Friday, January 24, 2020

This week's interesting finds

Improving investor behavior: Act like an owner

Most business owners can feel the pulse of their business. If you own a coffee shop, for instance, you can go to the location, see and interact with your employees, touch your inventory and keep your customers happily caffeinated. You can smell the aroma of your business. You can feel it.

What if you had that same feeling as a shareholder of a public company that sells coffee? What if you thought like an owner? For most investors, the feeling of being an owner of that company is divorced from owning a percentage of shares in a public company. Some may think those shares represent a lottery ticket that goes up and down every business day on some stock exchange, based on public consensus or what some analyst says or does not say about that company’s future prospects. Some almost consider it like a casino.

But when you think like an owner, your perspective changes. Owning a share of that business can be an abstract thought. Owning your own coffee shop worth $1 million is just as valuable as owning $1 million worth of stock in that public company.

Make no mistake, you are an owner of that business, albeit a minority owner, but still an owner!

You can’t tell the quality of a decision from the outcome

You make the best decision you can base on what you know, but the success of your decision will be heavily influenced by (a) relevant information you may lack and (b) luck or randomness. Because of these two factors, well-thought-out decisions may fail, and poor decisions may succeed. While it might seem counterintuitive, the best decision-maker isn't necessarily the person with the most successes, but rather the one with the best process and judgment.

You have to understand the significance of the information you have, as well as that which you don’t have. You need the nerve to bet heavily based on what you think you know and a healthy respect for what you may not know.

Coal-Driven Decline in U.S. CO2 Emissions

Since 2007, total net GHG emissions in the US have fallen by 13%.

What’s behind the significant reduction in U.S. emissions? In short, it’s almost entirely due to the decline in coal consumption. Last year, coal-fired power generation fell by a record 18% year-on-year to the lowest level since 1975. A large increase in natural gas electrical generation has offset some of the climate gains from this coal decline, but overall power sector emissions still decreased by almost 10%.

S&P 500 Index went an entire decade without a 20% drop, for only the second time on record

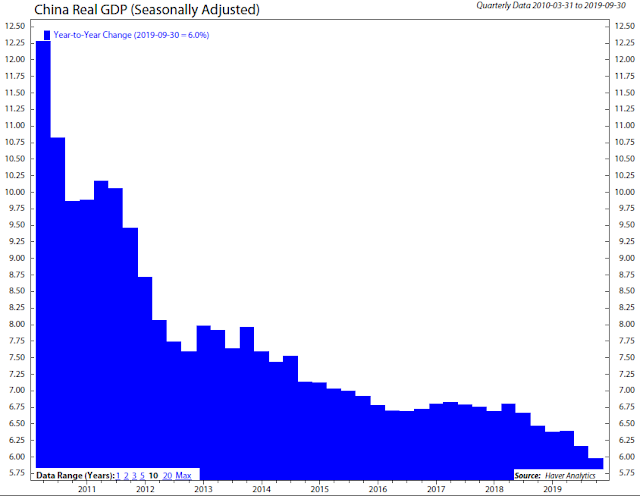

China’s growth rate was cut in half from 2010 to 2019

Nowhere was the slowdown more pronounced than in China, where real GDP growth was cut in half to 6.0% from the beginning to the end of the decade.

Shopify and the Power of Platforms

Despite the fact that Amazon had effectively split itself in two in order to incorporate 3rd-party merchants, this division is barely noticeable to customers. They still go to Amazon.com, they still use the same shopping cart, they still get the boxes with the smile logo. Basically, Amazon has managed to incorporate 3rd-party merchants while still owning the entire experience from an end-user perspective. Aggregators tend to internalize their network effects and commoditize their suppliers, which is exactly what Amazon has done. Amazon benefits from more 3rd-party merchants being on its platform because it can offer more products to consumers and justify the buildout of that extensive fulfillment network; 3rd-party merchants are mostly reduced to competing on price.

Comic relief