What Benjamin Graham Would Tell You to Do Now: Look in the Mirror

Forget about what the stock market is going to do. Instead, focus on what you, as an investor, ought to do. That advice from Benjamin Graham, the great investment analyst, and Warren Buffett’s mentor, can help you navigate the market’s latest storm.

First, determine whether you are an investor or a speculator. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices and the speculator, on the other hand, cares mainly about anticipating and profiting from market fluctuations.

If you’re an investor, price fluctuations have only one significant meaning. They are an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal.

Speculators are in thrall to the mythical, moody figure Graham called “Mr. Market”. Mr. Market always wants to trade. Much of the time, the prices he sets are sensible. Often, however, they are “ridiculously” high or low. Puzzlingly, many people become more eager to trade with Mr. Market as his prices become more chaotic. A speculator is happy to buy more shares when prices rise, betting that Mr. Market will buy them back later at even crazier prices. When Mr. Market’s enthusiasm turns to fear and prices fall, the speculator sells into that panic.

Buying spree

At least one group of investors has gone bargain hunting during the wildest stretch on Wall Street in over a decade. Corporate executives and officers have been scooping up shares of their own companies at a breakneck pace in the first two weeks of March, exceeding the total of the prior two months. Insider buys are outstripping sales by the most since 2011. “When insiders are buying, they think their companies are well undervalued”.

Vanguard’s $55bn fixed income ETF hit by price huge dislocation

This chart is the Net Asset Value (NAV) of the Vanguard Total Bond Fund (BND). It is the difference between the price of the ETF and the value of the bonds it holds. The ETF is trading fully 6% below the value of the bonds! This is no random ETF. BND has $50B in assets and is one of the largest bond ETFs. The NAV discount today is bigger than on the worst day in 2008 (Oct 10). The bond market was so bad back then that the Troubled Asset Relief Program (TARP) was announced the next day.

Thoughts on the Financial Markets and the Current Crisis

“Bear markets are born of pessimism, grow on skepticism, mature on optimism

and die on euphoria. The time of maximum pessimism is the best time to buy.”

“To buy when others are despondently selling and sell when others are avidly

buying requires the greatest fortitude and pays the greatest reward.”

-John Templeton

“Be fearful when others are greedy. Be greedy when others are fearful.”

-Warren Buffet

“Buy when most people including experts are overly pessimistic, and sell when

they are actively optimistic.”

-Benjamin Graham

Thinking long term in volatile markets

Many investors might feel anxious due to current market volatility and headlines about COVID-19 and oil price declines. We know that it’s at times like these that it’s most important to keep your long-term focus and stick with the investment strategy you put in place to get to Point B. Your point B, whether that’s retirement or saving for your kids’ education, won’t be affected by short-term market volatility. So why change your plan to get there because of it? The reason you have a plan is for times like this – to keep your emotions in check and think in the context of your long term goals.

Below is a collection of resources with strategies we believe can help keep your long-term focus and provide perspective on past periods of market volatility.

Investor affirmations

Want to become an above-average investor? Here is a list of 10 things people should and shouldn’t do to avoid becoming their own worst enemies when it comes to achieving their investment goals.

Videos:

Worth your while – knowing the value of what you own

Does that macroeconomic event affect the value of what you own in the long term? Only if you panic and sell. But knowing the value of what you own can help you avoid reacting this way to volatility.

EdgePoint’s investment approach – Investing is most successful when it’s most business-like

The EdgePoint investment approach is deceptively simple, we buy good undervalued businesses and hold them until the market fully recognizes their potential. Understanding the approach helps investors have confidence in it to stay invested through the market moves.

An investor's journey with EdgePoint – not always a smooth ride

EdgePoint’s first decade helped our partners and end clients build their wealth. We made a video about that journey, not to celebrate the results, but as a reminder that the way there meant patience was needed during some very bumpy ups and downs.

Slides:

Time after time

Why do we focus on 10-year performance? Since 1974, Time Magazine has had several cover stories about negative news and events. Those who invested in the S&P 500 Index on the day the issue hit newsstands were usually rewarded 10 years later.

Staying invested pays

Bear markets are inevitable but how you respond to them defines where you stand once the markets rise again.

Bull and bear markets in perspective

Since 1945, bear markets happened approximately every seven years. While past performance isn’t indicative of future results, looking at historical markets shows that bulls follow bears and we believe these are good times to take advantage of opportunities to build long-term value and buy great businesses on sale.

