EdgePoint video: Worth your while – knowing the value of what you own

Stocks get traded every day at prices that can have little to do with their value. This usually happens when people buy and sell based on greed and fear rather than knowing what their ownership stake in the business is worth. We believe that the best way to avoid falling into an emotional trap is to act like a rational business owner and differentiate between what the business is really worth versus what the market thinks it's worth.

Reasons not to sell

The past week marked the fastest correction in the S&P 500 Index on record. It is during times like this that people struggle to separate their emotions from their investment decisions and begin to behave erratically. Below is a chart that shows the top reasons to sell we’ve seen over the last decade. The key is to resist the urge to act irrationally and believe in your investment approach.

We just witnessed the fastest stock market correction on record

Crisis and Recovery

Divergence in ESG ratings

Charlie Munger at the 2020 Daily Journal AGM (video)

Takeaways:

Many people automatically assume that because the market has been rising for many years that we must be in a bubble. This may be true but Charlie noted that each time period is unique, and rather than trying to pattern-match the current environment to some past analog, it’s important to think from first principles. Doing so leads me to proceed very cautiously given the prevailing optimism in the prices for most investments, but to also make investments when I do find those that meet my criteria for margin of safety.

Being able to recognize when you are wrong is a godsend. Charlie fights behavioral biases by consciously seeking out ways in which he could be wrong or looking for beliefs that he holds that are invalid. If he were to not do that intentionally, it’s very likely that his anchoring and confirmation biases would negatively impact his ability to think rationally.

100 Little Ideas that help explain how the world works:

Feedback Loops: Falling stock prices scare people, which causes them to sell, which makes prices fall, which scares more people, which causes more people to sell, and so on. Works both ways.

Reflexivity: When cause and effect are the same. People think Tesla will sell a lot of cars, so Tesla stock goes up, which lets Tesla raise a bunch of new capital, which helps Tesla sell a lot of cars.

False-Consensus Effect: Overestimating how widely held your own beliefs are, caused by the difficulty of imagining the experiences of other people.

Founder’s Syndrome: When a CEO is so emotionally invested in a company that they can’t effectively delegate decisions.

Skill Compensation: People who are exceptionally good at one thing tend to be exceptionally poor at another.

Ringelmann Effect: Members of a group become lazier as the size of their group increases. Based on the assumption that “someone else is probably taking care of that.”

Group Attribution Error: Incorrectly assuming that the views of a group member reflect those of the whole group.

Normalcy Bias: Underestimating the odds of disaster because it’s comforting to assume things will keep functioning the way they’ve always functioned.

How much does it cost to buy a fast-food franchise?

Many people dream of buying a fast-food franchise of their own, but few can afford it. All told, it might cost a franchisee upwards of $2 million to develop, build, and buy the right to open a McDonald’s or a KFC. Many chains won’t even look at your application unless you have a net worth of $1 million and $500k in readily spendable cash sitting around.

But there’s an exception to this: A franchise at Chick-fil-A — one of America’s oldest, largest, and most profitable chains — can be yours for just $10k.

Why is opening a Chick-fil-A franchise so cheap? Chick-fil-A, not the franchisee, covers nearly the entire cost of opening each new restaurant. The franchisee only pays the $10k franchise fee. What’s the catch? In return for paying most of the upfront costs, Chick-fil-A takes a MUCH bigger piece of the pie (royalties). While a franchise like KFC takes 5% of sales, Chick-fil-A commands 15% of sales + 50% of any profit.

At $4.2m per store, Chick-fil-A’s average revenue is the highest of any fast-food chain in America.

Seems like a great deal if you can be accepted. With a 0.13% acceptance rate, it’s harder to become a Chick-fil-A franchisee than it is to get into Stanford University (4.8%), or get a job at Google (0.23%).

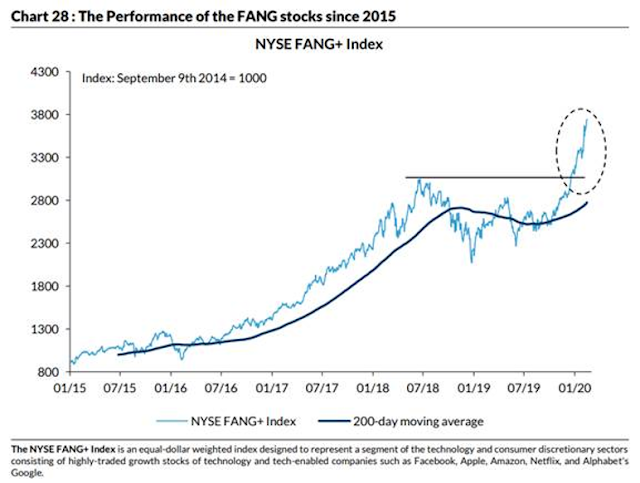

Charts of the week

This week's funnies.

