking in the 2030’s, 2 billion electric cars on the road by 2050, 50% of power generation by renewables by 2035, and many other predictions which may or may not be accurate.

Friday, March 22, 2019

Weekend catch-up

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due to the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens. After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same as everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

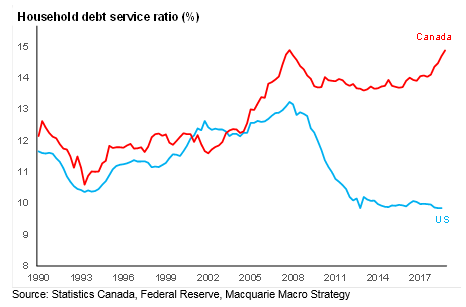

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due to the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens. After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same as everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

US labour stats

No obvious signs of overheating in US wage growth

Empirical Research

This is thanks to the baby boomers demographic who are reluctant to change jobs for higher wages

Empirical Research

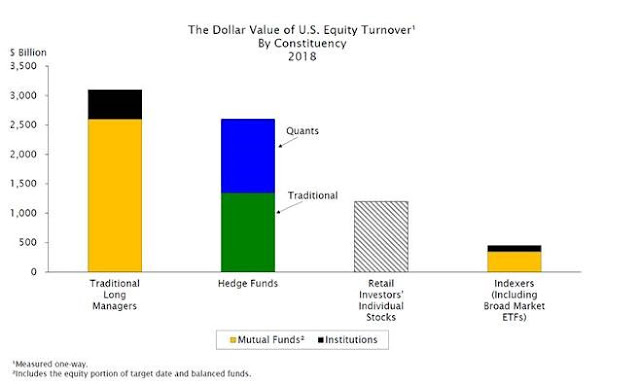

US asset flows

Hedge funds now represent almost 33% of trade volumes in the US

Empirical Research

ETF money flowing to safety in early 2019

Thursday, March 21, 2019

Friday reads

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens.

After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

_________________

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens.

After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Tuesday, March 19, 2019

Wednesday charts

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

_________________

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

US labour stats

No obvious signs of overheating in US wage growth

Empirical Research

This is thanks to the baby boomers demographic who are reluctant to change jobs for higher wages.

Empirical Research

US asset flows

Hedge funds now represent almost 33% of trade volumes in the US

Empirical Research

ETF money flowing to safety in early 2019

Sunday, March 17, 2019

Value chains | Thinking differently from the pack

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains. Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired, Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same a everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

_________________

Valuing Amazon’s & Walmart’s value chains. Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired, Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same a everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Friday, March 15, 2019

Weekend catchup

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

Chris Slubicki provides an objective perspective of the global and Canadian energy industries. Canadians are benefiting greatly today because we had the courage to build in the past.The world needs energy and no one is better at providing it then Canada. Chris concludes with great examples in Canadian history where we had to courage to build. We need to step up again and build.

Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

California is building unnecessary power plants (Link)Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Thursday, March 14, 2019

20 crazy investing facts I Labour force participation rate

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

_________________

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Tuesday, March 12, 2019

Canada's energy industry

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

_________________

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

Chris Slubicki provides an objective perspective of the global and Canadian energy industries. Canadians are benefiting greatly today because we had the courage to build in the past.The world needs energy and no one is better at providing it then Canada. Chris concludes with great examples in Canadian history where we had to courage to build. We need to step up again and build.

Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

Sunday, March 10, 2019

Misfits. Unnecessary power plants. Aging stock market

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

California is building unnecessary power plants (Link)

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

California is building unnecessary power plants (Link)

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

Friday, March 8, 2019

Weekend catchup

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Not caring: A unique and powerful skill (Link)

If you can remain dispassionate about what people think of you while you’re trying to get an outcome, or about the noise around you during the process, you have an advantage that 1 out of 100,000 has in the industry.

- Not caring about looking dumb when you’re confident others are being dumber.

- Not caring about your reputation after you change your mind.

- Not caring about not having no explanation for the majority of events.

Figure out what you can control and obsess over it. Identify what doesn’t matter and ignore it. Determine what you’re incapable of and stay away from it.Have room for error. Plan on things not going according to plan.

Advice from Charlie Munger : 2019 Daily Journal AGM (Link)

We’ve done better than average and now there’s a question why has that happened? The answer is pretty simple. We tried to do less. We never had the illusion we could just hire a bunch of bright young people and they would know more than anybody about canned soup and aerospace and utilities and so on and so on. We always realized that if we worked very hard, we could find a few things where we were right and the few things were enough and that that was a reasonable expectation. Audio recording here.

Only one constant in investing (Link)

You have to understand that there are no physical laws at work in investing. And the future is uncertain, and vague, and random. And psychology dominates. Richard Feynman said, "Physics would be much harder if electrons had feelings." You come in the room, you flip up the switch, and the lights go on. Because the electrons flow from the switch to the lights. They never flow the other way. They never go on strike. They never fall asleep. They never say, ‘Ah today I don’t feel like flowing from the switch to the light.'

You can use all the numbers, tables, and data visualizations you want, but you still won’t be able to quantify the only law in investing: everything is determined by your own behavior. Everything comes back to how you react to information.

Google vs. Amazon (Link)

Steve Yegge spent years at both Amazon and Google. His famous posting from 2011 gives an insiders look what Amazon was able to figure out early on and what hindered Google. Google did nearly everything better than Amazon, yet Amazon continued to be more successful. The difference came down to products vs. platforms and Amazon’s CEO Bezos was fierce about building platforms and Google didn't understand this. Products are always built on top of platforms. Platforms are all about long-term thinking. The power of a platform comes from the variety and sophistication of the products it enables. Bezos realized long before the vast majority of Amazonians that Amazon needs to be a platform.

What Happened When I Bought a House With Solar Panels (Link)

I’d soon learn that the system was tied to the title of the house. It appeared that if we bought Jug’s place, we’d have to assume his lease arrangement with Sunrun. On consumer review sites and in local news reports, rueful customers warn others to stay away from TPO solar offered by Sunrun and other companies. State attorneys general and politicians have fielded complaints from people who say they were sold expensive systems they can’t afford after signing contracts they didn’t understand; or are paying more now on their electricity bills, not less as promised; or are having trouble selling their homes because potential buyers are turned off, just as I was. (Customers of Sunrun and other companies must sign binding arbitration clauses, barring them from suing or joining in class actions.) Salespeople would cherry-pick data, skim over crucial details, and prioritize speed above all, he told me. A trainer from California who listened in on hundreds of sales calls for quality control estimated that 60 % of customers knew no more than half of what they were signing up for and 10 % had no clue.

Booming used car market?

The average price of a used car is now about $20,000 for the first time in history. What's driving the trend? The declining number of older used cars and the increasing number of late-model leased cars hitting the used car market are driving prices higher. These late model cars are newer which means they generally sell for a higher price which is helping to drive the profits of used cars sales higher. The increasing number of used cars is also a money maker for dealership's parts and services departments which represent about 40% of dealership's used car department profits.

Relative sizes of world stock markets 1899 vs 2019 (Link)

At the start of the 20th century, the UK equity market was the largest in the world, accounting for a quarter of world capitalization, dominating even the US market (15%). Germany (13%). Of the US firms listed in 1900, over 80% of their value was in industries that are today small or extinct. Today the US equity market us the largest in the world, accounting for 50% of world capitalization with the UK now under 6%.

World energy consumption through 2040

Fossil fuels projected to remain the largest energy source with natural gas, renewables and petroleum liquids being the fastest growing energy sources. Asia is projected to have the largest increase in energy use of non-OECD regions.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Not caring: A unique and powerful skill (Link)

If you can remain dispassionate about what people think of you while you’re trying to get an outcome, or about the noise around you during the process, you have an advantage that 1 out of 100,000 has in the industry.

- Not caring about looking dumb when you’re confident others are being dumber.

- Not caring about your reputation after you change your mind.

- Not caring about not having no explanation for the majority of events.

Figure out what you can control and obsess over it. Identify what doesn’t matter and ignore it. Determine what you’re incapable of and stay away from it.Have room for error. Plan on things not going according to plan.

Advice from Charlie Munger : 2019 Daily Journal AGM (Link)

We’ve done better than average and now there’s a question why has that happened? The answer is pretty simple. We tried to do less. We never had the illusion we could just hire a bunch of bright young people and they would know more than anybody about canned soup and aerospace and utilities and so on and so on. We always realized that if we worked very hard, we could find a few things where we were right and the few things were enough and that that was a reasonable expectation. Audio recording here.

