Friday, January 31, 2020

This week's interesting finds

When giants fall

America’s highest valued automaker

Tesla has an extremely high premium on earnings when compared with its more established counterparts in the auto industry.

The enterprise multiple (EV/EBITDA) measures the dollars in enterprise value for each dollar of earnings. The ratio is commonly used to determine if a company is undervalued or overvalued compared to peers.

The Apple effect

In 1997 Apple was valued at $3 billion — less than one-tenth of the value of Siemens, Europe’s largest industrial group both then and now. Fast forward two and a half decades, and Apple’s market capitalization exceeds not only Siemens — at $1.42 trillion Apple is worth more than the entire Dax index of Germany’s 30 leading companies.

A busy year for Constellation Software

A bright future

The many young people who seem to share her gloomy view of the future should read the new book by Laurence B. Siegel, “Fewer, Richer, Greener.” In it, he proclaims, “We are on the verge of the greatest democratization of wealth and well-being that the world has ever known” and “the market is a powerful mechanism for driving bad and dishonest providers out of business.”

On destroying the planet:

As the world gets richer it will continue to get greener. Switzerland is probably the most environmentally clean country in the world, and it is one of the very richest. As time passes, Greece will act more like Switzerland, Colombia more like Greece, Ethiopia more like Colombia and so on until the whole world is much greener than it is now.

On apocalyptic thinking:

Our neural network says to us all the time: That could be a tiger, or it could be a rabbit, so let’s assume it’s a tiger. In the modern world, though, that often leads us to worry more about some dangers than we need to, because they rarely or never occur anymore. Apocalyptic thinking has always been wrong as a forecast, and it will continue to be wrong. Here’s hoping young people will take his message to heart, realize that capitalism can be a force for good and stop fearing the future.

Cut back on email if you want to fight global warming

Everyone has seen the warning. At the bottom of the email, it says: “Please consider the environment before printing.” But for those who care about global warming, you might want to consider not writing so many emails in the first place.

The problem is that all those messages require energy to preserve them. And despite the tech industry’s focus on renewables, the advent of streaming and artificial intelligence is only accelerating the amount of fossil fuels burned to keep data servers up, running, and cool.

This is a sector “where emissions are increasingly getting out of control,” says Philippe Zaouati, chief executive officer of Paris-based Mirova, a $15 billion sustainable asset manager. “We need to decrease carbon emissions, and what we see in the IT sector is increasing emissions.”

Indeed, socially conscious investors have historically been attracted to tech stocks, based on the assumptions that it’s a low-emissions industry. Some are starting to rethink that.

Friday, January 24, 2020

This week's interesting finds

Improving investor behavior: Act like an owner

Most business owners can feel the pulse of their business. If you own a coffee shop, for instance, you can go to the location, see and interact with your employees, touch your inventory and keep your customers happily caffeinated. You can smell the aroma of your business. You can feel it.

What if you had that same feeling as a shareholder of a public company that sells coffee? What if you thought like an owner? For most investors, the feeling of being an owner of that company is divorced from owning a percentage of shares in a public company. Some may think those shares represent a lottery ticket that goes up and down every business day on some stock exchange, based on public consensus or what some analyst says or does not say about that company’s future prospects. Some almost consider it like a casino.

But when you think like an owner, your perspective changes. Owning a share of that business can be an abstract thought. Owning your own coffee shop worth $1 million is just as valuable as owning $1 million worth of stock in that public company.

Make no mistake, you are an owner of that business, albeit a minority owner, but still an owner!

You can’t tell the quality of a decision from the outcome

You make the best decision you can base on what you know, but the success of your decision will be heavily influenced by (a) relevant information you may lack and (b) luck or randomness. Because of these two factors, well-thought-out decisions may fail, and poor decisions may succeed. While it might seem counterintuitive, the best decision-maker isn't necessarily the person with the most successes, but rather the one with the best process and judgment.

You have to understand the significance of the information you have, as well as that which you don’t have. You need the nerve to bet heavily based on what you think you know and a healthy respect for what you may not know.

Coal-Driven Decline in U.S. CO2 Emissions

Since 2007, total net GHG emissions in the US have fallen by 13%.

What’s behind the significant reduction in U.S. emissions? In short, it’s almost entirely due to the decline in coal consumption. Last year, coal-fired power generation fell by a record 18% year-on-year to the lowest level since 1975. A large increase in natural gas electrical generation has offset some of the climate gains from this coal decline, but overall power sector emissions still decreased by almost 10%.