Bond funds are hotter than Tesla

From 1990 through 1999, bond funds and bond ETFs accounted for only 10% of the cumulative $2.37 trillion that flowed into funds, according to the Investment Company Institute. From 2000 through 2009, bond funds made up 26% of the $3.5 trillion in total inflows. Over the 10 years just ended, however, 74% of the total $2.68 trillion that investors added went into bond funds.

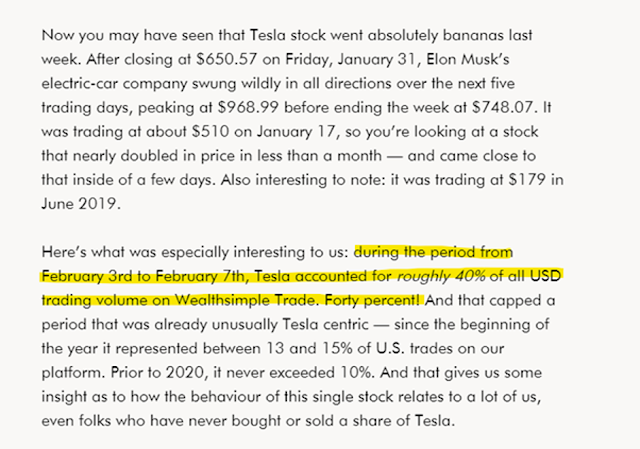

Tesla accounted for 40% of volume on online trading app

Housing in Canada

According to The Economist magazine, in the last 50 years, only 2 countries have touched Canada’s current House Price to Income Ratio. This is what happened to those two countries after:

Japan in the early 90’s and the US in the mid 2000’s never got close to where we are today:

Big Technology Stocks Dominate ESG Funds

Many of the tech companies that are among the most popular stocks in sustainable funds have earned high ratings across multiple elements that analysts consider in evaluating ESG practices. Index provider MSCI Inc. gave Microsoft an “AAA” rating on ESG—the highest possible score, awarded to just 4% of companies in the software and services industry. It cited the company’s strength on privacy and data security, corporate governance, lack of corruption and instability, and clean-tech-innovation capacity.

MSCI gave Facebook and Amazon poor ratings on privacy and data security and on labor management, respectively. The two stocks are held by a number of large sustainable funds anyway since they satisfy other criteria.

Many of the biggest ESG funds try to minimize how much their fund deviates from the broader market by creating a portfolio that, for the most part, looks like today’s technology-dominated S&P 500—just stripped of the companies with the worst ESG practices within each industry. Investors need to look beyond the “feel-good aspect of ESG” and understand what exactly they are buying.

The fact that definitions of ESG can vary so much from firm to firm has caught the eye of the Securities and Exchange Commission. The agency has sent letters to companies asking advisers how and what they determine are socially responsible investments, The Wall Street Journal reported last year.

Are massive inflows into sustainable funds lifting tech shares?

Photo contest: Winner!

Tye's concert (festival?) photo is this quarter's winner! You can almost hear the music. We loved the grittiness and the geometric designs captured in the moment.

EdgePoint: Planning for retirement

Our latest entry of the EdgePoint Academy focuses on retirement, specifically on topics and issues faced by investors preparing to retire or already there. Over the next few months, we’ll publish a series of articles covering the following topics:

Are your retirement savings on track? Compound your money, not your problems.

The big day has arrived: having the right investments can help meet your retirement income needs

The retirement income balancing act: the impact of withdrawal rates

Sequence of returns: a risk worth learning about

Your retirement preparedness temperature check

First things first – what you need to know while you’re saving for retirement and how compounding can help you.

Wealth is what you don’t spend

The median family income adjusted for inflation was $29,000 in 1955. Today it’s just over $63,000, an all-time high. But half of Americans today have zero dollars saved for retirement.

The gap between what you earn and what you spend is the figure that matters most. The majority of Americans earn more today than ever before, but it might not feel that way because the gains have been offset with higher spending.

To generalize only a little: In the 1950s camping was an acceptable vacation. Hand-me-downs were acceptable clothes. A 983 square foot house was an acceptable size. Kids sharing a room was an acceptable arrangement. A tire swing was acceptable entertainment. Few of those things are acceptable for most households today. The average new home now has more bathrooms than occupants.

The median household’s real wage gains over the last half-century have been spent. The household savings rate fell by 30% during a period when the median real income rose 40%.

The % of S&P 500 Index sectors at record valuations is higher than during the tech bubble

Inflows into Tech funds

Young people want to own Tesla, they don’t want to own fossil fuels

Jim Cramer on CNBC “The world’s changed. There’s new managers, they don’t want to hear whether these are good or bad… this has to do with new kinds of money managers who frankly just want to appease younger people who believe that you can’t ever make a fossil fuel company sustainable.”

Changes in global energy mix: