We hope everyone enjoys the holidays and we look forward to seeing you in the new year.

This week in charts

Large caps versus bonds

Household debt

Canadian population

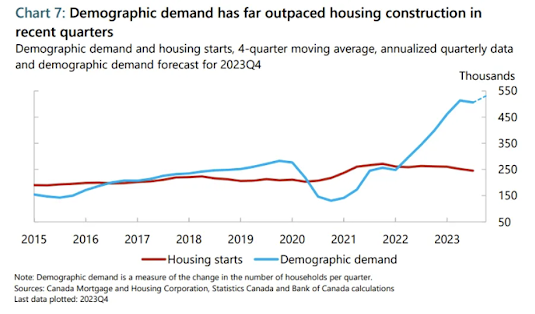

Canadian housing

Retail

Asset classes

The 4% rule could be true in 2024

Retirees can now draw 4% per year from a U.S.-based investment portfolio that is between 20% and 40% equities and still have a 90% probability that there will be money left after 30 years, according to a November Morningstar study.

This is the highest safe-withdrawal rate since the research began in 2021. Based on similar assumptions, the rates were 3.3% in 2021 and 3.8% last year.

The results came from researchers who sought the highest withdrawal rate for each combination of time horizon and asset class, where at least 900 of 1,000 computer simulations showed a positive balance at the end of the period.

The higher withdrawal rate was made possible by more attractive bond yields and a lower inflation forecast, allowing for a more conservative asset allocation.

In the 20th century, stocks averaged about a 7.5% real return rate a year, but it has dropped since then, and Morningstar predicts it will go to 4.5% in the current era, said John Rekenthaler, Morningstar’s research director.

“If we thought history was going to repeat itself, we would recommend more equity-heavy portfolios. We don’t think that’s realistic,” he said. “Prospective stock returns are relatively low.”

With equity returns looking less favourable, an all-equity portfolio would only allow for a 3.3% safe withdrawal rate compared to 4% for a 40% equity portfolio. However, with the all-equity option, a $1 million investment is expected to yield a median remaining balance of $4.5 million at the end of the 30-year period, compared to just $1.5 million for the conservative approach.

“We’re testing for a 90% success rate. So, the number that we’re focusing on is not the median result,” Rekenthaler said. “You only get one shot at retirement; you don’t get to roll the dice again if it’s a bad number. We think [retirees] should take a relatively conservative approach in terms of the odds.”

He said retirees may be able to take a chance on a higher-equity portfolio if they are willing to cut back on their spending during difficult years. The report shows that the safe-withdrawal rate falls only slightly — to 3.8% — when a portfolio consists of 70% equities.

In previous years, Morningstar calculated all withdrawal percentages assuming the retiree would spend the same amount of money each month. However, some financial advisors suggest clients use a variable withdrawal rate and retirees may adjust spending to reflect inflation.

This year, Morningstar added a new methodology that assumes retirees increase spending by 1% less than the annual inflation rate. Under this method, people could take out 5% in early retirement with a lifetime withdrawal rate of 3.9%.

Regulator Urges Chinese Companies to Boost Dividends, Buybacks

China’s securities regulator is asking publicly traded companies to boost dividends to reward investors and said it will increase supervision of those that don’t pay.

China Securities Regulatory Commission said on Friday it will strengthen disclosure requirements for companies that aren’t paying dividends. It also encouraged listed firms to increase the frequency of their dividend payouts and streamline interim distribution processes.

China has taken a tougher stance on firms that refuse to issue dividends to investors over the years. In 2017, then-CSRC Chairman Liu Shiyu said the regulator would take steps against “those iron roosters which have the ability to offer cash dividends but never plucked a feather.”

CSRC issued rules to ease conditions for companies’ share buybacks. It also warned it would crackdown on using buybacks for illegal activities including insider trading and market manipulation.

Japan Plans 10% Reduction in Debt Issuance Next Fiscal Year

Japan plans to reduce debt sales by about 10% in the fiscal year starting April 1 as the government tries to lower the world’s biggest debt load for a developed nation.

The finance ministry aims to issue ¥171 trillion ($1.2 trillion) of debt to the market, marking a fourth straight year of planned decreases in sales, with 20-year bonds and shorter notes seeing the big cuts.

Japan has been trying to reduce general government debt that has soared to a size equivalent to 255% of its economy, according to the International Monetary Fund. Bond issuance jumped in 2020 to finance stimulus measures during the pandemic, and the government has been cutting sales in the following years. But next fiscal year’s planned issuance still remains above pre-2020 levels.

Expectations that the Bank of Japan will end its negative interest rate policy next year has weighed on demand for bonds as investors anticipate increases in yields.

This week’s fun finds

Nike staff memo from 1977

Why Gift-Giving Makes You Anxious

Gifts are so meaningful that some people identify “receiving gifts” as their primary “love language.” Many believe that gifts from their romantic partner are a big way they can understand how much their partner loves them. Indeed, on the surface, gift-giving occasions seem like wonderful opportunities to experience and create delight. But according to a 2023 survey by Preply, gift-giving and receiving is actually the least popular love language overall.

Part of the problem is that occasions that involve gift giving are steeped in uncertainty. If it’s an occasion like Christmas, where people are simultaneously shopping for each other, people might be nervous about whether the gift they give will be in the same category as the gift they will also receive. For instance, you don’t want to give someone a gag gift when they’re giving you a sincere, heartfelt gift—or vice versa. It’s what game theorists call a “coordination game”: your main objective is simply to use whatever strategy you think your partner is using. Mismatched approaches to gift-giving are a recipe for awkwardness. Fans of The Office might recall how Michael’s outlandish Yankee Swap gift—an iPod (highly coveted at the time)—made the entire event uncomfortable for everyone.

There can also be tremendous uncertainty around how your gift will be experienced by the recipient. For example, imagine that someone you’re close to is showing some signs of Seasonal Affective Disorder, and you’re considering giving them a light therapy lamp as a holiday gift. Indeed, the recipient of such a gift may very well be appreciative, indicating that this is “just what they needed.” At least, that’s how it’s all likely to unfold in the hopeful imagination of the lamp-giver. But what if the lamp-recipient interprets the gift as an unwelcome piece of commentary on their affective state? One could imagine a reaction along the lines of “Gosh, I’m sorry I’ve been so unpleasant to be around. Thanks for the feedback.” The message we send with gifts (or emails, texts, or just about any form of communication) is not necessarily the same as the message received.

Worst of all, there’s the anxiety that comes with receiving gifts. If you’re anything like me, you may have, on occasion, found yourself in a setting where you expect that a lot of well-meaning but disappointing gifts are headed your way. There can be some dread that comes with knowing that you’ll soon need to perform joy and appreciation. Even worse, you might worry that the gift-giver will detect your insincerity, wounding them in the process.

It’s not all bad, of course. When done carefully, gift-giving can be a wonderful way to communicate to loved ones that we appreciate and understand them. Gifts can absolutely draw people closer together, in a lasting way.