This week in charts

P/E ratios

Berkshire’s cash levels

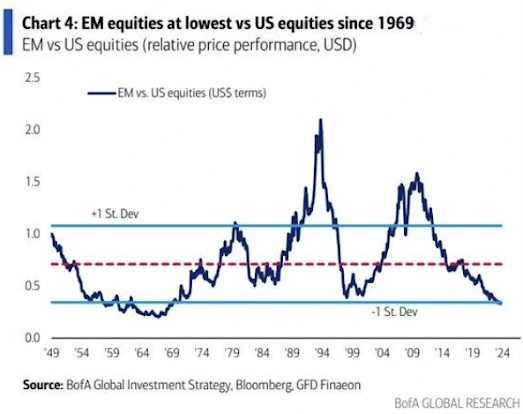

EM vs. U.S. equities

Valuations by country

Post-election day returns

U.S. dollar impact by sector

China’s % share of global commodity demand

Immigration and unemployment rates

Earnings impact on 1 percentage point change in tax rate

Primary budget deficit

Wall Street frenzy creates $11bn debt market for AI groups buying Nvidia chips

Wall Street’s largest financial institutions have loaned more than $11bn to a niche group of tech companies based on their possession of the world’s hottest commodity: Nvidia’s artificial intelligence chips.

Blackstone, Pimco, Carlyle and BlackRock are among those that have created a lucrative new debt market over the past year by lending to “neocloud” companies, which provide cloud computing to tech groups building AI products.

Neocloud groups such as CoreWeave, Crusoe and Lambda Labs have acquired tens of thousands of Nvidia’s high-performance computer chips, known as GPUs, that are crucial for developing generative AI models. Those Nvidia chips are now also being used as collateral for huge loans.

The frenzied dealmaking has shone a light on a rampant GPU economy in Silicon Valley that is increasingly being supported by deep-pocketed financiers in New York. However, its rapidly growth has raised concerns about the potential for more risky lending, circular financing and Nvidia’s chokehold on the AI market.

The $3tn tech group’s allocation of chips to neocloud groups has given confidence to Wall Street lenders to lend billions of dollars to the companies that are then used to buy more Nvidia chips. Nvidia is itself an investor in neocloud companies that in turn are among its largest customers.

Critics have questioned the ongoing value of the collateralised chips as new advanced versions come to market — or if the current high spending on AI begins to retract.

The future value of Nvidia’s chips being used as collateral for loans has also been called into question. Leasing contracts that neoclouds have with tech groups will begin to expire in the next few years, probably resulting in a glut of chips available on the market.

Listed tech giants which have spent billions on AI infrastructure, are also under pressure to produce significant returns. In June, David Cahn, partner at venture firm Sequoia Capital, said there was a $500bn gap between the revenue expectations implied by technology companies’ AI infrastructure buildout, and actual revenue growth in the AI ecosystem.

Neocloud lenders, however, are betting on AI’s continued advancement.

Solar Panel-Backed Bond Deals Are Heading for Europe’s Market

European investors accustomed to buying repackaged mortgages and car loans are getting another type of asset-backed security to invest in: bonds backed by solar panel loans.

Perfecta Energia and HomeTree Marketplace Ltd. are both planning to sell repackaged solar panel loans in the public debt market, according to executives at the companies. They would follow a successful deal by Enpal GmbH, which recently became the first company to sell a solar panel-backed security in Europe’s broadly-syndicated market. The German renewables firm also plans more issuance in future.

The deals are set to open up a new frontier for asset-backed debt in Europe, where securitization has been used for years to sell mortgages, car and consumer loans to investors. Such deals package up loans into a new instrument and sell them via a special purpose vehicle, taking risk off the company’s balance sheet. They’re also seen as a way to drive adoption of solar panels by lowering upfront costs for consumers.

While demand for Enpal’s deal was strong, the nascent nature of the asset class means that risks are hard to measure, leaving some questions around this type of debt. Ultimately, the technology that these ABS is based on is still in its infancy, and there are issues with both the lack of sun and power storage facilities in Europe.

Investors assessing the new asset class may also look to the US, where solar-panel backed deals by renewables companies have been growing for some time.

Still, the market for solar ABS in the US is currently going through a somewhat turbulent time, with SunPower Corp., one of the country’s top five residential solar installers, filing for bankruptcy earlier this year and raising concerns about the industry at large. Victory for Donald Trump in the US presidential election also means that the US will likely prioritize fossil fuels over renewables in coming years, potentially hurting demand for solar panels.

But European incumbents are hoping that investors take into account differentiating factors between the two regions.

This week’s fun finds

The EdgePoint film crew made their way to the TIFF Lightbox this week. Our inspiring and unique company culture resonated with a couple of fellow moviegoers. It made such an impact that they wondered when the next outing would be and asked if they could join. Good times had by all.

Painting With Thread: New Work by Cayce Zavaglia

A few years ago Cayce “discovered” the back of her work – a chaotic network of thread that forms as she works on the front. This show features the BACK side (or “verso”) to a greater degree, recognizing the beauty of these happy accidents and the metaphor of our private messy inner selves.