S&P 500 Index went an entire decade without a 20% drop, for only the second time on record

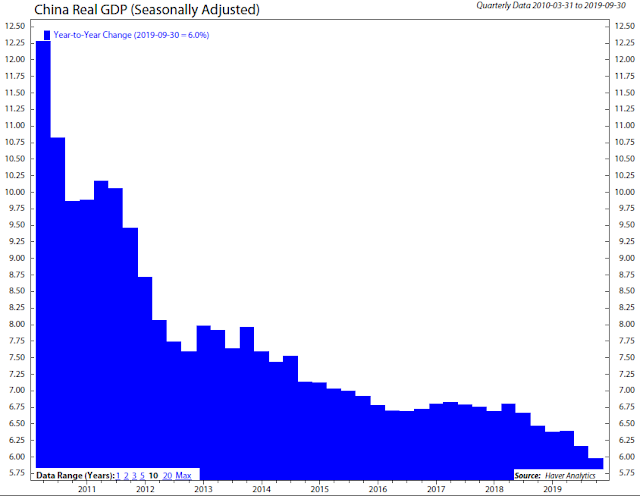

China’s growth rate was cut in half from 2010 to 2019

Nowhere was the slowdown more pronounced than in China, where real GDP growth was cut in half to 6.0% from the beginning to the end of the decade.

Shopify and the Power of Platforms

Despite the fact that Amazon had effectively split itself in two in order to incorporate 3rd-party merchants, this division is barely noticeable to customers. They still go to Amazon.com, they still use the same shopping cart, they still get the boxes with the smile logo. Basically, Amazon has managed to incorporate 3rd-party merchants while still owning the entire experience from an end-user perspective. Aggregators tend to internalize their network effects and commoditize their suppliers, which is exactly what Amazon has done. Amazon benefits from more 3rd-party merchants being on its platform because it can offer more products to consumers and justify the buildout of that extensive fulfillment network; 3rd-party merchants are mostly reduced to competing on price.

Comic relief

Friday, January 17, 2020

This week's interesting finds

EdgePoint video: EdgePoint's investment approach

At EdgePoint, we believe the most valuable thing about us is the application of our investment approach. Our primary goal is making money for you and your clients, but pleasing returns over the long term are more likely if you understand and believe in the EdgePoint investment approach. We hope this short video will help explain our process and act as a helpful reminder when your beliefs are tested.

Charts on the market

Multiple expansion explains the S&P 500’s impressive total return in 2019, despite muted earnings.

Bigger has never been better?

The % share of the largest five companies in the S&P 500 has reached record levels in recent weeks. They now account for roughly 18% of the S&P 500 market capitalization -- higher than even the tech bubble. In 2019, the % share of the top five continued to climb while their % share of overall S&P 500 net income declined.

Rising concentration risks

Apple and Microsoft, which surged 86% and 55% in 2019, respectively, together accounted for nearly 15% of the S&P 500′s advance last year. No other stock even came close to their contribution.

Don't get scared

Peter Lynch once said, “The real key to making money in stocks is not to get scared out of them.” Take Clorox for example over the last 30 years. This company is up more than 30-fold over 30 years!

Here’s the stock, but over one five-year stretch.

Rising number of ETF closures

A study on 1,662 ETFs that were active in December 2014 showed that by August of 2019, 24% shut down and 30% experienced a decline in assets. Most of the growing ETFs were broad-based ETFs managed by either BlackRock Inc., Vanguard Group and State Street Corp., which together control 81% of all ETF assets.

Friday, January 10, 2020

This week's interesting finds

January 11, 2020

Our Q4 commentaries are available now

This quarter, portfolio manager Andrew Pastor explains his investing journey (and what he learned to forget along the way), while portfolio manager Frank Mullen discusses finding positives in a negative-yield environment.

Our Q4 commentaries are available now

This quarter, portfolio manager Andrew Pastor explains his investing journey (and what he learned to forget along the way), while portfolio manager Frank Mullen discusses finding positives in a negative-yield environment.

Canadian energy makes the world a better place (en) (fr)

A short video that reinforces the benefits that the Canadian energy industry, directly and indirectly, brings to all Canadians.

Canada has an abundance of natural resources that can fuel our nation yet we are importing resources daily from countries that take advantage of us, and that do not share the social values or legal standards that we demand from ourselves.

Canada should be a world leader in supplying the most responsibly sourced energy not only to ourselves but to other parts of the world as well.

Streaming and cloud services are soaking up huge amounts of energy

A researcher at Huawei Technologies Sweden expects the world's data centers alone will devour up to 651 terawatt-hours of electricity. That is equivalent to the energy produced from Canada’s entire energy sector. This researcher also suggests that global data centre energy demands will double over the next decade and will represent 11% of global energy consumption by 2030.

What's driving the increased demand for data? Streaming video is currently the biggest culprit, with platforms like Netflix and Amazon Prime Video eating up 61% of all internet traffic.

The million-dollar age grid

This grid shows at what age you can become a millionaire, based on your yearly savings and when you start saving. This grid assumes you start with $0 and your savings are invested at 7% annually.

If you start saving $24,000 every year starting at age 30, you will have one million dollars by the time you are 50, or if you start saving $10,000 a year, by the time you are 60.

Efficiently concentrated through ETFs

One of the primary drivers of the boom in ETFs over the last decade is that they provide efficient diversification. While that’s the theory, the reality is that a number of the biggest sector ETF’s aren’t that diversified at all.

Investing in “the market” or a specific sector is increasingly becoming a concentrated bet on a few large names.

