Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due to the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens. After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same as everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

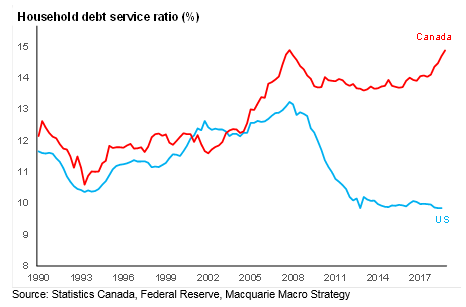

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

US labour stats

No obvious signs of overheating in US wage growth

Empirical Research

This is thanks to the baby boomers demographic who are reluctant to change jobs for higher wages

Empirical Research

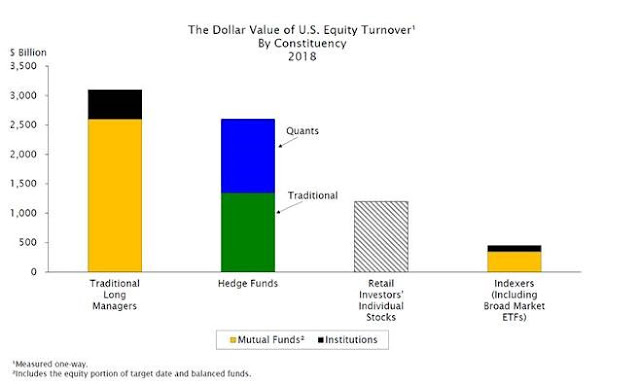

US asset flows

Hedge funds now represent almost 33% of trade volumes in the US

Empirical Research

ETF money flowing to safety in early 2019