Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Saudi oil production to peak......in just over a decade? (Link)

Saudi Arabia has produced 160 billion barrels of its 430 billion barrels of ultimate recoverable reserves, or nearly 40%. If Saudi Arabia produces at 10.5 million barrels a day, it would hit the 50% mark in approximately 14 years. After this point, according to the Hubbert curve, production would enter its period of structural decline.

Barbers are cashing in on this West Texas oil boom (Link)

A gusher of crude production has transformed the Permian Basin into America’s hottest oilfield. The Permian produced 3.9 million barrels per day as of January and could top 5 million barrels a day by 2023, surpassing Iraq. Fortunes are being made in this fracking-related gold rush, and money and workers are flooding in. Finding a haircut or grabbing a plate of good Texas barbecue is hard because demand outstrips supply.

Pete McGarity opened Headlines Barber Shop in Odessa in 1998 and has ridden the boom-bust cycle before. In this latest boom he decided to capitalize on it and spent about $25,000 to retrofit a trailer into a custom, mobile barber shop. He drove it about an hour west to Pecos, Texas, and parked in front of the town’s only grocery store, hoping to catch oil field workers between shifts. It was an instant success. A cut costs as much as $40, more than the $25 he charged before the boom. There is usually a long waiting list, but patrons can cut the line if they pay $60, or $75 with a shave. Mr. McGarity’s barbers are raking it in making anywhere from $130,000 to $180,000 per year. He is considering investing in additional trailers to send to farther-flung towns in the oil patch and says the additional revenue may allow him to retire soon.

More global energy demand predictions (Link)

Oil demand peaking in the 2030’s, 2 billion electric cars on the road by 2050, 50% of power generation by renewables by 2035, and many other predictions which may or may not be accurate.

Sunday, March 24, 2019

Friday, March 22, 2019

Weekend catch-up

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due to the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens. After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same as everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

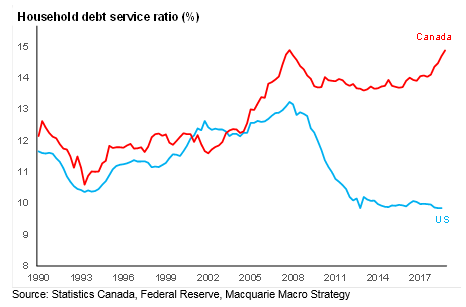

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due to the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens. After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same as everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

US labour stats

No obvious signs of overheating in US wage growth

Empirical Research

This is thanks to the baby boomers demographic who are reluctant to change jobs for higher wages

Empirical Research

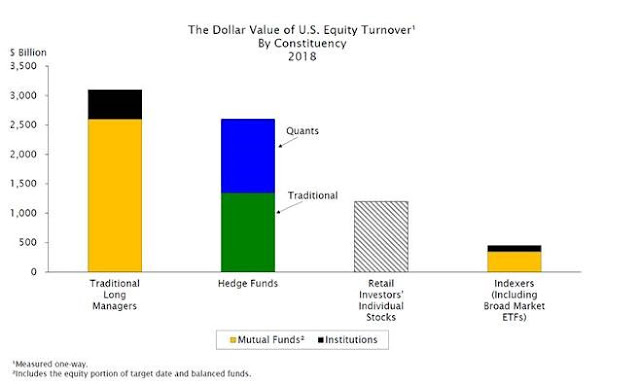

US asset flows

Hedge funds now represent almost 33% of trade volumes in the US

Empirical Research

ETF money flowing to safety in early 2019

Thursday, March 21, 2019

Friday reads

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens.

After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

_________________

Nothing happens, then everything happens (Link)

Investing can often be characterized as mostly smooth growth with occasional interruptions of violent fluctuations, similar to being an airline pilot. Ninety percent of the job is uneventful to the point of automation; ten percent of the job is terrifying and requires complex skills and a flawlessly calm demeanor.

One of the original entrepreneurs in the 3-D printing world (Link)

Hans Langer founded Electro Optical Systems "EOS" over 30 years ago. Today, EOS’s 3-D printing machines have a base price as high as $1.6 million and fill the factory floors of companies like Boeing, BMW, Lockheed Martin and Siemens.

After receiving his Ph.D., Langer thought he would become an academic, but a professor convinced him he could make a bigger difference in industry. Early in his career while working at General Scanning, Langer proposed the company start their own 3-D printing division. At the time, 3-D printing was in its infancy and the board of directors said no and argued it was to risky. Langer had an idea that 3-D printing would one day be significant to the manufacturing industry as it could produce parts that would have been impossible using traditional manufacturing techniques. Convinced of his idea for 3-D printing he quit his job. In 1989, at age 36 with two young kids and just over $50,000 to his name, he founded EOS. Today he is worth an estimated $2.6 billion.

Tuesday, March 19, 2019

Wednesday charts

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

_________________

Rising Canadian household debt

The Canadian household debt service ratio rose to 14.87% in Q4 2018, a shade below the all-time high of 14.88% set back in the Q4 2007. Interest paid by Canadian households is closing in on $100 billion per year, and was up $10.5 billion in 2018.

US labour stats

No obvious signs of overheating in US wage growth

Empirical Research

This is thanks to the baby boomers demographic who are reluctant to change jobs for higher wages.

