Fees don’t tell the full story

The Classic 60/40 Investing Strategy Could Now Be Working Against You

Some financial advisors and investors are wrestling with the standard portfolio known as “60/40”. For years it was a go-to for investment assets: 60% equities, 40% fixed income. A diversified basket of stocks gives you growth potential, and the bonds give you safety and ballast.

These days, though, you don’t hear as much about this old financial rule of thumb. In fact some market observers have called the idea “no longer good enough,” “leading investors over a cliff,” or even “dead” altogether.

Why is that?

When bonds used to pay 6-8% and interest rates were falling, the 60/40 model worked great. But as they say, past performance is no guarantee of future results, and that is especially true with the 60/40 portfolio. The 40% (bonds) which is supposed to reduce risk is now fraught with interest-rate risk, and if interest rates rise, the bonds will go down in value.

E&P spending in the US - It's still not coming back

Producers have historically put the brakes on capital spending when commodity prices fell, then stomped on the accelerator like a race car heading into a straightaway when prices rose. But recently unveiled 2021 budgets for many E&Ps suggest that, even with the rebound in prices, they are maintaining a conservative investment paradigm that highlights strengthening balance sheets and rewarding shareholders at the expense of rapid production growth.

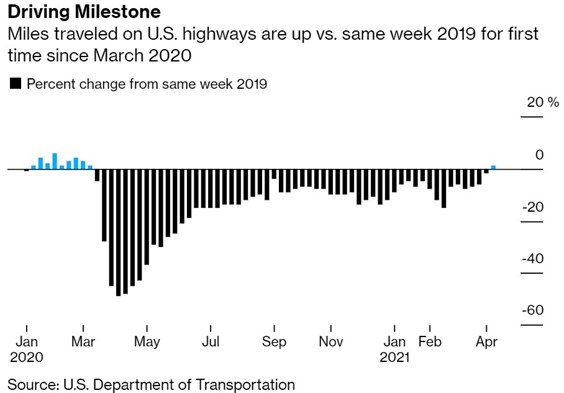

Driving on U.S. Highways Tops 2019 Levels

Here’s the latest sign of the great U.S. gasoline comeback: For the first time since the pandemic started, driving on the nation’s highways is higher than at the same time in 2019.

US E-Commerce Penetration

Overall US ecommerce penetration has not actually settled very far from the underlying trend line in the past year.

Tech, a big ESG overweight, isn’t all that green

Technology is one of the most over weighted sectors by ESG funds, but we find it has some of the highest indirect emissions among service industries.

Bitcoin purchases' carbon footprint

$1 billion in Bitcoin purchases is equal to 1.2 million cars driven over the course of a year