This week in charts

Post U.S. election stock market performance

Asian markets – weekly trading flows

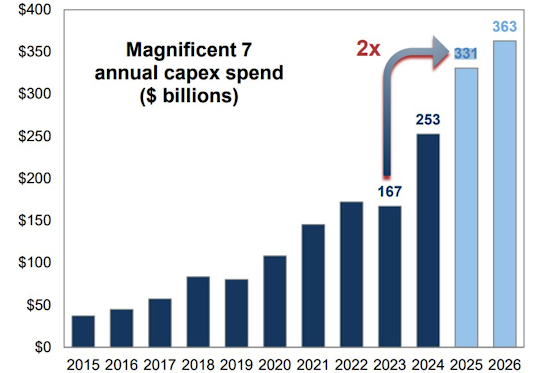

Market cap – BATX vs. Magnificent 7

S&P 500 free cash flow yield decline

OpenAI revenue model

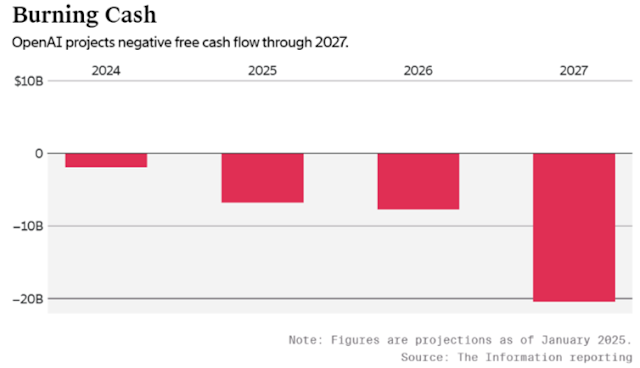

OpenAI negative free cash flow projections

Gold inflows vs. crypto outflows

Global Sector fund flows

YTD equity returns

Value vs. growth price performance

China puts brakes on US stock listings for homegrown companies

The rate of China-approved applications for US initial public offerings has slowed noticeably in the past year, falling from 22 in the first half of 2024 to 11 since June. Four people close to the China Securities Regulatory Commission said it intended to impose “tighter control” this year over US IPOs of Chinese companies with small capitalisation and weak fundamentals, viewing them as prone to market manipulation.

China has tightened regulations on offshore capital raising since 2021, following the introduction of new rules on cross-border cyber security and data security, which have also complicated the application process for companies seeking offshore listings.

A record number of Chinese companies went public on US stock exchanges last year, attended by increasing allegations of pump-and-dump schemes and warnings from US regulators to tread cautiously with the investments.

Analysts said the crackdown is Beijing’s latest effort to reduce financial ties with the US amid geopolitical tensions and underscores concerns over excessive speculation on New York-listed Chinese stocks.

The US listing boom of Chinese stocks came as many of them, especially small ones, had in recent years reported wild price swings that sparked concerns over manipulation.

According to a study released in January by Hindenburg Research, a now-shuttered investment research company, 128 Chinese companies have reported irregular price activity not explained by corporate fundamentals shortly after their New York IPOs since 2022.

US regulators, led by the Securities and Exchange Commission, have in recent years issued multiple warnings about pump and dump schemes involving small Chinese companies listed in New York.

In a report last month, the Financial Industry Regulatory Authority said such scams began to happen not only during the IPO but also weeks or even months afterwards.

China’s stock regulator was aware of the problem and sought to resolve it by raising the bar for local companies’ US listings. The CSRC is spending at least twice as much time as it did a year ago reviewing US listing requests from Chinese companies, led by those with plans to raise $10mn or less, according to bankers and lawyers.

The CSRC’s increased scrutiny has included more questions for IPO applicants ranging from whether stock option programmes may create insider trading to how user data will be protected.

IPO lawyers and bankers said it could take up to a year for clients to get CSRC approval to list in the US. That compared with less than two months a year ago.

Meanwhile, Chinese authorities are pushing more large-cap mainland-listed companies to pursue secondary listings in Hong Kong this year.

The shift could lead to a revival in listings worth $20bn in Hong Kong, led by the world’s largest battery maker CATL, marking a possible sharp pick-up in fundraising activities of the city in 2025.

The regulatory tightening looks set to continue this year.

This week’s fun finds

Jenna, from the Relationship Management Team, treated her fellow EdgePointers to the ultimate comfort food, chicken and waffles! Word on the street was that the sauces served alongside brought it to the next level.

Paper or Porcelain? Saori Matsushita Folds Delicate Ceramic into Playful Objects

It might be tempting to throw one of Saori Matsushita’s paper airplanes across the room, but we promise you the landing would be less than graceful.

From her Seattle studio, Matsushita transforms delicate sheets of porcelain into vases, mugs, and sculptures that appear as if they were folded from paper. Punctured with binder holes and the fringed edge of a torn-out sheet, the functional objects bear the iconic blue lines of a school notebook. Other works are similarly deceptive, like the cloth sack or collared-shirt vessels that capture the folds, bends, and bulges of fabric in ceramic.

To create these pieces, Matsushita utilizes nerikomi, a Japanese pottery technique that involves layering colored bodies of clay together and then cutting them to reveal a patterned section. Stripes of blue and pink appear through stacking slabs rather than the glazing process, and the artist builds most works by hand.