Daniela Orla – EdgePoint Partner since 2015 (Toronto, ON – Queen & Spadina)

Science or tobacco (Go West) - Geoff MacDonald talks about how fossil fuels have become the "new tobacco" in the media.

This week in charts

Back to brick and mortar

CPI contributor change – August vs. September 2022

Where Canadian immigrants are coming from

More immigrants are now working in Canada than before the pandemic, and, from 2016 to 2021, immigration contributed to 79.9% of the growth in Canada's labour force.

According to 2021 Census data, almost 1.9 million children younger than 15 years had at least one parent born abroad, accounting for almost one-third (31.5%) of all children in Canada. This proportion was up from 26.7% in 2011 and 29.2% in 2016.

BASF to downsize ‘permanently’ in Europe

BASF, which produces products from basic petrochemicals to fertilisers and glues, spent €2.2bn more on natural gas at its European sites in the first nine months of 2022, compared with the same period last year.

[CEO Martin] Brudermüller said the European gas crisis, coupled with stricter industry regulations in the EU, was forcing the company to cut costs in the region “as quickly as possible and also permanently”.

The company announced two weeks ago that it would reduce costs by €1bn over the next two years, targeting mainly “non-production areas” such as IT, communications as well as research and development.

Brudermüller, who has previously warned that an embargo on Russian gas would plunge Germany into its biggest crisis since the second world war, said on Wednesday the cost cuts were necessary to “safeguard our medium and long-term competitiveness in Germany and Europe”.

German exporters rethink €100bn ‘love affair’ with China

Since the turn of the millennium, China has gone from accounting for just over 1 per cent of German exports to commanding a 7.5 per cent share of sales abroad, making it second only to the US. In 2021, more than €100bn worth of German goods were sold there.

Source: Financial Times

Thorsten Benner, director of the Global Public Policy Institute in Berlin, described the ties as the main factor in the “golden age of the German economic model”, seen during the latter stages of Angela Merkel’s 16-year reign as chancellor, which ended last year.

Alicia García-Herrero, a senior economist at think-tank Bruegel, said the buoyancy of the links between the two export powerhouses had been replaced by a sinking feeling in Berlin as exports slide. “Germany is losing its trade surplus and part of its competitiveness, partially because China has moved so rapidly up the value ladder.”

It comes at a sensitive moment for the broader relationship between the two countries. Russia’s invasion of Ukraine has given fuel to German critics of Beijing, who argue the country’s economic ties are trumping foreign policy goals and leading to collaboration with prospective geopolitical rivals. Olaf Scholz, who will fly to Beijing next week for his first meeting with Chinese leaders as German chancellor, is set to unveil his new China strategy next year. He is under pressure from his coalition partners, the Greens and the Free Democrats, to loosen ties and courted controversy when he asked ministries to back an investment from Cosco, a state-owned Chinese shipping conglomerate, in a container terminal at the Port of Hamburg. The deal was approved earlier this week, though Cosco took a smaller-than-planned stake, which will limit its capacity to influence decision-making.

“The China strategy will include clear messages on the need to reduce dependencies, and diversify supply chains and trading partners,” said Benner.

Misreading Xi and the rise of Li

The professional China commentariat and its echo chamber in the Western media were blindsided by the appointment of Shanghai party head Li Qiang as the country’s premier, the number two position to Xi Jinping.

Li is a tech-savvy supporter of high-tech entrepreneurship who believes that China’s future lies in the digital economy. Xi, the Western press insisted with near unanimity, had reverted to Maoism.

In fact, Li’s appointment as premier-designate was foreseeable as well as foreseen. Asia Times wrote as much on October 21, forecasting that Xi would opt for retiring four out of the seven Politburo Standing Committee members, including not only Premier Li Keqiang, but also the widely touted premiership candidate Wang Yang, and would not miss the opportunity to install a new, younger and different cast of leaders.

Li is the Shanghai party chief. Few if any previous Shanghai leaders have failed to advance to the Standing Committee, Xi included. That his advance to the number two position nonetheless came as a surprise to most Western analysts merely proves how much so many have misread Xi in particular and Chinese governance in general.

