Robert, partner since 2013 (Toronto, Ontario)

This week in charts

CPI

Table: CPI breakdown by province & category

Savings by income group

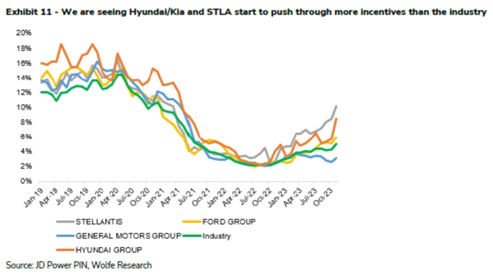

Retail

Labour market

Debt

VC Firm OpenView Collapsed Because Two Senior Leaders Quit, Sources Say

This week, OpenView Venture Partners shocked its employees and the venture capital industry by suspending new investments and laying off half its staff, including all its vice presidents and associates. With the future of the Boston-based firm uncertain, Forbes has learned that the fund made the decision because two of its three leaders — Mackey Craven and Ricky Pelletier — departed, just months after it raised a new fund, sources told Forbes.

Most of its investing partners are staying on — including the firm’s third leader Blake Bartlett, founder Scott Maxwell and about 10 lower-level partners — and the firm may resume new investments in the future, a source said.

So far, the firm has only drawn about $80 million out of its new $570 million fund, the seventh in its history, which it closed in March, a source said. Its remaining employees are planning to spend the next few months providing support to portfolio companies, as well as formulating a new plan to present to limited partners about the future of the firm.

The sudden and unexpected decision this week came after a chaotic several months that had left the firm with a leadership void. Shortly after OpenView announced its new fund earlier this year, Pelletier stepped down from his role and decided to leave the venture capital industry entirely (he is now investing in small businesses around New England, including car washes). In November, Craven told the remaining leaders that he wanted to step down, shocking his colleagues, two people said. It’s unclear what spurred the decision, but two sources say it appears to be driven by personal circumstances. Leaders told stunned employees at an all-hands meeting Tuesday that Craven wasn’t leaving to invest elsewhere.

Bartlett had been on sabbatical, but was pulled back last month in an emergency attempt to rescue the firm, the sources said. Ultimately, Craven could not be persuaded to stay on and Bartlett found it untenable to move forward as the sole leader.

OpenView was founded in 2006 by Maxwell, a former investor at Insight Partners. The firm has some $2.4 billion in assets under management. Maxwell is still part of the firm’s leadership circle, but has taken a step back in the last several years after coordinating a transition to the management triumvirate of Bartlett, Craven and Pelletier. Its partners and backers have cashed out in recent years, most notably through Craven’s investment in New York-based cloud software company Datadog, which went public in 2019 (the investment helped him make Forbes’ 30 Under 30 list for Venture Capital in 2017). That may have made retiring from VC more enticing, particularly for OpenView’s team which is not located inside Silicon Valley’s insular tech bubble.

The Road to China-Free Supply Chains Is Long. Warning: Legless Lizards Ahead.

Building China-free supply chains is tough. Sometimes it means dealing with lizards that don’t have legs and sands that are radioactive.

That is the case with making rare-earth magnets—a powerful piece of tech that is as crucial to jet fighters and wind turbines as it is to smartphones and electric cars.

For decades, China has dominated every step in the process of making rare-earth magnets. It is the only nation capable of producing the magnets from start to finish at scale.

Now, with demand growing for China-free magnets in the U.S. and Europe, a diverse group of companies are stitching together globe-spanning supply chains and encountering all kinds of obstacles as they attempt to break China’s grip on the market.

An Australian company has spent years relocating protected pink-tailed reptiles from its rare-earths mine site to unlock a new source of the minerals outside China. Meanwhile, the company is trying to find other sources of rare earths, from countries such as Vietnam and the U.S., for its processing plant in South Korea.

On the other side of the world, the hunt for rare earths has led a Canadian company to use ones that have been extracted from the mineral-rich sands in the U.S. state of Georgia. The rare earths there had to be brought to Utah to be stripped of radioactive uranium, and then shipped to Estonia to be ready for magnets.

Two-thirds of the world’s rare-earth mining occurs in China. It processes around 85% of the ore, and it builds more than 90% of the magnets.

The new ventures can’t deliver prices as low as China’s. But the companies say some Western automakers and defense manufacturers are willing to pay more for magnets largely untouched by China.

This week’s fun finds

We’ll miss you, Sylvie!

After 13 years, Sylvie is retiring to enjoy her post-EdgePoint life. Although she’s no longer an internal partner, she’ll always be part of the family.

Hot sauce reviews

The test team tried out a hot sauce collection from Costco. Review:

- “Looks interesting, but it just tastes like vinegar.”

- “Only the last one has any heat.”

Luckily, someone had some hot sauces they found at a farmers' market, Purple Tongue Hot Sauce made in Ontario!

- Way spicier than I thought!

- Why are there so many types of pepper in there? Some of those have to be made up names.

- Great flavour…and the heat lingers.

Houston, we have a tomato: ISS astronauts locate missing fruit (or vegetable)

It's gotta be hard to lose something when you're swirling around the Earth on the International Space Station — right? Well, apparently not. A missing tomato sparked a lighthearted mystery for the astronauts on board the ISS – and it's finally been solved after months of accusations and intrigue.

What is likely one of the first tomatoes ever harvested in space was plucked by astronaut Frank Rubio in March, shared in a post on X (formerly known as Twitter) by NASA. So when it makes sense that when it vanished, all finger pointing was directed at Rubio.

He explained that NASA is conducting botany studies onboard the ISS so astronauts could figure out ways to grow fresh food in space for longer term missions.

"I put [the tomato] in a little bag, and one of my crewmates was doing [an] event with some schoolkids, and I thought it'd be kind of cool to show the kids, 'Hey guys, this is the first tomato harvested in space,' " he said. "Then, I was pretty confident that I Velcroed it where I was supposed to Velcro it, and then I came back and it was gone."

Rubio estimated he spent between 8 and 20 hours of his own time searching for the lost fruit. (Whether tomatoes are fruits or vegetables depends on who you ask. In the 19th century, the Supreme Court came down on the side of vegetables — sort of.)

Rubio said he hoped someone would find it one day — and that hope was finally realized more than eight months later.

"We might have found something that someone has been looking for quite a while," astronaut Jasmin Moghbeli said in a NASA video talk from the ISS earlier this week.

"Our good friend Frank Rubio who headed home has been blamed for quite a while for eating the tomato — but we can exonerate him: We found the tomato."

The crew laughed. No word on where it was hiding or what it looked like when it was discovered, though.