Only one constant in investing (Link)

You have to understand that there are no physical laws at work in investing. And the future is uncertain, and vague, and random. And psychology dominates. Richard Feynman said, "Physics would be much harder if electrons had feelings." You come in the room, you flip up the switch, and the lights go on. Because the electrons flow from the switch to the lights. They never flow the other way. They never go on strike. They never fall asleep. They never say, ‘Ah today I don’t feel like flowing from the switch to the light.'

You can use all the numbers, tables, and data visualizations you want, but you still won’t be able to quantify the only law in investing: everything is determined by your own behavior. Everything comes back to how you react to information.

Google vs. Amazon (Link)

Steve Yegge spent years at both Amazon and Google. His famous posting from 2011 gives an insiders look what Amazon was able to figure out early on and what hindered Google. Google did nearly everything better than Amazon, yet Amazon continued to be more successful. The difference came down to products vs. platforms and Amazon’s CEO Bezos was fierce about building platforms and Google didn't understand this. Products are always built on top of platforms. Platforms are all about long-term thinking. The power of a platform comes from the variety and sophistication of the products it enables. Bezos realized long before the vast majority of Amazonians that Amazon needs to be a platform.

What Happened When I Bought a House With Solar Panels (Link)

I’d soon learn that the system was tied to the title of the house. It appeared that if we bought Jug’s place, we’d have to assume his lease arrangement with Sunrun. On consumer review sites and in local news reports, rueful customers warn others to stay away from TPO solar offered by Sunrun and other companies. State attorneys general and politicians have fielded complaints from people who say they were sold expensive systems they can’t afford after signing contracts they didn’t understand; or are paying more now on their electricity bills, not less as promised; or are having trouble selling their homes because potential buyers are turned off, just as I was. (Customers of Sunrun and other companies must sign binding arbitration clauses, barring them from suing or joining in class actions.) Salespeople would cherry-pick data, skim over crucial details, and prioritize speed above all, he told me. A trainer from California who listened in on hundreds of sales calls for quality control estimated that 60 % of customers knew no more than half of what they were signing up for and 10 % had no clue.

Booming used car market?

The average price of a used car is now about $20,000 for the first time in history. What's driving the trend? The declining number of older used cars and the increasing number of late-model leased cars hitting the used car market are driving prices higher. These late model cars are newer which means they generally sell for a higher price which is helping to drive the profits of used cars sales higher. The increasing number of used cars is also a money maker for dealership's parts and services departments which represent about 40% of dealership's used car department profits.

At the start of the 20th century, the UK equity market was the largest in the world, accounting for a quarter of world capitalization, dominating even the US market (15%). Germany (13%). Of the US firms listed in 1900, over 80% of their value was in industries that are today small or extinct. Today the US equity market us the largest in the world, accounting for 50% of world capitalization with the UK now under 6%.

Fossil fuels projected to remain the largest energy source with natural gas, renewables and petroleum liquids being the fastest growing energy sources. Asia is projected to have the largest increase in energy use of non-OECD regions.

Thursday, March 7, 2019

Used cars. Constants in investing. EdgePoint culture

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Only one constant in investing (Link)

You have to understand that there are no physical laws at work in investing. And the future is uncertain, and vague, and random. And psychology dominates. Richard Feynman said, "Physics would be much harder if electrons had feelings." You come in the room, you flip up the switch, and the lights go on. Because the electrons flow from the switch to the lights. They never flow the other way. They never go on strike. They never fall asleep. They never say, ‘Ah today I don’t feel like flowing from the switch to the light.'

You can use all the numbers, tables, and data visualizations you want, but you still won’t be able to quantify the only law in investing: everything is determined by your own behavior. Everything comes back to how you react to information.

Booming used car market?

The average price of a used car is now about $20,000 for the first time in history. What's driving the trend? The declining number of older used cars and the increasing number of late-model leased cars hitting the used car market are driving prices higher. These late model cars are newer which means they generally sell for a higher price which is helping to drive the profits of used cars sales higher. The increasing number of used cars is also a money maker for dealership's parts and services departments which represent about 40% of dealership's used car department profits.

Pancake Tuesday and Robert's 6th anniversary!