Would you believe that the two largest holdings in two sector ETFs account for more than 40% of the entire ETF? That’s right, in the Energy sector, the top two holdings (Exxon and Chevron) account for just under 43% of the entire ETF, while Alphabet and Facebook account for 41.8% of the Communications Services sector. In the Tech sector, Apple and Microsoft account for just under 40% of the ETF.

This grid shows at what age you can become a millionaire, based on your yearly savings and when you start saving. This grid assumes you start with $0 and your savings are invested at 7% annually.

If you start saving $24,000 every year starting at age 30, you will have one million dollars by the time you are 50, or if you start saving $10,000 a year, by the time you are 60.

One of the primary drivers of the boom in ETFs over the last decade is that they provide efficient diversification. While that’s the theory, the reality is that a number of the biggest sector ETF’s aren’t that diversified at all.

Investing in “the market” or a specific sector is increasingly becoming a concentrated bet on a few large names.

Would you believe that the two largest holdings in two sector ETFs account for more than 40% of the entire ETF? That’s right, in the Energy sector, the top two holdings (Exxon and Chevron) account for just under 43% of the entire ETF, while Alphabet and Facebook account for 41.8% of the Communications Services sector. In the Tech sector, Apple and Microsoft account for just under 40% of the ETF.

Friday, January 3, 2020

This week's interesting finds

January 4, 2020

When kicking off a new year it’s a good idea to remind yourself of some important investing lessons. As we enter a new decade, here are some of our favourites from this list.

- Be humble or the markets will eventually find a way to humble you. Having more confidence is a good thing in many areas of life. Markets are not one of them. More confident investors tend to trade more and take on undue risk, leading to worse performance.

- Being good at suffering is a superpower. When you think about the great investors in history, suffering probably isn’t the first word that comes to mind. But having a high threshold for pain is just about the most important trait you can have in this business.

- Be humble or the markets will eventually find a way to humble you. Having more confidence is a good thing in many areas of life. Markets are not one of them. More confident investors tend to trade more and take on undue risk, leading to worse performance.

- Being good at suffering is a superpower. When you think about the great investors in history, suffering probably isn’t the first word that comes to mind. But having a high threshold for pain is just about the most important trait you can have in this business.

- The longer your holding period, the higher your odds of success.

- The best strategy is the one you can stick with long enough to reap the benefits of compounding.

- Price targets are pointless. Forecasts are foolish. Cycles and trends exist. That does not mean they are easy to predict or navigate.

- Learn to control your emotions or your emotions will control you. Don’t be afraid to say “I don’t know.” Stay within your “circle of competence.” Thinking you know something and acting on that opinion can be far more harmful than admitting you just don’t know.

The disappearing edge

The disappearing edge

The rise in computing power and new regulations for full instant transparency have made it increasingly hard to gain an edge over the competition. In Charlie Ellis’s Winning the Loser’s Game, he lists another possible way to gain an edge. You try to remain steadier than the competition. You can never get too hot or too cold, even when those around you are acting irrationally.

Cyclicals comprise less than 30% of the S&P 500 Index.

8 out of 11 sectors underperformed the S&P 500 over the last three years.

The number of billion-dollar IPOs surged this decade, but their performance lags.

This was the decade when companies behind some of the world’s most-used apps went public at record valuations. In 2019 alone, there were 13 U.S. unicorns valued at $1 billion or more. Far more than in any prior year.

From 2010 to 2014, nine unicorns reported an annual profit. From 2015 to 2019 only four unicorns have reported an annual profit at least once, including Uber and Zoom Video in 2019. Uber’s profit was due to a gain on the sale of investments.

The last decade was tough for the average green stock.

Global clean energy shares underperformed the S&P 500 Index by 70% in the past, despite an estimated $2.4 trillion invested in projects involving the two fast-growing renewable power technologies – wind and solar.

The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of more than 100 companies around the world specializing in renewables and related areas, such as energy efficiency and electric vehicles, was trading at 215.60 on Friday, December 20, 2019 – some 13% down compared to its level on the last day of 2009.

Cyclicals comprise less than 30% of the S&P 500 Index.

8 out of 11 sectors underperformed the S&P 500 over the last three years.

The number of billion-dollar IPOs surged this decade, but their performance lags.

This was the decade when companies behind some of the world’s most-used apps went public at record valuations. In 2019 alone, there were 13 U.S. unicorns valued at $1 billion or more. Far more than in any prior year.

From 2010 to 2014, nine unicorns reported an annual profit. From 2015 to 2019 only four unicorns have reported an annual profit at least once, including Uber and Zoom Video in 2019. Uber’s profit was due to a gain on the sale of investments.

The last decade was tough for the average green stock.

Global clean energy shares underperformed the S&P 500 Index by 70% in the past, despite an estimated $2.4 trillion invested in projects involving the two fast-growing renewable power technologies – wind and solar.

The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of more than 100 companies around the world specializing in renewables and related areas, such as energy efficiency and electric vehicles, was trading at 215.60 on Friday, December 20, 2019 – some 13% down compared to its level on the last day of 2009.

Subscribe to:

Comments (Atom)