This week in charts

Interest rate cuts

Unemployment rates

Manufacturing GDP Per Capita

T-bill issuance

December Nonfarm payroll above expectations

S&P 500 sector performance by political outcome

30-year government bond yields

U.S. 10-year yields before and after rate cuts

Equity market concentration

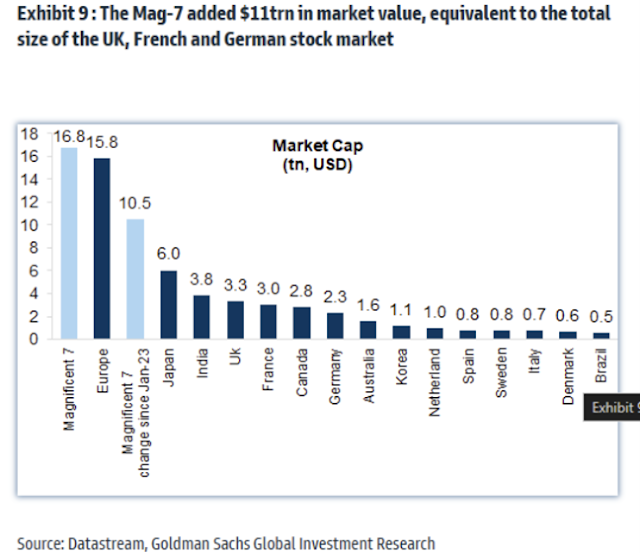

Magnificent 7 market cap

2024 price return performance

S&P 500 price-to-earnings ratios

2-year calendarized S&P 500 performance since 1928

Car companies have an infuriating software problem

Last month, my car went into the shop for its third software-related recall in six months. Once again the friendly guys at the dealership were unable to install the necessary update on their own. Instead our now-undriveable SUV sat on their lot, awaiting its turn with experts at BMW headquarters. The queue took four days.

That delay was both painful and pointless. Automakers learned long ago to have the necessary parts and labour on hand before calling in a vehicle for a physical recall. Surely a company that claims to have 9mn fully upgradeable cars on the road already can set up an equivalent process for software.

Managing such updates is only going to grow more important with the spread of electric vehicles and increasingly sophisticated digital information and safety systems in petrol-driven cars. Software fixes made up 15 per cent of US recalls last year, up from 6 per cent five years ago, according to National Highway Traffic Safety Administration data.

BMW’s three US software recalls last year put it ahead of many rivals, NHTSA records show. Ford had the most overall with 19, followed closely by Chrysler. Tesla had the highest share with 50 per cent of its 16 recalls requiring a software fix. That is not surprising given that electric vehicles rely far more on software and have fewer parts than internal combustion engines.

Software woes have delayed recent launches at Volvo and General Motors, among others. Volkswagen executives grew so frustrated with their internal software development that they signed a $5bn tie up with Rivian last summer.

Traditional carmakers struggle with updates for the same reason big banks have spent billions modernising back office technology: sprawling legacy systems. While Tesla started with a clean slate, incumbent carmakers have to wrangle old electrical systems and production lines, cross firewalls and integrate software code written by suppliers.

The rewards for getting this right are considerable. As more cars offer snazzy screens and infotainment systems, and EV battery technology improves, carmakers will need to find new ways to differentiate themselves from their rivals.

Luxury goods makers have already shown that making customers feel they are getting something special is crucial to convincing them to pay extra. Done properly, software updates can strengthen the ties between carmaker and customer, maintaining the regular contact that oil changes and maintenance checks used to provide.

This week’s fun finds

For the first time at EdgePoint, a partner created their own hot sauce for others to try. The two orange habanero sauces were less spicy with a sweet mango flavour, while the two green habaneros brought the heat (an unlabelled bottle not pictured). We’re hoping she’ll bring in more for the office fridges!

We also sampled two hot sauces from Truff. Neither were incredibly spicy, but the truffle flavour really came through.

When we lose weight, where does it go?

The world is obsessed with fad diets and weight loss, yet few of us know how a kilogram of fat actually vanishes off the scales.

Even the 150 doctors, dietitians and personal trainers we surveyed shared this surprising gap in their health literacy. The most common misconception by far, was that fat is converted to energy. The problem with this theory is that it violates the law of conservation of matter, which all chemical reactions obey.