Commentaries and articles:

Our Investment team has successfully implemented our investment approach thorough many periods of market turmoil, learned from them and is stronger for it today. In periods of market pessimism, we have written to our investors on our thoughts. Here are some excerpts:

What helps us sleep at night, part 6

With all the negative headlines recently about the COVID-19 virus, we’ve received a few requests to update our “What helps us sleep at night” series. As our partners know, we don’t get too fussed by noisy headlines. No one knows answers to questions like this. Instead, we focus on the performance of the businesses that make up your Portfolios. The reality is nobody knows if the markets will experience a further pullback from here, how sharp it could be or how long it might last. However, the media is full of people willing to give you their opinion. We don’t waste our time (or yours) trying to forecast such things. Rather, we consider the facts surrounding the underlying businesses we own.

Things are always bad…or so you might believe (Q3 2018 commentary)

Armed with the fact that the market historically has experienced an average drawdown of 13.8% every year, and that paying a lower price for an investment is better than paying a high price for that same investment, there should be no drama in the head of any strong investor the next time the market moves lower. The drawdowns should be looked at as a constant, something that has taken place every year. Knowing that it happens every year and will happen again next year will make it harder to overreact and easier to act on good investment opportunities.

Understanding these two simple facts leaves less room in one’s head for the drama. Adding in some other facts and insight about the individual businesses you own leaves even less room for the drama that will be created around you at the time, giving you a much higher probability of doing something intelligent. In fact, the lower prices will make it easier to do something intelligent with your investments as well.

The most important question (Q4 2015 commentary)

What gives us the ability to buy a business below its true worth is volatility. We like to capitalize on volatility as much as possible.

As many of our investment partners already know, we believe volatility is the friend of the investor who knows the value of a business and the enemy of the investor who doesn’t. Volatility is caused by emotions. The two primary emotions that drive volatility are greed and fear.

The right choice for our families (Q4 2011 commentary)

The financial impact of emotional investing can be devastating as it causes investors to behave irrationally. The good news is irrationality creates opportunities for those who can resist it. It’s our job to live in a narrow emotional band and seize opportunities presented to us by the irrational investor.

The spotted zebra versus fortune tellers and noise makers (Q2 2009 commentary)

“History has shown that it is not the economy that tends to hurt investors. Over the medium-to-long term, the economy has grown and will continue to do so.

Fortune tellers and noisemakers are very good at getting people to listen and unfortunately, they are also good at amplifying emotions, such as fear and greed, in investors which can cause them to make poor financial decisions.

What helps us sleep at night - part 6

The recent market volatility is undoubtedly keeping many investors up at night. While we have no idea how long the recent downturn will last, the investment team continues to rely on our investment approach and long-term thinking. Today, Tye and Geoff wrote “What helps us sleep at night – Part 6”, which should prove to be useful in conversations with clients.

Nobody Knows II

So many questions and few answers surround the coronavirus and its impact on global markets. In Howard Marks’s latest memo he shares his own questions, guesses, observations and inferences to help make sense of the potential impact of the virus on global economies and markets. Here are some takeaways.

There’s no doubt about the fact that coronavirus

represents a major problem, or that the reaction so far has been severe. What

really matters is whether the price change is proportional to the worsening of

fundamentals. For most people, the easy thing is to say:

The disease is dangerous,

It will have a negative impact on business,

It has kicked off a major reaction to date,

We have no way of knowing how far the decline will go,

We should sell to avoid further carnage.

But none of the above means selling is necessarily the right thing to do.

Will stocks decline in the coming days, weeks and months? This is the wrong question to ask, primarily because it is entirely unanswerable. Instead, intelligent investing has to be based on the relationship between price and value. In other words, not ‘will the collapse go further?’ but rather ‘has the collapse to date caused securities to be priced right; or are they overpriced given the fundamentals; or have they become cheap?’

US traditional flu in numbers

The stock market is not the economy

The chart below plots every time the Fed changed rates since 1994 against U.S. real GDP:.

What’s amazing about this plot is how little U.S. real GDP fluctuates in comparison to the stock market. For example, the largest decline in U.S. real GDP since 1994 occurred during the 2008 financial crisis when it contracted by only 4%.

This is just a simple reminder that the stock market is not the economy. Just because investors react quickly and negatively to a breaking news story doesn’t mean that those fears will ever materialize.

30-Year Mortgage Rate in the US hit a new all-time low

Canada’s economy remains dependent on housing

While the U.S. economy has only spent about 3.8% of GDP per quarter on gross private residential investment, Canada is spending roughly twice that … even after large declines since the peak at the end of 2017.

Most private equity firms are not achieving their projected margin expansion

For 65 fully realized buyout deals completed between 2009 and 2015, the average margin was well below the deal model forecast.

EdgePoint video: Worth your while – knowing the value of what you own

Stocks get traded every day at prices that can have little to do with their value. This usually happens when people buy and sell based on greed and fear rather than knowing what their ownership stake in the business is worth. We believe that the best way to avoid falling into an emotional trap is to act like a rational business owner and differentiate between what the business is really worth versus what the market thinks it's worth.

