Juan, partner since 2016 (Amsterdam, The Netherlands)

The Dutch “tulipmania” of the 1600s was one of the most famous asset bubbles in history, with some bulbs reaching extreme prices due to speculation and greed.

This week in charts

Korean investors

Provincial monetary policies

Oil production

Steel production

Retail spending

Jobs

What’s Missing From Amazon’s Big New AI Product; OpenAI’s Interest in Human Brain-Inspired Chips

For those of you who didn’t spend last week in Las Vegas for Amazon Web Services’ Re:Invent conference, I’m here to fill you in on Q, an artificial intelligence chatbot and assistant that the company hopes will change the public perception that it’s behind in AI. Q aims to compete with Microsoft’s AI tools, dubbed “copilots,” and OpenAI’s ChatGPT. On price, Q will undercut Microsoft’s productivity copilot by $10 per person per month.

Q, which isn’t yet broadly available to customers, is expected to serve several different purposes. One of them is particularly striking: AWS said customers can connect Q to their corporate data so that employees can use it to answer business-related questions, summarize documents and draft emails. AWS doesn’t sell productivity apps (a longtime Achilles heel), but Q will be able access information from applications such as Gmail, Slack, Jira, and Microsoft 365. Those apps already have embedded generative AI features, but AWS hopes Q will be attractive because it can access information across all of them. That assumes enterprises want AWS to access all their data, which has to be a question in a time of pitched concerns about data leakage via large-language models.

Poor Charlie’s Almanack – The Essential Wit and Wisdom of Charles T. Munger

I first came across Poor Charlie’s Almanack in my 20s, when I was trying to learn everything I could about what made successful businesses tick. As I leafed through its oversize pages, I found it to be a refreshing rebuttal of conventional financial wisdom, delivered with unusual simplicity and candor. Never before had I heard a venerated businessperson express such trenchant insights about investing, finance, and the world more broadly, and with such—to use a favored Munger phrase—chutzpah. One can’t help but read a line like “Without numerical fluency… you are like a one-legged man in an ass-kicking contest” and come away not only chuckling but also a little bit wiser.

Poor Charlie’s Almanack is a testament to the power of thinking across disciplines. It’s not just a book about investing; it’s a guide to learning how to think for yourself to understand the world around you. Charlie [Munger’s] philosophy combines insights from nearly every discipline in which he’s ever taken even a passing interest—not only business and finance but also mathematics, physics, history, ethics, and more—delivered with a characteristic irreverence that has persisted for 99 years (and counting). His essays extol the virtues of free enterprise, yes, but also of doing business the right way, with integrity and rigor. Of taking your work very seriously, but never yourself.

Whether you are a seasoned investor or an enthusiastic newcomer, whether you run a business or are seeking to improve your decision-making skills in everyday life, I encourage you to read Charlie’s speeches and essays with an open, curious mind. You will be rewarded with insights that stay with you for a lifetime. As Charlie once said, “There is no better teacher than history in determining the future. There are answers worth billions of dollars in a $30 history book.” The same might be said of Poor Charlie’s Almanack. It is the ultimate value investment.

Postscript: Charlie died on November 28, 2023, at the age of 99, one week before this website was due to go live.

China’s Exports Snap Half-Year Slide

China’s exports grew in November after six straight months of declines, though economists cautioned the uptick in trade wouldn’t be enough to offset weakness in the world’s second-largest economy.

China’s exports in recent months have been supported by the country’s manufacturers slashing prices to gain global market share, economists said, as elevated interest rates and wars in the Middle East and Ukraine weigh on global demand. Trade volumes have been hitting record highs, even as exports, as measured by value, had been falling prior to November.

A steep drop in the price of some goods shipped from China has already drawn concerns in the U.S. and Europe. European Union regulators unveiled an antisubsidy probe in September over concerns China was undercutting its producers by flooding the market with low-cost electric vehicles. European officials are expected to raise the issue with Chinese leaders in Beijing on Thursday. China has said its manufacturers are competing fairly.

The drop in imports reflects weak domestic demand. China’s economy has long suffered from an imbalance, relying more heavily on demand from overseas than its own consumers. That was particularly the case during the pandemic, when exports, buoyed by demand in the West, helped to prop up China’s economy. But that demand was curtailed as policy makers raised interest rates to combat inflation.

November’s growth in exports won’t be enough to meaningfully boost China’s economy, economists said, with the country suffering from a protracted downturn in the property market, mounting government debt and sluggish consumer spending.