Empirical Research

US asset flows

Hedge funds now represent almost 33% of trade volumes in the US

Empirical Research

ETF money flowing to safety in early 2019

Sunday, March 17, 2019

Value chains | Thinking differently from the pack

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Valuing Amazon’s & Walmart’s value chains. Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired, Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same a everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

_________________

Valuing Amazon’s & Walmart’s value chains. Podcast (Link) Article (Link)

As Amazon looked to enter the digital grocery business, they had a problem. Amazon quickly learned their existing distribution network was not well-suited to offer grocery products due the grocery markets finite selection of goods and perishability as grocery products degrade with time and transport. To help solve this problem Amazon acquired, Whole Foods in 2017 as they were already integrated into local markets and had the experience and ability to manage perishable goods that needed to be stocked and sold quickly, ensuring freshness and quality. Amazon's digital grocery channel could now be layered on Whole Foods existing network and stores. Walmart's value chain was already well integrated in local markets giving them a massive head start as both giants moved into the digital grocery business.

Howard Marks discusses how to think differently from the pack. Podcast (Link)

It is really easy to be average in investing. If you think the same a everyone else you will take the same actions as everyone else. If you take the same actions as everyone else you should have the same outcome. So you can't think the same as everyone else if you want a different outcome. You have to diverge. To be an above average investor you have to accomplish two things. First, think different from everyone and therefore take different actions. Second, you have to be right when you think different. Second level thinking is thinking which is different and better. Very few people can do it.

Friday, March 15, 2019

Weekend catchup

Your weekend edge - catch up with this week's readings:

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Listen to the story behind "The Incredibles" and the power of misfits (Link)

Pixar was founded on a disruptive vision. Their leaders fervently believed it was never too early to throw your own recipe out the window. Pixar founder Steve Jobs wanted to keep raising the bar—bigger hits, longer run times—so he picked a couple of outsiders to drive a shakeup. So they hired Brad Brid who was just fired from Disney. Brad hated being told “that’s the way we’ve always done it” as he believed you needed to continually shake things up. Brad joined Pixar with an idea that was far beyond what Pixar had ever done. That idea was The Incredibles, which required animating a whole family with super powers..Pixar had never animated humans before because the coding behind creating a realistic animated human was something viewed as impossible in CG animation. Brad searched Pixar’s ranks for people who were frustrated with the status quo and willing to give Brads idea a try. It turns out Brad was onto something as his new team of frustrated individuals was super motivated to develop fresh new solutions and wanted to bring Brads incredible idea to life. The Incredibles went onto gross over $600 million and win two Oscars. Not bad for a misfit like Brad.

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

Human development: fueled by energy - Chris Slubicki, CEO of Modern Resources Inc. (Link)

Chris Slubicki provides an objective perspective of the global and Canadian energy industries. Canadians are benefiting greatly today because we had the courage to build in the past.The world needs energy and no one is better at providing it then Canada. Chris concludes with great examples in Canadian history where we had to courage to build. We need to step up again and build.

Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

California is building unnecessary power plants (Link)Government policies have made Canada less attractive to investment in energy industry (Link)

U.S based, Devon Energy adds to the exodus of foreign oil and gas companies leaving the Canadian oil patch. Devon Energy has roots in Canada dating back to 1998 and opened its first facility in 2007. Their Canadian operation represented about 24% of their overall production with 750 employees in Canada. The company is leaving Canada to complete its“transformation to a high-return U.S. oil growth business". According to the 2018 Global Petroleum Survey, the U.S. is the most attractive region for oil and gas investment, while Canada now ranks fourth.

California uses 2.6% less electricity annually from the power grid now than in 2008, despite this reduction residential and business customers are paying $6.8 billion more for power than they did then. The added cost to customers will total many billions of dollars over the next two decades, because regulators have approved higher rates for years to come so utilities can recoup the expense of building new plants. California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Today the gap between what Californians pay to turn on their lights versus the rest of the country has nearly doubled. California has this tradition of astonishingly bad decisions.

How did the U.S. stock market get so old? (Link)

The average age of companies listed on US exchanges has been steadily rising for three decades. Now it’s 20 years which is almost twice the average in 1997, during the dot-com craze. The trend toward fewer and older companies has been developing for years. Firms are staying private for longer, and initial public offerings—once a rite of passage for a successful startup—get done later. Once companies do list, they quickly become prey. In a market dominated by megacaps, behemoths swallow up competitors with ease.

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Thursday, March 14, 2019

20 crazy investing facts I Labour force participation rate

Get the Edge - Click here to view an archive of investment education, daily musings, book recommendations and more.

_________________

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

_________________

Twenty crazy investing facts (Link)

- Since 1916, the Dow has made new all-time highs less than 5% of all days, but over that time it’s up 25,568%. 95% of the time you’re underwater. The less you look the better off you’ll be.

- The Dow has compounded at less than 3 basis points a day since 1970. Since then its up more than 3,000%. Compounding really is magic.

- The Dow has only been positive 52% of all days. The average daily return is 0.73% when it’s up and -0.76% when it’s down.

- The Dow has spent more time 40% or more below the highs than within 2% of the highs (20.6% of days vs. 18.4% of days) No pain no gain.

- In 1949 the stock market was trading at 6.8x earnings and had a 7.5% dividend yield. 50 years later it reached a high of 30x earnings and carried just a 1% dividend yield.You can calculate everything yet still not know how investors are going to feel

US prime age labour force has room to grow

Ex-cons are now joining the US labour force

US prison populations are declining and a thriving job market is giving many ex-prisoners a second chance in the labour market.

Subscribe to:

Comments (Atom)