This week in charts

MSCI EMU Index vs S&P 500 Index (minus NVIDIA)

Equity allocation - U.S. vs. Eurozone

Fund Manager Survey cash allocation

S&P 500 Index – Top 10 concentration

EV/Sales greater than 10x

Tariffs

10-year yield move on FOMC Days

S&P 500 Index historical returns

Central bank tracker

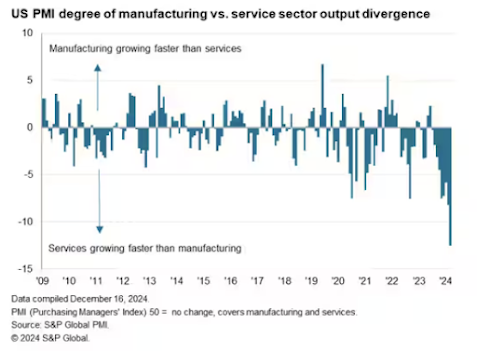

Manufacturing vs. services

Monthly interest expenses

US Yield Curve Is Steepest Since 2022 After Fed’s Rate-Cut Shift

Longer-dated US Treasuries weakened Thursday, propelling the yield curve to steepen to a level last seen about 30 months following the Federal Reserve’s hawkish interest-rate easing and projections for fewer rate cuts next year.

The two-year yield was lower by 4 basis points to 4.31%, while the 10-year rose some 8 basis points to a session high of 4.59%, and was trading around the highest level since late May. That divergence in yields saw the two-year trade as much as 0.27 percentage points below the 10-year — a level previously seen in June 2022, with the yield curve steeper by some 11 basis points on the session.

The so-called steepening has been driven by a reticence among investors to own longer-dated Treasuries given sticky inflation and a resilient economy after the Fed has cut policy rates by 1 full percentage point in recent months.

The benchmark 10-year note’s yield surged above 4.5% on Wednesday after the Fed indicated a pause was likely in the cutting cycle early next year and officials saw only two quarter-point rate cuts for all of 2025, given the lack of progress in bringing inflation down to their 2% target.

Reticence for Treasuries beyond the front end also extended to the inflation market. A $22 billion sale of five-year Treasury inflation protected securities at 1pm in New York attracted weak demand from non-dealers. The auction cleared at 2.121%, up sharply from a level of 2.05% leading into the bidding deadline.

The latest losses in the 10-year Treasury built on a steady losing streak that has driven its yield up from a low of 3.60% in mid-September. In that time, the 2s10s yield curve has turned positive after a prolonged period of inversion.

The trend of preferring the short-end at the expense of the 10- and 30-year yields Thursday was maintained after data showed a slightly higher-than-expected upward revision to economic growth in the third quarter and after weekly initial jobless claims were weaker than forecast.

This week’s fun finds

After a successful term, our interns, Renae, Arrangan and Ramneek (not shown in the photo), served up a delightful flapjack breakfast for all their new friends at EdgePoint. We wish them all the best in the new year.

B.C. man drops camera into ocean, accidentally captures 'breathtaking' whale video

Before it turned into an extraordinary day, Peter Mieras says it began being quite ordinary.

The underwater videographer with Subvision Productions was trying to see if he could tie his new camera to an old fishing pole, so he could reel it in and out of the water. But then the line broke and the video camera sunk to the bottom of the ocean.

But before he could dive down to fetch it, a flock of birds and a herd of sea lions started feasting on a school of anchovies, just a few meters from the dock.

But then he captured the unexpected arrival of a humpback whale joining the hunt.

After two hours of witnessing in the wonder that was unfolding above the water, Peter retrieved that camera that had sunk, and was shocked to see what had been recorded under the sea.

“Failure is just another step towards success,” Peter says.

So why get frustrated when things don’t go according to plan? Things might just turn out even better than you could conceive.