Investment Team 2024 summer reading and listening list

School’s almost out and we wanted to make sure everyone’s ready for the summer with book, blog and podcast recommendations from our Investment Team. The list has biographies, histories of humanity and financial markets, self-improvement tips and all you could ever want to know about the business of semiconductors. We’ve even included some podcasts to make those summer road trip kilometers fly by.

This week in charts

Wealth

10 largest companies in the U.S.

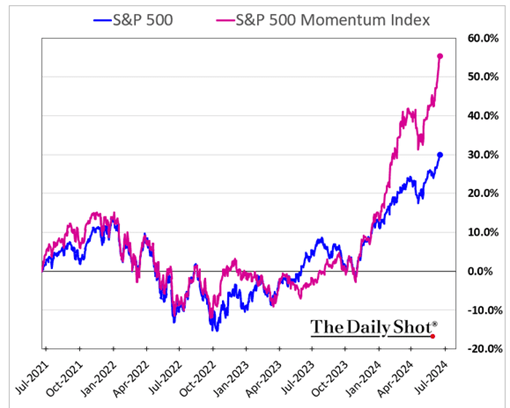

S&P 500 Index

U.S. office space

Mortgages

Rating agencies give high marks to bonds financing defaulted properties

Credit agencies have mis-rated more than $100bn of commercial real estate debt in an increasingly popular segment of the market, say mortgage veterans, including at least a dozen deals that maintain top investment-grade ratings even though the borrowers are in default.

The questionable ratings are cropping up in a portion of the mortgage bond market that has evolved in the past decade or so, in which deals are backed by one loan or mortgage on a single major office building rather than on a bundle of multiple properties.

Single-loan deals now make about 40 per cent of the nearly $700bn in outstanding commercial mortgage bonds. Developers like them because they can get better terms than simply borrowing from a bank. Investors like the deals because they tend to have floating interest charges, which has insulated them from the high rate environment of recent years.

Early repayments shrink China’s mortgage-backed securities market by 65%

China’s residential mortgage-backed securities market has shrunk by almost two-thirds over the past year after a wave of early repayments from property owners that highlight the country’s constrained investment landscape.

In March, mortgages backing securitisations were repaid at the highest level this year, which would equate to a prepayment rate of 43 per cent on an annualized basis — about four times the typical rate.

The securitisation industry, in which assets are packaged together and sold as bond-like instruments to investors, provides a window into China’s vast Rmb38tn mortgage market at a time when the property sector has struggled to reverse a multiyear slowdown.

The nationwide pre-payment rate on residential mortgage-backed securities initially leapt as high as 63 per cent on an annualised basis in September, when major state-owned banks unveiled cuts to mortgage interest rates that analysts say drove refinancing.

The move was one of several attempts to support the property market after a funding crisis among developers emerged in 2021 that weighed heavily on construction and the wider economy.

This week's fun finds

A 342-mile journey to the best McDonald's in the world

Right now, tucked between two high desert ridges filled with scrub brush and snakes that bake away in the California sun is a McDonald’s where the food tastes better than anywhere else in the world.

To truly experience what may be the best fast food hamburger of your life, you have to start 342 dusty trail miles away in Campo, California, where the Golden State meets Mexico — and bring a good pair of walking shoes.