_________________

Only one constant in investing (Link)

You have to understand that there are no physical laws at work in investing. And the future is uncertain, and vague, and random. And psychology dominates. Richard Feynman said, "Physics would be much harder if electrons had feelings." You come in the room, you flip up the switch, and the lights go on. Because the electrons flow from the switch to the lights. They never flow the other way. They never go on strike. They never fall asleep. They never say, ‘Ah today I don’t feel like flowing from the switch to the light.'

You can use all the numbers, tables, and data visualizations you want, but you still won’t be able to quantify the only law in investing: everything is determined by your own behavior. Everything comes back to how you react to information.

Booming used car market?

The average price of a used car is now about $20,000 for the first time in history. What's driving the trend? The declining number of older used cars and the increasing number of late-model leased cars hitting the used car market are driving prices higher. These late model cars are newer which means they generally sell for a higher price which is helping to drive the profits of used cars sales higher. The increasing number of used cars is also a money maker for dealership's parts and services departments which represent about 40% of dealership's used car department profits.

Tuesday, March 5, 2019

The power of not caring I Charlie Munger I World energy consumption

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Not caring: A unique and powerful skill (Link)

If you can remain dispassionate about what people think of you while you’re trying to get an outcome, or about the noise around you during the process, you have an advantage that 1 out of 100,000 has in the industry.

- Not caring about looking dumb when you’re confident others are being dumber.

- Not caring about your reputation after you change your mind.

- Not caring about not having no explanation for the majority of events.

Figure out what you can control and obsess over it. Identify what doesn’t matter and ignore it. Determine what you’re incapable of and stay away from it.Have room for error. Plan on things not going according to plan.

Advice from Charlie Munger : 2019 Daily Journal AGM (Link)

We’ve done better than average and now there’s a question why has that happened? The answer is pretty simple. We tried to do less. We never had the illusion we could just hire a bunch of bright young people and they would know more than anybody about canned soup and aerospace and utilities and so on and so on. We always realized that if we worked very hard, we could find a few things where we were right and the few things were enough and that that was a reasonable expectation. Audio recording here

World energy consumption through 2040

Fossil fuels projected to remain the largest energy source with natural gas, renewables and petroleum liquids being the fastest growing energy sources. Asia is projected to have the largest increase in energy use of non-OECD regions.

_________________

Not caring: A unique and powerful skill (Link)

If you can remain dispassionate about what people think of you while you’re trying to get an outcome, or about the noise around you during the process, you have an advantage that 1 out of 100,000 has in the industry.

- Not caring about looking dumb when you’re confident others are being dumber.

- Not caring about your reputation after you change your mind.

- Not caring about not having no explanation for the majority of events.

Figure out what you can control and obsess over it. Identify what doesn’t matter and ignore it. Determine what you’re incapable of and stay away from it.Have room for error. Plan on things not going according to plan.

Advice from Charlie Munger : 2019 Daily Journal AGM (Link)

We’ve done better than average and now there’s a question why has that happened? The answer is pretty simple. We tried to do less. We never had the illusion we could just hire a bunch of bright young people and they would know more than anybody about canned soup and aerospace and utilities and so on and so on. We always realized that if we worked very hard, we could find a few things where we were right and the few things were enough and that that was a reasonable expectation. Audio recording here

World energy consumption through 2040

Fossil fuels projected to remain the largest energy source with natural gas, renewables and petroleum liquids being the fastest growing energy sources. Asia is projected to have the largest increase in energy use of non-OECD regions.

Sunday, March 3, 2019

Google vs. Amazon. World stock markets 1899 vs 2019. Solar Panels.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Google vs. Amazon (Link)

Steve Yegge spent years at both Amazon and Google. His famous posting from 2011 gives an insiders look what Amazon was able to figure out early on and what hindered Google. Google did nearly everything better than Amazon, yet Amazon continued to be more successful. The difference came down to products vs. platforms and Amazon’s CEO Bezos was fierce about building platforms and Google didn't understand this. Products are always built on top of platforms. Platforms are all about long-term thinking. The power of a platform comes from the variety and sophistication of the products it enables. Bezos realized long before the vast majority of Amazonians that Amazon needs to be a platform.

Relative sizes of world stock markets 1899 vs 2019 (Link)

At the start of the 20th century, the UK equity market was the largest in the world, accounting for a quarter of world capitalization, dominating even the US market (15%). Germany (13%). Of the US firms listed in 1900, over 80% of their value was in industries that are today small or extinct. Today the US equity market us the largest in the world, accounting for 50% of world capitalization with the UK now under 6%.

What Happened When I Bought a House With Solar Panels (Link)

I’d soon learn that the system was tied to the title of the house. It appeared that if we bought Jug’s place, we’d have to assume his lease arrangement with Sunrun. On consumer review sites and in local news reports, rueful customers warn others to stay away from TPO solar offered by Sunrun and other companies. State attorneys general and politicians have fielded complaints from people who say they were sold expensive systems they can’t afford after signing contracts they didn’t understand; or are paying more now on their electricity bills, not less as promised; or are having trouble selling their homes because potential buyers are turned off, just as I was. (Customers of Sunrun and other companies must sign binding arbitration clauses, barring them from suing or joining in class actions.) Salespeople would cherry-pick data, skim over crucial details, and prioritize speed above all, he told me. A trainer from California who listened in on hundreds of sales calls for quality control estimated that 60 % of customers knew no more than half of what they were signing up for and 10 % had no clue.

_________________

Google vs. Amazon (Link)

Steve Yegge spent years at both Amazon and Google. His famous posting from 2011 gives an insiders look what Amazon was able to figure out early on and what hindered Google. Google did nearly everything better than Amazon, yet Amazon continued to be more successful. The difference came down to products vs. platforms and Amazon’s CEO Bezos was fierce about building platforms and Google didn't understand this. Products are always built on top of platforms. Platforms are all about long-term thinking. The power of a platform comes from the variety and sophistication of the products it enables. Bezos realized long before the vast majority of Amazonians that Amazon needs to be a platform.

Relative sizes of world stock markets 1899 vs 2019 (Link)

At the start of the 20th century, the UK equity market was the largest in the world, accounting for a quarter of world capitalization, dominating even the US market (15%). Germany (13%). Of the US firms listed in 1900, over 80% of their value was in industries that are today small or extinct. Today the US equity market us the largest in the world, accounting for 50% of world capitalization with the UK now under 6%.

What Happened When I Bought a House With Solar Panels (Link)

I’d soon learn that the system was tied to the title of the house. It appeared that if we bought Jug’s place, we’d have to assume his lease arrangement with Sunrun. On consumer review sites and in local news reports, rueful customers warn others to stay away from TPO solar offered by Sunrun and other companies. State attorneys general and politicians have fielded complaints from people who say they were sold expensive systems they can’t afford after signing contracts they didn’t understand; or are paying more now on their electricity bills, not less as promised; or are having trouble selling their homes because potential buyers are turned off, just as I was. (Customers of Sunrun and other companies must sign binding arbitration clauses, barring them from suing or joining in class actions.) Salespeople would cherry-pick data, skim over crucial details, and prioritize speed above all, he told me. A trainer from California who listened in on hundreds of sales calls for quality control estimated that 60 % of customers knew no more than half of what they were signing up for and 10 % had no clue.

Friday, March 1, 2019

Weekend catch up

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Life lessons from Blackstone's Byron Wien (Link)

- If you want to be successful and live a long, stimulating life, keep yourself at risk intellectually all the time.

- The hard way is always the right way.

- Don’t try to be better than your competitors, try to be different.

- If it pays the most, you’re lucky. If it doesn’t, take it anyway, I took a severe pay cut to take each of the two best jobs I’ve ever had, and they both turned out to be exceptionally rewarding financially.

Don’t ask for his macro forecast - Howard Marks (Link)

“I don’t think anybody can consistently know the economy, interest rates, currencies, and the direction of the markets better than anybody else. So I swear off forecasting, and one of the elements in Oaktree’s investment philosophy is that we do not base our investments on macro forecasts. That doesn’t mean we’re indifferent to the macro, and our approach is, rather than depend on forecasts of the future, we depend on reading the present. I believe one of the greatest predictors of what the market’s going to do, or influences on what the market’s going to do, is where it stands in the various cycles, and if we can have an idea when the market is at an extreme position, I believe that can help us increase or decrease our aggressiveness or defensiveness in a timely fashion.”

The greatest investor you’ve never heard (Link)