This week in charts

European spreads

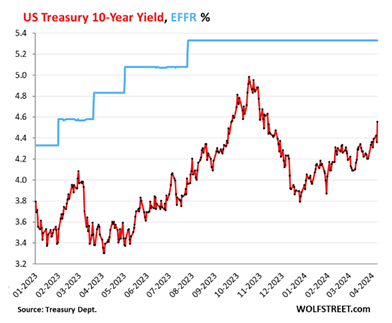

US Treasury 10-year yield

Construction equipment

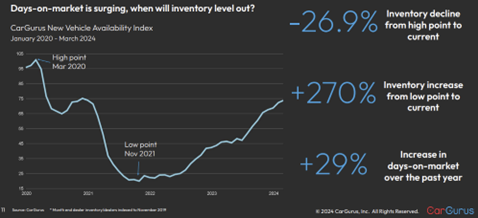

Automotive

Asset allocation

Inflation

Pharmaceuticals

China Tells Telecom Carriers to Phase Out Foreign Chips in Blow to Intel, AMD

SINGAPORE—China’s push to replace foreign technology is now focused on cutting American chip makers out of the country’s telecommunications systems.

Officials earlier this year directed the nation’s largest telecom carriers to phase out foreign processors that are core to their networks by 2027, a move that would hit American chip giants Intel and Advanced Micro Devices, people familiar with the matter said. , people familiar with the matter said.

The deadline given by China’s Ministry of Industry and Information Technology aims to accelerate efforts by Beijing to halt the use of such core chips in its telecom infrastructure. The regulator ordered state-owned mobile operators to inspect their networks for the prevalence of non-Chinese semiconductors and draft timelines to replace them, the people said.

In the past, efforts to get the industry to wean itself off foreign semiconductors have been hindered by the lack of good domestically made chips. Chinese telecom carriers’ procurements show they are switching more to domestic alternatives, a move made possible in part because local chips’ quality has improved and their performance has become more stable, the people said.

Such an effort will hit Intel and AMD the hardest, they said. The two chip makers have in recent years provided the bulk of the core processors used in networking equipment in China and the world.

Shares of Intel dropped 3.6% to $36.27 in early trading Friday while AMD fell 4.2% to $163.27.

Beijing’s desire to wean China off American chips where there are homemade alternatives is the latest installment of a U.S.-China technology war that is splintering the global landscape for network equipment, semiconductors and the internet. American lawmakers have banned Chinese telecom equipment over national-security concerns and have restricted U.S. chip companies including AMD and Nvidia from selling their high-end artificial-intelligence chips to China.

Chinese authorities have in turn been pushing for years to remove foreign suppliers from critical supply chains, seeking to source products from grains to semiconductors locally as national-security concerns rise. Similar orders requiring Chinese state-linked entities to shift their buying to local tech alternatives have resulted in U.S. software and hardware firms including Microsoft and Dell Technologies gradually losing their grip on the market, The Wall Street Journal has reported.

China has also published procurement guidelines discouraging government agencies and state-owned companies from purchasing laptops and desktop computers containing Intel and AMD chips. Requirements released in March give the Chinese entities eight options for central processing units, or CPUs, they can choose from. AMD and Intel were listed as the last two options, behind six homegrown CPUs.

Computers with the Chinese chips installed are preapproved for state buyers. Those powered by Intel and AMD chips require a security evaluation with a government agency, which hasn’t certified any foreign CPUs to date. Making chips for PCs is a significant source of sales for the two companies.

China Mobile and China Telecom are also key customers of both chip makers in China, buying thousands of servers for their data centers in the country’s mushrooming cloud-computing market. These servers are also critical to telecommunications equipment working with base stations and storing mobile subscribers’ data, often viewed as the “brains” of the network.

The two chip giants have the lion’s share of the overall global market for CPUs used in servers, according to data from industry researcher TrendForce. In 2024, Intel will likely hold 71% of the market, while AMD will have 23%, TrendForce estimates. The researcher doesn’t break out China data.

China’s localization policies could diminish Intel and AMD’s sales in the country, one of the most important markets for semiconductor firms. China is Intel’s largest market, accounting for 27% of the company’s revenue last year, Intel said in its latest annual report in January. The U.S. is its second-largest market. Its customers also include global electronics makers that manufacture in China.

In the report, Intel highlighted the geopolitical risk it faced from elevated U.S.-China tensions and China’s localization push. “We could face increased competition as a result of China’s programs to promote a domestic semiconductor industry and supply chains,” the report said.

Geopolitics already cloud the outlook for Intel and AMD’s China operations. Intel said in January that $3.2 billion, or 6% of its revenue in 2023, was dependent on U.S. government export control authorization, an amount the company expected may increase in future years.

China contributed 15% of AMD’s revenue last year, according to the company’s annual report. That was down from 22% in 2022 after AMD was restricted by U.S. authorities from selling its high-end AI chips to China.

China will form the bulk of demand for wireless communications equipment over the next few years, said Earl Lum, the founder of telecommunications consulting firm EJL Wireless Research. The country is seeking to move from 5G to even faster network speeds, and global telecom operators outside of China are slowing down their purchases, he said.

Local CPU substitutes have made large strides in recent years, with companies including Huawei Technologies’ HiSilicon and Hygon Information Technology, as well as entities including the National University of Defense Technology, gaining ground.

Chinese chips aren’t always considered as good, people familiar with the matter said, but they have been winning over Chinese telecom customers.

When China Telecom bought some 4,000 artificial-intelligence servers last October, 53% were powered by Intel’s CPUs. The rest used Huawei’s Kunpeng processors, according to a tender document. In some earlier tenders seeking to buy servers, Intel made up a much higher proportion.

Companies Reconsider Research Spending With Tax Deal Held Up in Senate

Large U.S. companies are pressing lawmakers to revive expired tax breaks for research and development spending, as a political stalemate keeps some finance executives wrestling with those investments.

Lawmakers hoped April’s tax filing deadline would spur action, but with a bill proposing the change stalled in the Senate, expectations are waning for a deal soon.

The political wrangling comes as large public companies say the law as it stands is costing them hundreds of millions or billions of dollars, while some owners of small and medium-size businesses say they wonder if their firms will survive.

The tax change went into effect in 2022. Under a provision in the 2017 Tax Cuts and Jobs Act designed to generate revenue to help pay for cutting the corporate tax rate, companies must deduct research costs over five years for domestic research costs and over 15 years for those incurred abroad, rather than immediately.

Companies of all sizes have been urging lawmakers to reverse the law. The House passed a bipartisan bill in January to restore immediate domestic research deductions retroactively from 2022, but Republicans have held up the bill in the Senate over details of child-credit changes, their inability to amend the bill and the prospect of a better deal if the GOP wins a Senate majority in November’s election.

Hyster-Yale, which in its last fiscal year booked revenue of $4.1 billion, spends around $100 million a year on R&D, and the law change that went into effect in 2022 increased its tax bill by about $25 million a year. “So that’s $25 million less that I have to invest back into my business, whether it’s R&D, whether it’s plants and equipment, hiring new people,” Minder said.

Like many others, Hyster-Yale’s executives expected the law would be repealed. That hope is fading, and what’s more, the repeal in the current bill runs only through 2025, so it’s a stopgap, said Minder, also his company’s treasurer.

“In the lack of certainty from D.C., we have to make certainty for ourselves,” said Minder, adding companies that invest heavily in research, like Hyster-Yale, may need to reconsider how much to allocate for R&D and where that money is spent. The company spends around 80% of its research budget in the U.S. and the remainder elsewhere, according to the CFO.

“We have people here in the U.S., we have facilities, processes, R&D here, and we much prefer to keep it that way,” Minder said. “But even if we get this temporary measure, we have to have a plan B. Do we have to act on it? No, but we can’t be in this spot again come 2025.”

Other companies likewise are considering future R&D outside the U.S., where incentives can be more favorable, said Rohit Kumar, a former Senate GOP leadership aide who now is a co-leader of the national tax practice at accounting firm PricewaterhouseCoopers. It also means companies have “dramatically” slowed research spending since the law took effect, he said, pointing to U.S. Bureau of Economic Analysis data showing R&D spending declined last year after growing 6.6% on average over the previous five years.

“It’s sort of natural that if Congress makes something more expensive to do, companies will do less of it,” Kumar said, adding the situation worsens with each estimated tax payment date. Companies make estimated tax payments to cover liabilities throughout the year, with the next date for large companies on April 15. “Every payment date that we go through where we don’t address this, you take more R&D money out of the economy,” he said.

Steve Valenzuela, CFO at Alarm.com, is frustrated by the holdup in the Senate. Roughly 30% of the technology provider’s revenue, which last year was $881.7 million, goes to R&D, he said. The law change increased Alarm.com’s 2023 tax bill by around $43 million.

Valenzuela said Alarm.com can cover the increase, but the company would prefer to invest those dollars into its business. He also said the change in the law has him thinking about whether to spend more in other areas of the business such as sales and marketing.

For Jack Henry & Associates CFO Mimi Carsley, the longer the bill sits in the Senate, the less likely it becomes law this year. Carsley is preparing the financial technology company’s tax payment this month along with a plan for the full tax year as though the law remains unchanged.

R&D is central to Jack Henry’s business, and while the law isn’t likely to affect current spending, it may prompt reduced investment in other areas and increase the rate of return required for new projects, a measure known as hurdle rates, according to Carsley.

“Even in the largest companies, you’ve had the combination of higher interest rates plus this extra hit from a cash perspective,” she said. Jack Henry’s tax bill rose between $70 million to $80 million in its last fiscal year because of the change. “Hurdle rates will have to go up for projects as a result.”

This week’s fun finds

Crocs is on an absolute roll with its food-focused partnerships, and its latest collab announcement will surely make chip fans happy.

On Thursday, the shoe company announced an all-new set of kicks with Pringles. And no, it's not just slapping mustaches on everything, but rather, it's making footwear that's actually useful to everyone who can't go a single step without their chips.