_________________

Behavioral coaching ranks last on what investors value most from their advisors. (Link)

On a list of 15 attributes, “helps me stay in control of my emotions” was ranked dead last by the 693 investors surveyed about what they value most from their financial advisors.

Many advisors believe that helping to control investor emotions is one the most valuable things they bring to the table making it clear that there is a disconnect between what advisors believe investors want and what investors are looking for. Could the perception of behavioral coaching’s stem from ego? Behavioral coaching has the opposite impact on advisor and client egos. As the purveyor of behavioral coaching, the advisors ego is boosted. Advisors get to be the “responsible adult” in the relationship, which feels gratifying. Conversely, the client’s ego must seemingly be checked to admit that behavioral coaching is necessary.

Gradual improvements go unnoticed (Link)

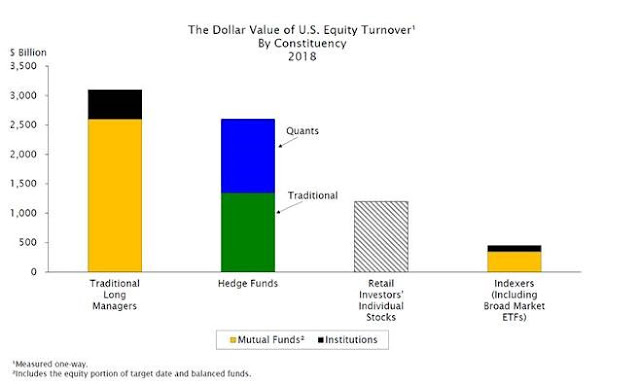

Since stocks bottomed in 2009, there have been so many potential reason to sell, making it very easy to fill this chart in. The hard part was choosing what to leave off.

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. This was a much harder task as bad news makes headlines while gradual improvements go unnoticed. The fact that bad news is disseminated 10x as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns for the average investor.

Zach celebrating his 1st and Tracey celebrating her 2nd work anniversaries!