On Tuesday, Moody’s Investors Service lowered its outlook for China’s credit rating from stable to negative, warning that the financial stresses of some regional and local governments will require Beijing to provide support to them.

Hedge funds and mutual funds have been chasing the same tech stocks, Goldman analysis finds

The world’s major hedge funds and mutual funds have upped their exposure to equity markets in 2023 after investing heavily in a selection of popular tech companies, according to new analysis from Goldman Sachs.

The shift saw hedge funds exposure to stock markets increase up to 66% in the year-to-date 2023, up from long-time lows of 61% at the start of the year.

Levels of exposure to equity markets, however, remained below long-time averages of 70%, as investments in stocks remained significantly lower than in 2021 during the COVID-19 stock market boom.

The uptick in exposure to stock markets was driven by trends that saw both hedge funds and mutual funds plow money into the info tech sector as they piled into popular stocks that have repeatedly given strong returns over extended periods of time.

The strategy has seen hedge funds generate solid returns in the year so far as they benefited from the recent rally in mega-cap stocks, even as crowding and concentration among hedge funds hit all-time highs.

The strategies taken by hedge funds and mutual funds, however, diverged in relation to the energy sector. This saw hedge funds reduce their exposure to the energy sector even as mutual funds increased their holdings in energy stocks, the Goldman analysis finds.

This week’s fun finds

Those are some spicy meatballs!

Andrew’s moai (our version of bringing EdgePointers together for a meal) came from a family-run Italian restaurant that he’s been going to since his childhood. Thanks to him, we all carb-loaded for the upcoming winter weather.

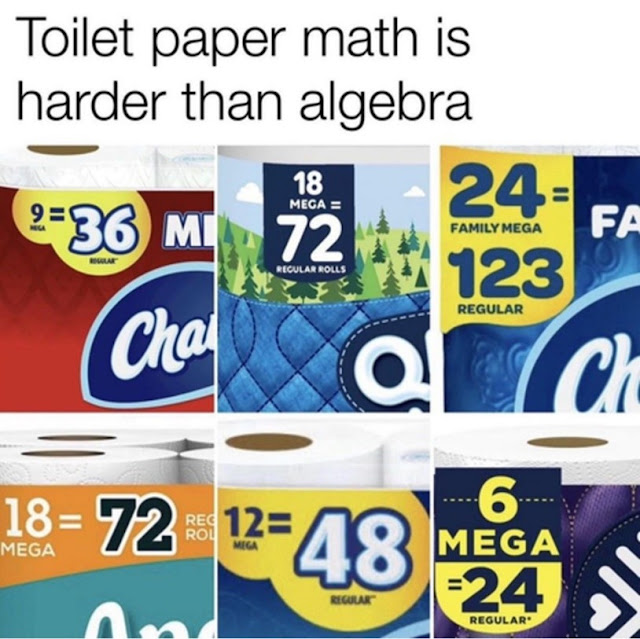

Questionable conversion rates

What dollar-cost averaging (DCA) / systematic investment plan (SIP) feels like

‘How do you reduce a national dish to a powder?’: the weird, secretive world of crisp flavours

Reuben and Peggy are not their real names. Reuben is a snacks development manager and Peggy is a marketer, and they work for a “seasoning house”, a company that manufactures flavourings for crisps.

I meet the pair on Zoom, hoping they can answer a question that has consumed me for years. In January 2019, I was visiting Thailand when I came across a pink packet of Walkers with layered pasta, tomato sauce and cheese pictured on the front. Lasagne flavour, the pack said. You can’t get lasagne Walkers – or Lay’s, as they are known in most of the world – in Italy. Relatively speaking, Italians have a small selection of Lay’s – paprika, bacon, barbecue, salted and Ricetta Campagnola, a “country recipe” flavour featuring tomato, paprika, parsley and onion. I’ve sampled Hawaii-style Poké Bowl crisps in Hungary and chocolate-coated potato snacks in Finland; I have turned away from Sweet Mayo Cheese Pringles in South Korea. So why can you get lasagne flavour Lay’s in Thailand but not in Italy, home of the dish? Who figures out which country gets which crisps?

For more than 75 years, Leicester has been the place where British potatoes become crisps. Its Walkers factory produces 5m packets a day, steam billowing from behind big blue security gates. Just down the road sits its HQ, where 300 marketers, scientists and chefs decide which crisps the world needs next.