EdgePoint’s journey – the first 15 years

While a lot has changed over that time, our investment approach and commitment to compounding our clients’ wealth remain the same. We’re looking forward to the next 15 years helping our partners reach their Point B.

This week in charts

Consumer spending

Apparel and grocery pricesCustomers by apparel tierCustomers by restaurant tierElectricity consumption – data centres

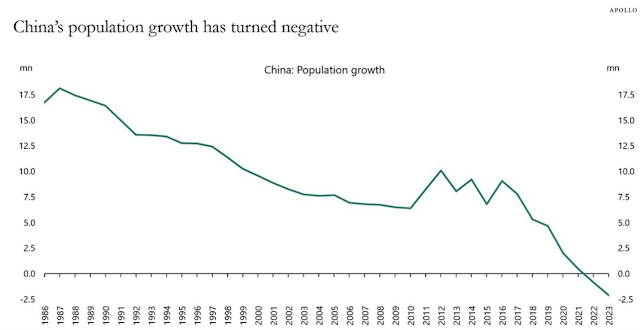

Electricity consumption per requestChina’s population growthStart-up shutdownsEmerging economiesStart-up failures rise 60% as founders face hangover from boom years

Start-up failures in the US have jumped 60 per cent over the past year, as founders run out of cash raised during the technology boom of 2021-22, threatening millions of jobs in venture-backed companies and risking a spillover to the wider economy.

According to data from Carta, which provides services to private companies, start-up shutdowns are rising sharply, even as billions of dollars of venture capital gushes into artificial intelligence outfits.

Carta said 254 of its venture-backed clients had gone bust in the first quarter of this year. The rate of bankruptcies today is more than seven times higher than when Carta began tracking failures in 2019.

The collapses are part of a painful adjustment for start-ups triggered by interest rate rises in 2022. VC investment into early-stage companies has plummeted, while venture debt has diminished following the collapse of Silicon Valley Bank last year, leaving many start-ups stranded.

Founders are now facing the hangover. The jump in bankruptcies is due to the fact that “an abnormally high number of companies raised an abnormally large amount of money during 2021-2022”, said analysts at Morgan Stanley in a recent note to clients.

Private Credit Managers Are Helping Banks Keep Risky Clients

In the market for private credit, managers are increasingly partnering with banks to help them maintain lucrative contracts with risky oil, gas and coal clients.

It’s a model that allows banks to continue doing deals in areas like commodity trade finance, where exposures might otherwise clash with European restrictions on fossil fuels and capital requirements. By sharing risky exposures with private-credit managers, banks are figuring out how to stay on the right side of regulations without losing access to lucrative commodities markets.

Banks in Europe are adjusting to the region’s shifting regulatory landscape, which has brought stricter climate rules than exist in other jurisdictions. BNP Paribas SA, the European Union’s biggest bank, and ING Groep NV, the largest lender in the Netherlands, are among financial firms to have stepped up restrictions on fossil-fuel clients in lending and bond underwriting. ING has also announced its plans to cut back its oil and gas trade finance.

This week’s fun finds

Neeti, a member of the trade operations team, treated her fellow partners to a delightful Italian Moai. Italian cuisine has always been one of her favourites — not just for its delicious flavours, but also for the rich culture and tradition behind it. From the fresh ingredients to the time-honoured recipes, Italian food has a way of bringing people together and creating memorable experiences.

Although an island, Madagascar has never been isolated. Situated in the Indian Ocean, at the crossroads of trade networks, its people have long had close ties to Asia, Africa, and Europe. Nowhere is this more visible than in their vibrant textile arts, which continually incorporate new fibres, dyes, and decoration. Traders from Indonesia settled the island from 300CE. They brought with them textile styles, colours, and techniques that are recognizably Southeast Asian.