This week in charts

Mutual fund cash balances

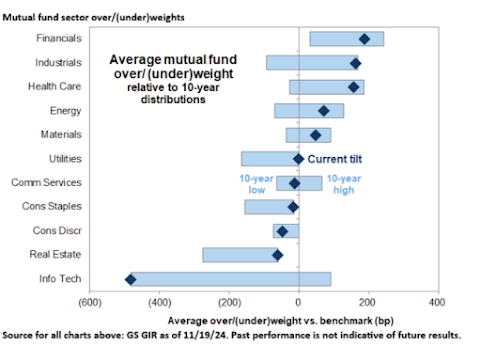

Mutual fund sector weights

U.S. dollar dominance

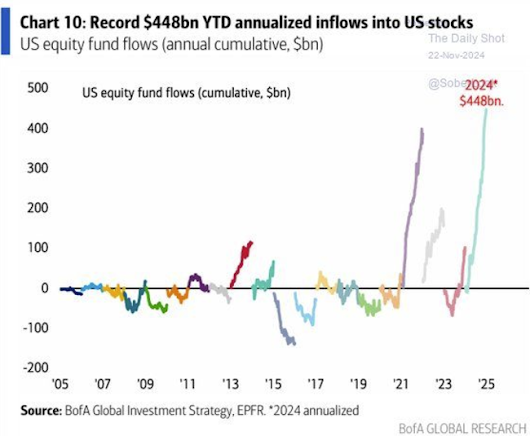

U.S. equity fund flows

Private credit borrowers

Business development companies

MSCI World Index valuations

Before and after the Global Financial Crisis

S&P 500 cumulative returns

Nvidia total market cap

How is private credit weathering its first big rate hiking cycle?

Private credit — basically, bilateral corporate loans made by specialist investment funds rather than banks — has been one of the hottest asset classes over the past decade. Possibly the hottest. Depending on who you believe, there’s somewhere between $2tn and $3tn of money in private credit funds.

The problem is that they make floating rate loans — typically priced at 5-10 percentage points above SOFR — and that can be a double-edged sword. Higher rates mean interest income balloons, but at some point it becomes a challenge for even a healthy, growing company to keep servicing its debts. And for many companies the weight of their debt burdens have almost doubled in just a few years.

FT Alphaville has been sceptical over the argument that private credit now poses systemic risks, but we’ve long thought that there was probably a lot of dumb stuff happening in the space, given how hot it became. So how is private credit actually faring through the first proper interest rate hiking cycle in its life as a “proper” trillion-dollar-plus asset class?

By its nature it will be hard to know exactly how things are going, because private credit is, well, private. Moreover, the locked-up money of private credit funds means that there are a lot of ways for them to keep any distress hidden away. As the old saying goes, a rolling loan gathers no loss.

Even when there are outright defaults it will in many cases be handled discreetly, with no one outside the company and its lender knowing about it. It will therefore probably take many years before we discover the full extent of the pain.

The latest data indicates that private credit funds continue to report impressive returns, boosted by higher interest rates. In fact, MSCI’s data indicates that they notched up another 2.1 per cent gain in the second quarter, putting private equity in the shade.

However, there are other signs of deeper stress if you look closely enough. First and foremost, the growing use of “payment-in-kind” loans — where interest payments are rolled into the principal rather than paid to lenders — is a sign that all is not well in privatecreditland.

PIKs can be a perfectly acceptable tool in fast-growing companies that are better off investing in their core business than spending valuable cash on servicing onerous interest payments. But when a company that previously made interest payments in cash switches to a PIK loan it is not a great sign of health. And that is what appears to be happening a lot in the private credit ecosystem.

The problems can be compounded by the fact that private credit loans seem to do a lot worse than commonly thought when they go bad.

Private credit funds often tout how they can get restrictive, bespoke loan agreement clauses to protect themselves, but recoveries have lately actually been worse than for traditional syndicated loans, and only slightly better than from unsecured junk bonds.

To us, the massive drop in private credit loan prices from just three months before default to default us also noteworthy. It indicates that there is a lot of denial and fantastical marking going on in private credit, even as companies are clearly hurtling towards default.

This week’s fun finds

Santa came early for our little EdgePoint helpers this year. Thanks to all the partners who helped bring the spirit of the holiday season to our Toronto office.

LEGO ZH1 - Working and Functional 35mm Film Camera

The camera proudly features the classic LEGO logo from 1934, adding a nostalgic touch. The main lens is based on an existing magnifying piece, while I also developed a special pinhole lens that produces unique and stylish effects, as seen in the samples.

.jpg)