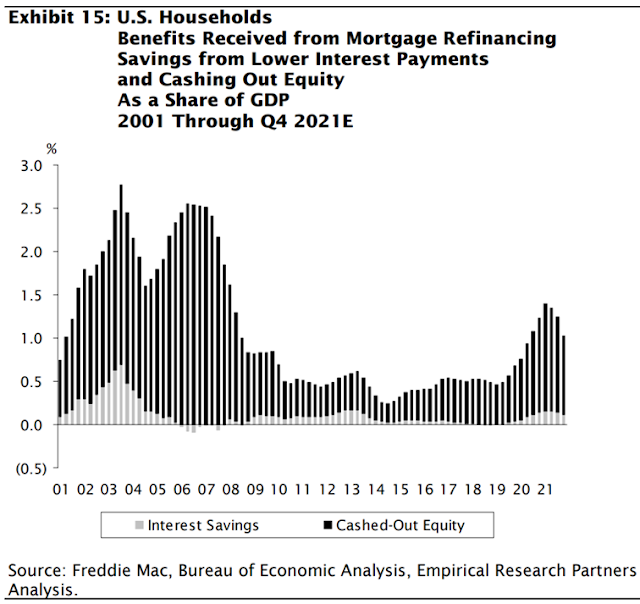

Refinancing and cashing out equity

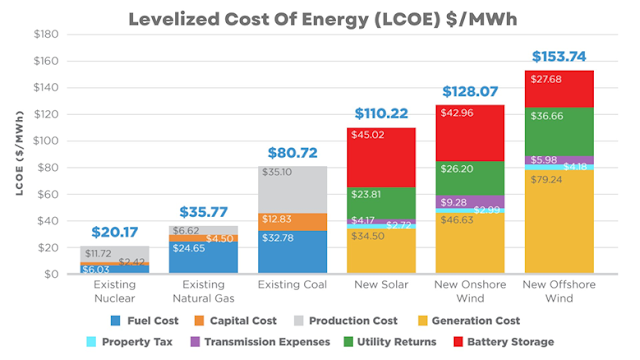

Battery input costs are on the rise

Cost of energy

Net oil exports

“Price of regret” by Tye Bousada and Geoff MacDonald (Pg. 7 to 9)

We (Geoff and Tye) learned about the idea of future regret as children. For example, one of us grew up surrounded by friends who raced motocross for fun. Despite this person’s mother telling him not to get on those motorcycles, he did it anyway. One day after a big fall, he ran home bleeding, scratched, and bruised, and asked his mom to bring him to the hospital. The mom, who happened to be an ER nurse, saw an opportunity to teach her son about the idea of future regret. Instead of taking him, she sewed him up on the kitchen counter. Rubbing alcohol was used to sterilize the wounds and no freezing was applied before the stiches. Lesson learned.

Daniel Kahneman, a psychologist notable for his work on the psychology of judgment, once said that “The key to investing is having a well-calibrated sense of your future regret”.

We agree that a good part of pleasing long-term returns is about having a well-calibrated view of future regret. The motorcycle example above highlights that when you boil down life’s experiences, our most learned ones are usually when we didn’t get the outcome we wanted. How do we take our experiences from the past and use them to ensure we get better and better outcomes in the future? A key is that well-calibrated understanding of risk.

The overarching problem with future regrets is that they can interrupt the magic of compounding. Our goal is to compound your wealth at a pleasing rate over the long term. The words “long term” are essential to the way we do things. We aren’t trying to achieve the highest returns in any given year. We have seen many people try to do this and believe it’s a fool’s game that leads most to ruin. Instead, our goal is to earn pleasing returns for the longest period of time possible. Recognizing this distinction is critical to understanding how we do things.

This week’s fun finds:

Hot off the presses – Cymbria annual report this week. This edition's fun finds features some of our favourite snippets from the partners' section of the latest Cymbria annual.

(Unbiased opinion – the rest of the annual is a great read, too.)

Good talk

Conversations about money are rarely easy, especially when its between family members. At a time when companies are asking investors whether "it's time to switch", we thought we could use our back page as a friendly reminder about what a good advisor can offer their clients.

EdgePoint in numbers – A year in review

Unlike most fund companies that judge their success based on assets under management, we prefer to focus on the figures that really matter to us. Below are some of the stats that mattered the most to us in 2021.

The 10-year club

We wouldn’t be where we are today without being able to partner with like-minded advisors helping their clients reach their investment goals. We wanted to recognize the advisors with clients who have remained committed for at least 10 years.

A lot's happened in the last few years since we updated the Foothills chart. We've updated the most recent events as we look at what an investment of $100,000 in Cymbria on November 3, 2008 would have grown into at the end of 2021.