We’re hiring!

Specifically, we want to add a Product Manager to our Investment Analytics team in our Toronto office.

We're always looking for talented people who can help us achieve our goals and we understand that extraordinary human ability is a scarce resource in high demand. If you think you've got some and are interested in our company, please send your resume to: WeAreGrowing@edgepointwealth.com

This week in charts

Manufacturing

Growth

Mexico

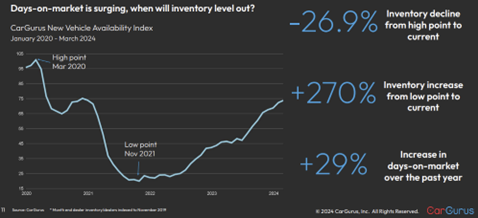

Housing

Energy

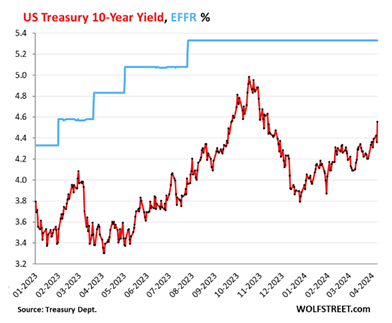

Interest ratesHedge Fund ‘Pod Shop’ Strategy Imitated by Pensions, EndowmentsUniversity of Texas Investment Management Co. and the State of Wisconsin Investment Board — with a combined $230 billion of assets — are among institutions investing in hedge funds in a way that mimics how multimanagers use individual pods of traders to wager on a variety of strategies.

Each hedge fund essentially becomes a kind of pod. By using customized sleeves, known as separately managed accounts — or SMAs — institutional investors can tailor their trading exposures, save on execution costs and impose their own risk limits.

Rather than pooling their cash alongside other investors, the institutional clients request that a hedge fund trade theirs separately, allowing them to control leverage and own the underlying assets. That also gives them insight into the exact trades the hedge fund makes — unusual in a world where money-making methods are kept secret. With that knowledge, they can then replicate winning bets elsewhere in their portfolios.

Comparing Trades

Firms like Dockside and Innocap help allocators invest in hedge funds through managed accounts and negotiate terms. The allocator picks the funds they want as their so-called pods and can compare trades made by the various vehicles.

Innocap has more than 30 allocators investing in hundreds of hedge funds, while Dockside has six clients so far.

Wisconsin’s $156 billion pension fund is invested in 10 managers through Dockside, mostly stock-pickers, and may grow that to as many as 20 by year-end.

The concept isn’t entirely new.

The Canada Pension Plan Investment Board and Duke University’s endowment have been running internal hedge fund SMA programs for years. Building out the infrastructure to do so is costly and time-consuming.

Some firms, such as BoothBay Fund Management, New Holland Capital and Crestline Investors, offer clients exposure to hedge funds through SMAs. They determine which funds to invest in on the allocators’ behalf, risk limits and how to adjust exposures. In these instances, pensions and endowments have less control than with Innocap and Dockside.

Institutions aren’t necessarily seeking to replace or compete with their investments in the multistrat giants, which have hundreds of trading teams and are far more complex.

Traditionally, smaller hedge funds were open to creating the more onerous SMAs in order to boost assets. But Innocap has noticed that some of the industry’s larger hedge funds, those running billions of dollars, have been more receptive in recent years. In a challenging fundraising environment, access to any capital is prized, along with being able to share that a prominent institutional investor is a client.

SMAs gained favor after the 2008 financial crisis and the Bernard Madoff Ponzi scheme, as investors sought more transparency and the ability to own the assets. Now they’re in even more demand.

The amount of cash hedge funds manage in such pools has jumped by almost 50% over four years, reaching $226 billion at the end of 2022, according to a Goldman Sachs Group Inc. report last June. It’s most popular among the biggest institutional investors — those with more than $10 billion of assets — such as pensions, endowments and sovereign wealth funds.

Of those considering SMAs, 60% plan to use a third-party platform, while 13% intend to build their own operations in-house, according to a fourth-quarter Morgan Stanley investor survey. The remainder plan to do both.

Rising interest rates prompted the Wisconsin pension to act.

It typically borrows capital to make hedge fund investments, but that became too expensive. Using Dockside’s prime brokerage relationships means it can turn a smaller stake into more exposure. Plus, efficiencies such as offsetting buy and sell orders of the same asset across various funds could also trim the expense of executing trades.

China’s EV Price War Is Just Getting Started

With a historic round of price cuts this month, Tesla, Li Auto and a host of others have extended China’s monthslong electric-vehicle price war into a new quarter. Some say the fight is just getting started.

EV makers in the world’s biggest market for electric and hybrid vehicles have been cutting prices en masse since last year, when slowing sales and rising competition from upstarts forced a rethink of the playing field. This month, prices were cut or incentives offered on more than 40 EV models, amounting to some of the largest reductions in China auto market history.

CCB International analyst Qu Ke said he expects growing and intensified competition into the third quarter, given the current oversupply and soft consumer sentiment in China. Nomura analyst Joel Ying said the current level of competition could last for two to three years before the market enters a new, stabilized stage, potentially trimming the field to a handful of survivors.

Drivers in the short term include a new batch of models launching this week at the Beijing Auto Show and coming government subsidies for trade-ins that have companies competing to capture an expected uptick in demand. Tesla’s fresh announcement that it plans to roll out cheaper models early next year could add to the pressure.

One likely outcome of prices in free fall is that the popularity of alternative-energy vehicles will continue to rise, cementing their place atop China’s auto market. In the first two weeks of April, retail sales of EVs and plug-in hybrids overtook those of traditional vehicles for the first time, according to China Passenger Car Association data. The International Energy Agency this week estimated that 60% of EVs sold in China are already cheaper than combustion-engine cars. Elsewhere, it expects price parity only by about 2030.

Another outcome is that the smallest players are at greater risk of going under. Lower prices will likely drive some industry consolidation, said Vincent Sun, a Morningstar equity analyst, citing recent exits of weaker players.

Qu of CCB said he expects more startup original equipment manufacturers to go bankrupt in the next two to four years.

Margins are also likely to suffer, although on that front the more established players have more room to give. Only three EV makers in China were profitable in 2023: Tesla, BYD and Li Auto. The latter two had enviable gross profit margins of 20% and 22.2%, respectively, while Tesla’s global gross profit margin was 18.2%.

Others, including NIO and XPeng, have growing sales but are spending billions of dollars to catch up to rivals.

XPeng and NIO still have ample liquidity to support their ambitions and potentially withstand withering prices. XPeng said it had the equivalent of $2.92 billion in cash and cash equivalents as of 2023, up 45% from a year earlier, while NIO’s rose 66% to the equivalent of $4.55 billion.

EV makers will have some natural room for price cuts in an environment of declining input costs, such as lower lithium battery prices, and on greater efficiencies, coming via economies of scale and trimmed operating costs, analysts said.

This week’s fun finds

She definitely paid attention…

On her last day at EdgePoint, intern Aakanksha showed us everything she learned about our culture by designing sugar cookies based on each department. We thought they were pretty accurate (and delicious).

EdgePoint Corporate League Winter Champions

We’re excited to share the news that our EdgePoint basketball team has won the championship title in the BWT Winter Corporate Basketball League after a heart-stopping triple overtime victory.

The game began with high energy, Mike Lo was outstanding, hitting three consecutive jumpers to set the tone early.

In the second quarter, our team demonstrated resilience and discipline. Steven Lo's critical three-pointer from the corner, coupled with Alex's impactful performance off the bench—securing rebounds and adding a physical edge —helped us prepare for the tough half ahead.

After halftime, Bryan Long led our defense and grabbed crucial rebounds, keeping us in the game.

The fourth quarter turned into a defensive showdown, led by Jin, who boosted our energy and set the defensive tone. Both teams focused intensely on defense as the game neared its end and eventually leading to overtime. The intensity didn't drop in overtime; Bryan Long's buzzer-beating layup in the second overtime pushed us into TRIPLE OVERTIME!

In the final stretch of triple overtime, our determination was unmistakable, allowing EdgePoint to secure the win.

This championship is more than just a victory; it's a reflection of our team's spirit, perseverance, and teamwork.