Notice of minimum investment amount increase for the EdgePoint Canadian Portfolio

EdgePoint Investment Group, Inc. has announced today that it is changing the minimum amount of an initial investment in the EdgePoint Canadian Portfolio (the “Fund”) from $20,000 (the “Previous Minimum”) to $100,000 (the “New Minimum”).

Click here to learn more.

This week in charts

Bitcoin and gold ETFs cumulative flows

Asset returns and volatility

60/40 portfolio

Valuations vs. return on equity

European equity fund flows

Equity issuance by type

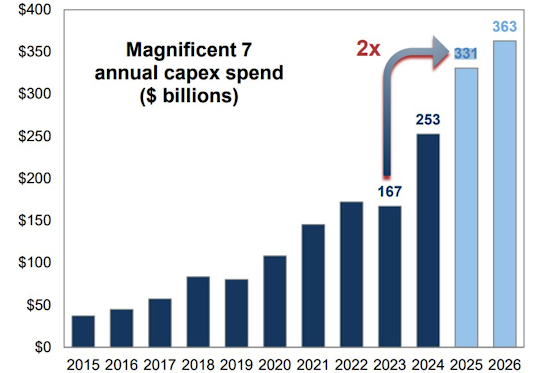

Magnificent 7 annual capital expenditure

Inflation discussions

U.S. trade partners

U.S. household debt

Variable mortgage rates

China’s tech stocks enter bull market after DeepSeek breakthrough

A benchmark for Chinese technology stocks has risen more than 20 per cent in the past month, entering a bull market as investors pile into the country’s internet companies following DeepSeek’s artificial intelligence breakthrough.

The Hang Seng Tech index, which tracks the 30 largest tech groups listed in Hong Kong, is up 25 per cent from its 2025 low on January 13. It has outpaced the Nasdaq 100’s 4.4 per cent increase and a 0.5 per cent decline for the “Magnificent Seven” US tech stocks over the past month.

The positive movement is a boon to China’s markets, which have been buffeted by concerns over US President Donald Trump’s tariffs, a mainland property slump and deflationary pressures in the Chinese economy. Mainland China’s broader CSI 300 index is up just 4 per cent in the past month.

DeepSeek stunned Silicon Valley in late January when it released a large language model (LLM) that it said was built on a bootstrapped budget, raising questions about the need for huge investment in AI.

The news led US tech stocks to a sharp drop on January 27. Nvidia set a record for the biggest one-day loss in market capitalisation, with $589bn wiped from its market value.

Conversely, Chinese tech shares boomed. Cloud computing and tech hardware companies that stand to benefit from AI innovations have led the recent rally.

They include Alibaba, consumer electronics group Xiaomi, search engine developer Baidu and electric-car maker BYD, which are up 43 per cent, 34 per cent, 13 per cent and 40 per cent, respectively, in the past month.

E-commerce platforms JD.com and Meituan have also advanced 24 per cent and 11 per cent, boosted by relatively strong consumption data from the lunar new year holiday and growing expectations of large-scale fiscal stimulus from Beijing this year.

The broader Hang Seng index is up 15 per cent in the same period. Data from the Stock Connect programme, which allows mainland traders to buy Hong Kong stocks, indicates heightened interest among Chinese investors, with average daily turnover in February up two-thirds from January and three times higher than February 2024.

Analysts said investors were boosted by the belief that Chinese development of LLMs was advancing and consumer-facing companies would rapidly adopt them.

This week’s fun find

Sometimes love needs a grand gesture: a bouquet of roses or a big night out. But strong relationships also need regular care and attention, so we asked New York Times readers to tell us how they show their affection day-in and day-out, all year long.