This week in charts

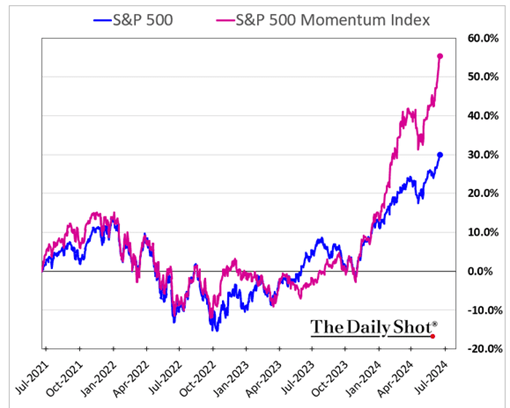

Equities

Real estate

Corporate taxes

China

Macro

Leveraged loans

Japanese yen falls to weakest level since 1986

The Japanese yen has fallen to its weakest level against the US dollar since 1986, putting traders on alert that officials might again be forced to step in to support the ailing currency.

The yen slipped 0.4 per cent against the dollar to ¥160.3 on Wednesday, past the level it reached in late April before Japan’s finance ministry spent a record ¥9.8tn ($62bn) to boost the currency.

Analysts expect Japanese officials to intervene again if the yen continues to decline, but warn that they will be reluctant given the cost of intervention and the relatively shortlived impact of previous efforts.

Japan’s government will not want to let the currency fall too much further because the weak yen has pushed up living costs and Prime Minister Fumio Kishida will be keen to garner support ahead of his Liberal Democratic party’s leadership election in September, Halpenny added.

The yen has fallen 12 per cent against the dollar this year as investors scaled back their expectations for Federal Reserve interest rate cuts, driving the US currency higher. Although the Bank of Japan ended eight years of negative interest rates in March, it has been cautious about the prospect of further increases in Japanese borrowing costs.

Japanese officials have said that they do not defend the currency at a specific level, and have tended to intervene following sharp rather than gradual declines. Some analysts expect they may wait to intervene until after upcoming elections in France and the release of US data that could support the yen if there is further evidence that the world’s largest economy is slowing.

Americans' pandemic savings are gone - and the economy is bracing for impact

The pandemic savings cushions that helped Americans weather high prices in recent years have worn through, contributing to a loss of consumer firepower that’s rippling through the U.S. economy.

Delinquencies are rising. Executives are flagging caution among shoppers in recent earnings calls, and retail sales barely increased in May after falling the month prior. Economists forecast solid inflation-adjusted consumer spending in data out Friday, helped by lower gasoline prices, but that would follow an outright decline in April.

The resilience of American consumers — and their willingness to spend despite rising prices and high borrowing costs — has been a pillar of the unwavering strength of the U.S. economy in recent years. A healthy labour market has played a key role, but so has the roughly US$2 trillion in excess savings Americans accumulated during the Covid-19 pandemic.

Those excess savings have been fully depleted as of March, according to the U.S. Federal Reserve Bank of San Francisco, heightening concerns about the durability of consumer spending.

Employers added 272,000 jobs in May, surpassing all economists’ forecasts, and layoffs are low. But the pace of hiring has cooled, and the unemployment rate has begun to edge higher.

For now, that resilient labour market is keeping consumers afloat and giving the Fed the space to keep interest rates high to tame inflation, and economists say household balance sheets overall are healthy. But policymakers, including Fed Governor Lisa Cook earlier this week, acknowledge the growing financial strain in some pockets of the economy.

It doesn’t help that borrowing money isn’t likely to get cheaper anytime soon. Fed officials have signaled they plan to keep interest rates at current levels, a more than two-decade high, until they gain more confidence inflation is continuing to cool.

This week’s fun finds

Maya’s moai was the schnit(zel)

Member of Compliance Maya didn’t break any rules when she shared her schnitzel, falafel and other dishes from her favourite café!

Wild elephants may have names that other elephants use to call them

Wild elephants seem to address each other using distinctive, rumbling sounds that could be akin to individual names.

That’s according to a provocative new study in the journal Nature Ecology & Evolution, which was inspired by earlier work showing that bottlenose dolphins have signature whistles.

Elephants’ trumpeting is well known, but [Cornell University biologist Mickey] Pardo says trumpeting is an abrupt noise that’s more like screaming or laughing. He figured that if elephants had names, they’d be somehow encoded in elephants’ constant, low-frequency rumblings.

“The rumbles themselves are highly structurally variable,” says Pardo, who conducted this research while working at Colorado State University. “There's quite a lot of variation in their acoustic structure.”

And elephants make these particular noises in all kinds of contexts — everything from greeting family members to comforting a calf to staying in touch with relatives over long distances.

So Pardo and some colleagues analyzed recordings of 469 rumbling calls that wild African elephants had made to each other in the Amboseli National Park and Samburu and Buffalo Springs National Reserves in Kenya between 1986 and 2022.

For every recorded call, the researchers knew the identity of the elephant making the rumble as well as, based on the context, the elephant that was being addressed.

If elephants had names, not every call would be expected to contain one — just like people don’t use each other’s names every time they speak to each other.

Still, the research team used machine learning to see if the rumbles contained identifying information — essentially, a “name” — that their computer model could learn to use to accurately predict the receiver of a call.

What they found is that their model was able to identify the correct elephant recipient of the call 27.5% of the time, which is much better than it performed during a control analysis that fed it random data, says Pardo.

This indicates, he says, that “there must be something in the calls that's allowing the model to figure out at least some of the time who that call was addressed to.”