This week in charts

Household income

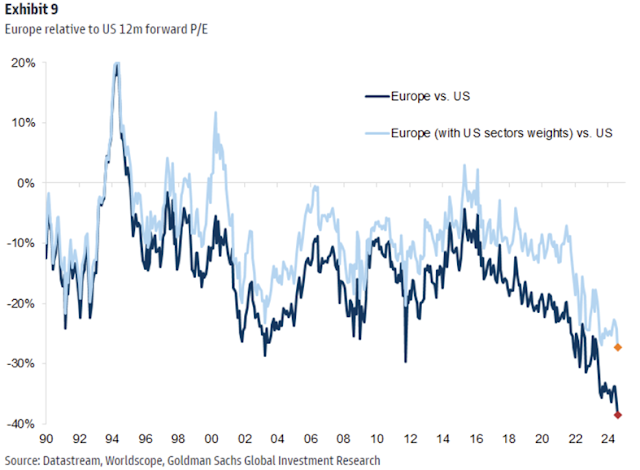

Household spendingServices vs. retail spendingHousehold debtAffordabilityS&P 500 performanceU.S. market concentrationGlobal Market capitalizationRelative valuationsBerkshire HathawayUnwinding of yen ‘carry trade’ still threatens markets, say analysts

Over the past three years, the yen version of the carry trade — borrowing in a low-interest-rate country to fund investment in assets elsewhere that offer higher returns — has exploded because of Japan’s ultra-low rates.

A stronger yen, buoyed by last week’s Bank of Japan interest rate rise, has forced hedge funds and other investors to rapidly unwind their carry trades. This has contributed to turbulence in global markets, including a dramatic sell-off on Monday, as investors rushed to dump assets they had purchased by borrowing in yen.

While a chunk of the trade involves hedge funds and other short-term investors taking short positions in the yen, the long period of ultra-low rates in Japan has, for years, enticed Japanese households, pension funds, corporates and banks to look overseas for higher yields in a form of carry trade.

However, the recent dynamic was radically altered when the Japanese authorities intervened to strengthen the yen and then, last week, the BoJ hit the market with a surprise interest rate increase and a strong hint that there would be more tightening to come.

Some analysts and traders suspect that the majority of the more speculative bets for which the carry trade was used have now been liquidated. Others believe there could be plenty more liquidation to come as the selling moves from hedge funds to “real money” investors.

China Tells Firms to Screen Bond Fund Duration to Curb Risk

Chinese regulators have asked some money management firms to report the duration of any new bond fund products, in the latest effort to curb risks in the market, according to people familiar with the matter.

The China Securities Regulatory Commission has also significantly slowed down the approval process for new bond funds and asked some fund companies to document their existing bond fund durations, the people said, requesting not to be named discussing private matters.

A rally in Chinese government bonds is raising concerns from regulators that banks and investment funds are exposing themselves to excessive risk if the market turns. Demand for bonds has been so strong that investors snapped up government debt at record low yields at the latest auction.

Duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features.

Bonds have soared after the central bank cut interest rates to revive growth in an economy battered by a housing slump and weak consumer demand. The Bloomberg China Aggregate Total Return Index has risen 5% this year, double the gain for a similar US gauge.

In a bid to cool the market, regulators are taking at least six months to approve new funds, people familiar said. That’s at least double the time it used to take, one of them added.

This week’s fun finds

How to Clean Your Home in 15-Minute Chunks (and Why You Should)

If your home is a mess but you don't really know where to start, it's time to set a daily cleaning schedule, but don't feel the need to do everything all at once. It's well established that working in short bursts can help keep you motivated when you're feeling overwhelmed, and cleaning in 15-minute bursts will do the trick. There are a bunch of areas around your home where that's all you need, so start today and thank yourself in a few weeks.

Use the principles of time boxing and limit yourself to just 15 minutes per day. When you're using time boxing, you dedicate a predetermined amount of time to a specific task and work on it with no distractions, but you stop when the allotted time is up. If necessary, you pick the task back up during the next time box. Even if you're really getting into the cleaning groove, try to stay within the 15-minute mark every time to stave off burnout and keep yourself challenged to stay totally on-task the whole time.