We're always looking for talented people who can help us achieve our goals and we understand that extraordinary human ability is a scarce resource in high demand. If you think you've got some and are interested in our company, please send your resume to: WeAreGrowing@EdgePointwealth.com.

Current opportunities:

- Product managerThis week in Charts

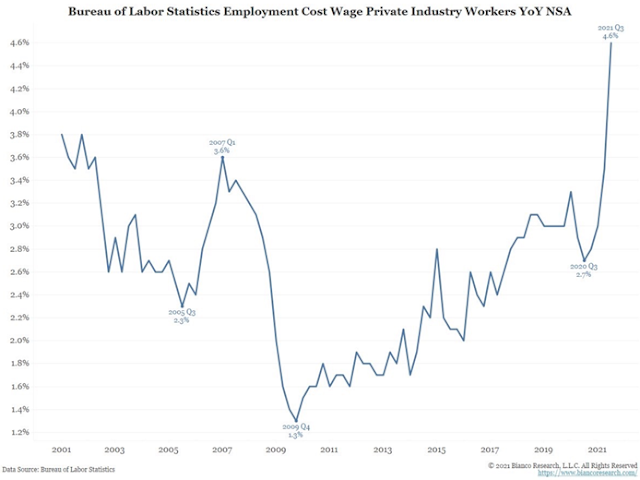

Wages and salaries for private industry workers (not seasonally adjusted)

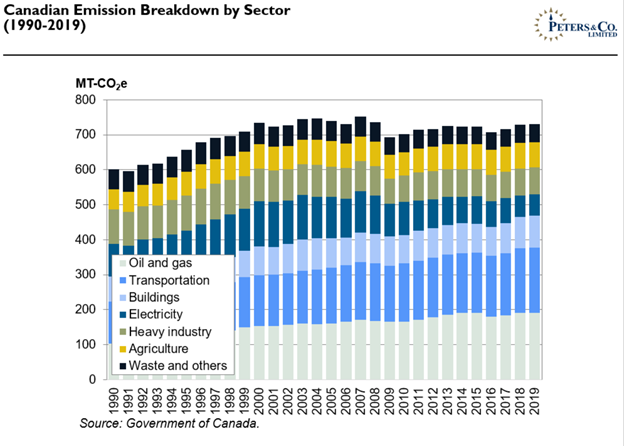

Emissions by sector

Bill Ackman’s presentation to NY Fed on why they should raise interest rates

Key points:

- More than 25 million jobs were lost due to the pandemic between February and April 2020, but the economy has since recovered 20 million jobs (~80%).

- At the current pace of ~500K monthly job additions, we expect the five million employment gap to pre-pandemic levels to close within the next 10 months.

- The annualized pace of growth across several key inflation measures, including wage inflation, has remained elevated in the mid to high-single-digit range.

- Even excluding the impact of new vehicles and used cars and trucks, which have experienced heightened inflation, CPI has been increasing at an annualized growth rate of approximately 5%.

- Both the unemployment rate is lower AND inflation measures are substantially higher today than at the beginning of prior rate hike cycles.

Highest price hike to milk in recent memory

The Canadian Dairy Commission, a crown corporation that sets the price that dairy farmers get for their milk, had just put out a statement recommending an increase of 8.4 per cent, to make up for big jumps in the cost of feed, fuel and equipment.

The price hike, if approved by provincial authorities, will take effect in February, amounting to an extra six cents per litre for processors that buy milk from farmers and turn it into retail-ready products.

These Lenders Are Making A Growing Number of LBOs Possible

Private equity firms are finding that more leveraged buyouts of tech companies are becoming possible, thanks to lenders that have deeper pockets than ever: private credit firms.

These lenders are providing financing to companies that wouldn’t be able to borrow as much in bond or leveraged loan markets. Private credit firms’ willingness to finance these kinds of deals is helping to fuel the highest volume of LBOs for tech companies since 2016. And they’ve enlarged the universe of publicly traded U.S. corporations that private equity firms can readily buy by somewhere around $550 billion.

The loans in question are either to companies that are burning through cash and don’t have enough earnings to pay interest, or to corporations that need more debt for a leveraged buyout than bond or syndicated loan markets will provide. Some of these financings can pay interest of 8 percentage points or more, far above yields available in other comparable markets.