This week’s fun finds

Discovery Unlocks Potential of 'Special' Muscle

And Marc Hamilton, professor of Health and Human Performance at the University of Houston, has discovered such an approach for optimal activation – he’s pioneering the “soleus pushup” (SPU) which effectively elevates muscle metabolism for hours, even while sitting. The soleus, one of 600 muscles in the human body, is a posterior leg muscle that runs from just below the knee to the heel.

Building on years of research, Hamilton and his colleagues developed the soleus pushup, which activates the soleus muscle differently than when standing or walking. The SPU targets the soleus to increase oxygen consumption – more than what’s possible with these other types of soleus activities, while also being resistant to fatigue.

So, how do you perform a soleus pushup?

In brief, while seated with feet flat on the floor and muscles relaxed, the heel rises while the front of the foot stays put. When the heel gets to the top of its range of motion, the foot is passively released to come back down. The aim is to simultaneously shorten the calf muscle while the soleus is naturally activated by its motor neurons.

While the SPU movement might look like walking (though it is performed while seated) it is the exact opposite, according to the researchers. When walking, the body is designed to minimize the amount of energy used, because of how the soleus moves. Hamilton’s method flips that upside down and makes the soleus use as much energy as possible for a long duration.

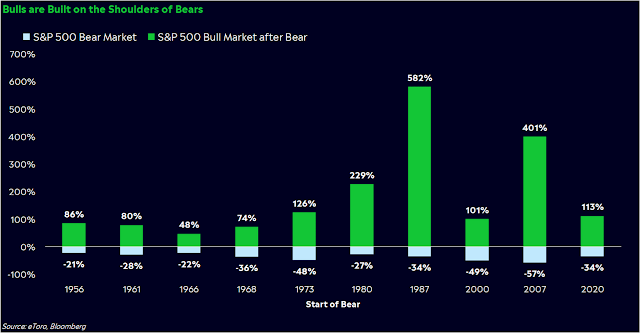

Save Like A Pessimist, Invest Like An Optimist

But there was another side of Bill Gates. It was almost paranoia, virtually the opposite of his unshakable confidence.

From the day he started Microsoft he insisted on always having enough cash in the bank to keep the company alive for 12 months with no revenue coming in. In 1995 he was asked by Charlie Rose why he kept so much cash on hand. Things change so fast in technology that next year’s business wasn’t guaranteed, he said, “Including Microsoft’s.” In 2007 he reflected:

"I was always worried because people who worked for me were older than me and had kids, and I always thought, ‘What if we don’t get paid, will I be able to meet the payroll?’”

Optimism and pessimism can coexist. If you look hard enough you’ll see them next to each other in virtually every successful company and successful career. They seem like opposites, but they work together to keep everything in balance.

What Gates seems to get is that you can only be an optimist in the long run if you’re pessimistic enough to survive the short run.

The best way for most people to apply that is: Save like a pessimist, invest like an optimist.

1 in 3 Gen Z Adults Have Seen a Horror Movie in Theaters in the Past Month

It's spooky how fast Spirit Halloween stores pop up. Here's how the retailer does it

Beneath the songs and the memes, the story of Spirit Halloween is really one of urban development patterns.

Perhaps above all, Spirit's business model hinges on space. Lots of it. Spirit looks for anywhere between 5,000 and 50,000 square feet of space, but in the company's own words, "no store is too large (or too small)" — and the company has no problem finding the space it needs.

Drop any ZIP code or address into the company's store locator, and a flurry of orange arrows is almost sure to pop up.

The company finds this space largely in abandoned buildings — malls that have shut down, retailers that have filed for bankruptcy and so on.

"Spirit is pretty much a bottom-feeder business that works only at the expense of other stores; if there weren't vacant storefronts, this business wouldn't exist," writes Rachel Quednau, program director for Strong Towns, an urban planning advocacy group that emphasizes incremental city planning.

From January to August, the company spends its time scouring the country and scoping out properties for temporary leases, and a big part of what makes this a reliable process for Spirit Halloween is that these abandoned spaces are otherwise unusable within local economies.