Reasons not to sell

The past week marked the fastest correction in the S&P 500 Index on record. It is during times like this that people struggle to separate their emotions from their investment decisions and begin to behave erratically. Below is a chart that shows the top reasons to sell we’ve seen over the last decade. The key is to resist the urge to act irrationally and believe in your investment approach.

We just witnessed the fastest stock market correction on record

Crisis and Recovery

Divergence in ESG ratings

Charlie Munger at the 2020 Daily Journal AGM (video)

Takeaways:

Many people automatically assume that because the market has been rising for many years that we must be in a bubble. This may be true but Charlie noted that each time period is unique, and rather than trying to pattern-match the current environment to some past analog, it’s important to think from first principles. Doing so leads me to proceed very cautiously given the prevailing optimism in the prices for most investments, but to also make investments when I do find those that meet my criteria for margin of safety.

Being able to recognize when you are wrong is a godsend. Charlie fights behavioral biases by consciously seeking out ways in which he could be wrong or looking for beliefs that he holds that are invalid. If he were to not do that intentionally, it’s very likely that his anchoring and confirmation biases would negatively impact his ability to think rationally.

100 Little Ideas that help explain how the world works:

Feedback Loops: Falling stock prices scare people, which causes them to sell, which makes prices fall, which scares more people, which causes more people to sell, and so on. Works both ways.

Reflexivity: When cause and effect are the same. People think Tesla will sell a lot of cars, so Tesla stock goes up, which lets Tesla raise a bunch of new capital, which helps Tesla sell a lot of cars.

False-Consensus Effect: Overestimating how widely held your own beliefs are, caused by the difficulty of imagining the experiences of other people.

Founder’s Syndrome: When a CEO is so emotionally invested in a company that they can’t effectively delegate decisions.

Skill Compensation: People who are exceptionally good at one thing tend to be exceptionally poor at another.

Ringelmann Effect: Members of a group become lazier as the size of their group increases. Based on the assumption that “someone else is probably taking care of that.”

Group Attribution Error: Incorrectly assuming that the views of a group member reflect those of the whole group.

Normalcy Bias: Underestimating the odds of disaster because it’s comforting to assume things will keep functioning the way they’ve always functioned.

How much does it cost to buy a fast-food franchise?

Many people dream of buying a fast-food franchise of their own, but few can afford it. All told, it might cost a franchisee upwards of $2 million to develop, build, and buy the right to open a McDonald’s or a KFC. Many chains won’t even look at your application unless you have a net worth of $1 million and $500k in readily spendable cash sitting around.

But there’s an exception to this: A franchise at Chick-fil-A — one of America’s oldest, largest, and most profitable chains — can be yours for just $10k.

Why is opening a Chick-fil-A franchise so cheap? Chick-fil-A, not the franchisee, covers nearly the entire cost of opening each new restaurant. The franchisee only pays the $10k franchise fee. What’s the catch? In return for paying most of the upfront costs, Chick-fil-A takes a MUCH bigger piece of the pie (royalties). While a franchise like KFC takes 5% of sales, Chick-fil-A commands 15% of sales + 50% of any profit.

At $4.2m per store, Chick-fil-A’s average revenue is the highest of any fast-food chain in America.

Seems like a great deal if you can be accepted. With a 0.13% acceptance rate, it’s harder to become a Chick-fil-A franchisee than it is to get into Stanford University (4.8%), or get a job at Google (0.23%).

Charts of the week

This week's funnies.

Bond funds are hotter than Tesla

From 1990 through 1999, bond funds and bond ETFs accounted for only 10% of the cumulative $2.37 trillion that flowed into funds, according to the Investment Company Institute. From 2000 through 2009, bond funds made up 26% of the $3.5 trillion in total inflows. Over the 10 years just ended, however, 74% of the total $2.68 trillion that investors added went into bond funds.

