EdgePoint Q3 2022 commentaries are now live on the website. This quarter:

• Think different (equity) – Jeff Hyrich talks about why we “think different” from the investment industry.

• Let’s get ready to rumble (fixed income) – Frank Mullen discusses two behavioural biases that lead to sub-optimal returns and how we believe EdgePoint is structured to avoid them.

Geoff Goss – EdgePoint Partner since 2008 (Halifax, NS – Armdale Rotary)

This week in charts

Canadian mortgages

These Global Cities Show the Highest Real Estate Bubble Risk

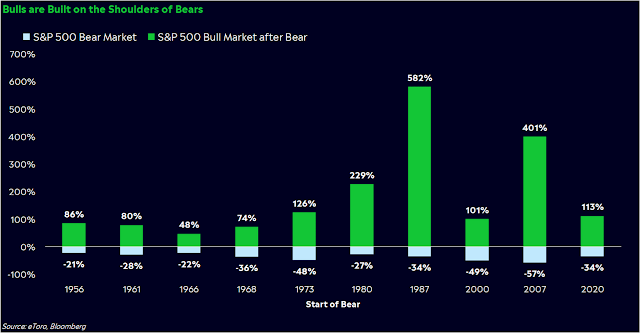

Bears before bulls?

Figure 1A shows that the decline in childbearing in the U.S. accelerated between March 2020 and January 2021, with Table 1 showing the number of births falling by 76,000 more than anticipated by the pre-pandemic trend (column 3). The qualitative pattern for the total fertility rate is remarkably similar: TFR fell from around 1.75 in January 2020 to 1.6 in January 2021, over 3 times the rate of decline from 2007 to 2020. Notably, the accelerated decline in childbearing began around March 2020, about nine months too soon for domestic pandemic lockdowns or the April 2020 pandemic surge in unemployment to affect conceptions. In order for the shortfall in births beginning in early 2020 to reflect falling conceptions, behavioral changes would have had to start in June 2019, well before COVID-19 had even been identified. In short, declines in fertility rates during 2020 happened too quickly to reflect changes in childbearing desires in response to the economic uncertainty and job losses caused by COVID-19.

The laggards include such-hyped stocks as Robinhood Markets, Lyft and DoorDash, all of which went public during a market boom that ended in late 2021. The Nasdaq Composite index that contains many growth companies has fallen 32 per cent this year.

With share prices plunging, private equity groups are aggressively circling newly public companies as potential buyout targets, several Wall Street executives said. And some corporate boards have been receptive.

“When you think about the amount of private capital that has been raised that hasn’t been deployed, then look at how public equity valuations have re-rated, it feels like it’s going to be a natural pairing up,” said David Bauer, who runs equity capital markets at KKR, the investment group known for its private equity business.

This week’s fun finds

Ask an AI Art Generator for Any Image. The Results Are Amazing—and Terrifying.

The AI systems interpret your words and create fully original images. You could insert the same prompt and never get this same image.

So how did the AI know what a podcasting monkey would look like? By studying the AI equivalent of flashcards. Programmers train AI using hundreds of millions of captioned photos, which it deconstructs in a mathematically complicated process. By now, the Dall-E 2 AI has deconstructed many images of monkeys and many scenes of podcasting. Then, through another complex process called diffusion, it turns a meaningless cloud of pixels into an image with a reasonably high probability of resembling what you requested. In this case, that pensive little guy in headphones, talking into a studio mic.