This week in charts

Performance after 20% declines

Stocks and 10-year yield movement

Historical U.S. Treasury ownership

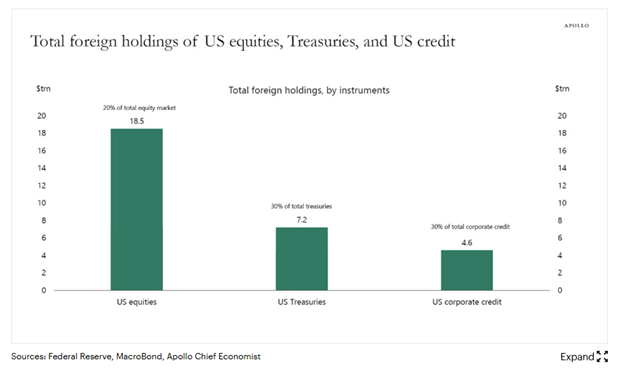

Total foreign holdings

U.S. equity fund flows

Record high valuation relative to GDP

Historical U.S. bear markets and recoveries

Correlation between markets

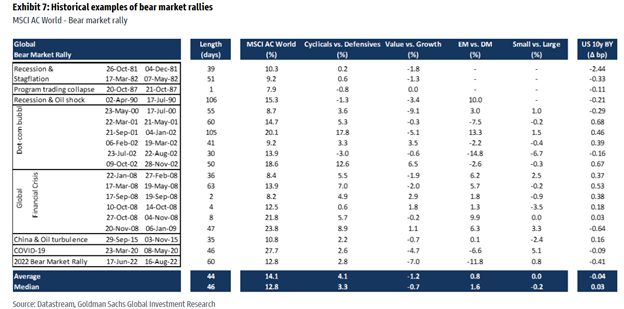

Historical bear market rallies

Duration and performance of bear market rallies

Private credit secondary sales set to rise as market turmoil spurs hunt for cash

Investors are preparing to step up sales of their private credit holdings, as heightened market volatility unleashed by U.S. President Donald Trump's trade wars forces them to find new ways to raise cash, fund managers and executives say.

While so-called "secondary sales" of stakes in private equity funds have soared amid a downturn in dealmaking, assets in private credit seldom change hands. This week's dramatic market tumble may change that.

Investors are enquiring about shedding their private credit investments in the secondary market because they worry about being overly exposed to private assets as public markets fall in value and as the need for accessing cash in more volatile markets grows, executives say.

Negotiating a sale in the secondary market takes time, typically weeks, and is not the first place institutional investors turn to raise cash.

The scale and speed of market selloffs this week have seen some hedge funds rush to offload private debt positions, however, with several forced to unwind highly leveraged debt purchases after lenders hit them with margin calls.

Secondary market deal volumes hit a record $160 billion last year, driven by asset sales by leveraged buyout funds that could not exit investments through M&A and initial public offerings in volatile markets, and by their investors such as pension funds and insurers needing cash back faster than they could deliver.

Private equity transactions account for a much larger share of transactions. Ares has said an estimated 2-3% of private equity assets are traded in the secondary market, against less than 1% in private credit.

DENOMINATOR EFFECT

One big driver for investors to sell is the "denominator effect", which leaves them with too much private market exposure when public stock and bond markets tank.

That's because private assets are often marked to market, or revalued, monthly or quarterly, shielding investors from the volatility seen in public markets but leaving them overly exposed.

Fund managers caution that there has been little sign of distressed selling yet, with discounts being discussed in the range of 5-10% below par.

This week’s fun finds

Interns Vishnu, Nikki and Khushi organized a Hakka moai on Friday. We can’t thank them enough for such a wonderful lunch and all the hard work they've done throughout the term.

‘Robobear’ Is Training People to Fight Off an Actual Bear

To educate the public on how to handle an encounter with an aggressive predator, the Wyoming Game and Fish Department created a low-tech robotic bear that can help teach people how to respond quickly to a charging bear.

It is springtime, after all. The bears are waking up from their slumber, and they are starving. There’s no telling what they’ll do if they spot you, so it’s best to be armed, not just with some form of bear repellent but with the knowledge of how to use it on a bear that has you in its sights.