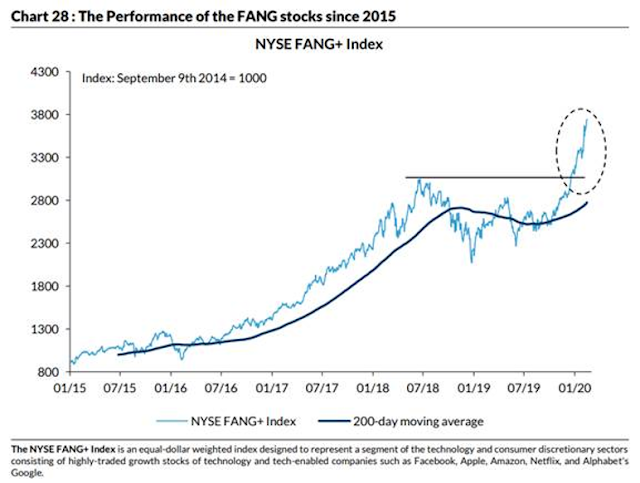

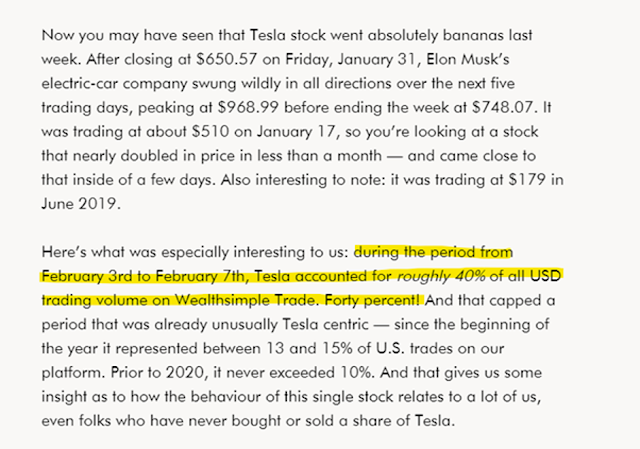

Tesla accounted for 40% of volume on online trading app

Housing in Canada

According to The Economist magazine, in the last 50 years, only 2 countries have touched Canada’s current House Price to Income Ratio. This is what happened to those two countries after:

Japan in the early 90’s and the US in the mid 2000’s never got close to where we are today:

Big Technology Stocks Dominate ESG Funds

Many of the tech companies that are among the most popular stocks in sustainable funds have earned high ratings across multiple elements that analysts consider in evaluating ESG practices. Index provider MSCI Inc. gave Microsoft an “AAA” rating on ESG—the highest possible score, awarded to just 4% of companies in the software and services industry. It cited the company’s strength on privacy and data security, corporate governance, lack of corruption and instability, and clean-tech-innovation capacity.

MSCI gave Facebook and Amazon poor ratings on privacy and data security and on labor management, respectively. The two stocks are held by a number of large sustainable funds anyway since they satisfy other criteria.

Many of the biggest ESG funds try to minimize how much their fund deviates from the broader market by creating a portfolio that, for the most part, looks like today’s technology-dominated S&P 500—just stripped of the companies with the worst ESG practices within each industry. Investors need to look beyond the “feel-good aspect of ESG” and understand what exactly they are buying.

The fact that definitions of ESG can vary so much from firm to firm has caught the eye of the Securities and Exchange Commission. The agency has sent letters to companies asking advisers how and what they determine are socially responsible investments, The Wall Street Journal reported last year.

Are massive inflows into sustainable funds lifting tech shares?

Photo contest: Winner!

Tye's concert (festival?) photo is this quarter's winner! You can almost hear the music. We loved the grittiness and the geometric designs captured in the moment.

EdgePoint: Planning for retirement

Our latest entry of the EdgePoint Academy focuses on retirement, specifically on topics and issues faced by investors preparing to retire or already there. Over the next few months, we’ll publish a series of articles covering the following topics:

Are your retirement savings on track? Compound your money, not your problems.

The big day has arrived: having the right investments can help meet your retirement income needs

The retirement income balancing act: the impact of withdrawal rates

Sequence of returns: a risk worth learning about

Your retirement preparedness temperature check

First things first – what you need to know while you’re saving for retirement and how compounding can help you.

Wealth is what you don’t spend

The median family income adjusted for inflation was $29,000 in 1955. Today it’s just over $63,000, an all-time high. But half of Americans today have zero dollars saved for retirement.

The gap between what you earn and what you spend is the figure that matters most. The majority of Americans earn more today than ever before, but it might not feel that way because the gains have been offset with higher spending.

To generalize only a little: In the 1950s camping was an acceptable vacation. Hand-me-downs were acceptable clothes. A 983 square foot house was an acceptable size. Kids sharing a room was an acceptable arrangement. A tire swing was acceptable entertainment. Few of those things are acceptable for most households today. The average new home now has more bathrooms than occupants.

The median household’s real wage gains over the last half-century have been spent. The household savings rate fell by 30% during a period when the median real income rose 40%.

The % of S&P 500 Index sectors at record valuations is higher than during the tech bubble

Inflows into Tech funds

Young people want to own Tesla, they don’t want to own fossil fuels

Jim Cramer on CNBC “The world’s changed. There’s new managers, they don’t want to hear whether these are good or bad… this has to do with new kinds of money managers who frankly just want to appease younger people who believe that you can’t ever make a fossil fuel company sustainable.”

Changes in global energy mix: