Our willingness to look different – Notice of EdgePoint Go West Portfolio’s closure…for a good reason!

Rather than close a fund for underperforming, we’re redeeming investors’ money on June 19, 2024 to lock in pleasing returns for our investors from what we believed was a once-in-a-multi-decade opportunity in Canadian energy.

Go West was launched back in November 2019 to capitalize on an underappreciated sector where we believed we could add value through our proprietary insights on each of the businesses we owned.

We said this was a Portfolio with a finite life. If the market recognized the sector’s potential and the opportunity was no longer as attractive as when we launched Go West, we would close the Portfolio and return the funds to all investors.

For more on Go West’s closure, you can read this letter from Portfolio Managers Frank Mullen and Geoff MacDonald.

This week in charts

Office loans

Workplace occupancy

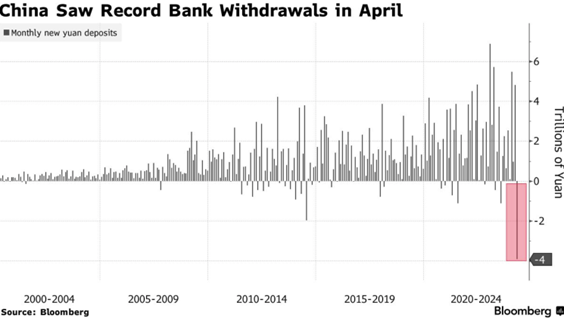

Bank withdrawals

Unrealized gains (losses)

Equities

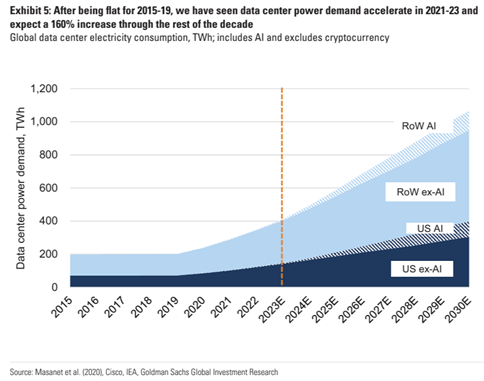

Data centres

ChatGPT

Consumer spending

U.S. stock market

The rise of private credit over the past decade has been nothing short of monumental. But JPMorgan Chase CEO Jamie Dimon warned this week that parts of the burgeoning sector have some of the same problems that the mortgage market had prior to the Great Recession of 2008, including questionable credit ratings from ratings agencies.

Losses Pile Up in Top-Rated Bonds Backed by Commercial Real Estate Debt

For the first time since the financial crisis, investors in top-rated bonds backed by commercial real estate debt are getting hit with losses.

Buyers of the AAA portion of a $308 million note backed by the mortgage on the 1740 Broadway building in midtown Manhattan got less than three-quarters of their original investment back earlier this month after the loan was sold at a steep discount. It’s the first such loss of the post-crisis era, according to Barclays Plc. All five groups of lower ranking creditors were wiped out.

Market watchers say the fact the pain is reaching all the way up to top-ranked holders, overwhelming safeguards put in place to ensure their full repayment, is a testament to how deeply distressed pockets of the US commercial real estate market have become.

This week’s fun finds

This week, Catherine and Kevin celebrated their two year work anniversary and treated the team to authentic Cuban food. Congratulations and well done. Definitely happy to have you as part of the EdgePoint family.

The Cube Rule of Food Identification

The question was asked: are hot dogs sandwiches? New York said yes.