This week in charts

S&P 500 stock correlations to the market

Top 10 weights in the S&P 500 Index

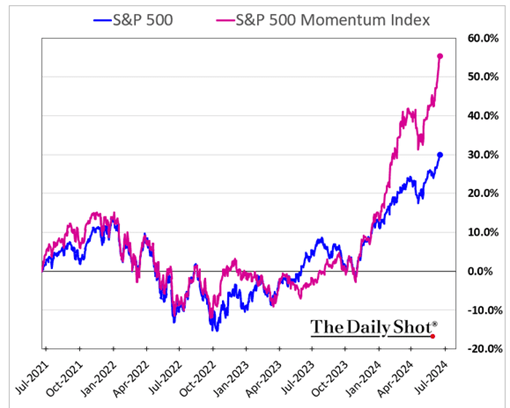

Tech stocks

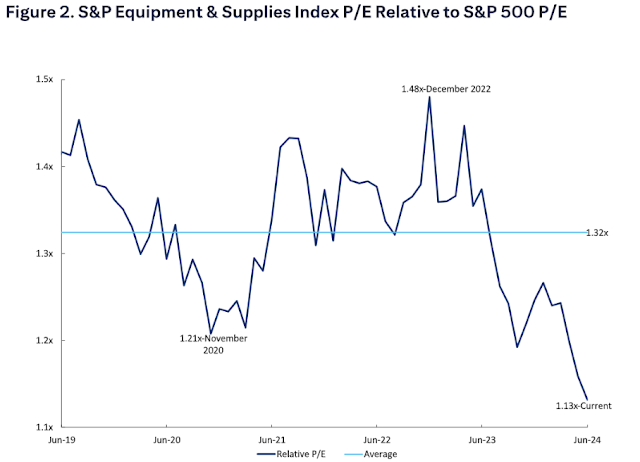

Equipment & supplies

Negative real bond returns

World stock markets

Industry weights

60/40

Correlations

U.S. Large caps

Distressed Property Buyers Seek Out ‘Exceptional Bargains’

Distressed investors see one of the best opportunities in a generation to buy troubled US real estate assets as the commercial property crash continues to roil the market.

Private equity firms are already positioning to take advantage. About 64% of the $400 billion of dry powder that the industry has set aside for property investment is targeted at North America, the highest share in two decades, according to data compiled by Preqin.

The fear elsewhere is that a strong US bias will mean other parts of the world won’t draw the same demand, delaying the work out of troubled loans and properties there.

Shrinking Pool

While the US looks attractive to private equity buyers, the overall pool of PE capital for CRE has shrunk. That will throw up some problems for credit investors, for example.

The amount of money set aside for real estate debt strategies globally by the firms shrank by 26% to $56.1 billion through May from the end of 2021, Preqin data show. That could, for example, limit buyer interest in non-performing CRE loans from Korea to China as loans sour.

Investors shun riskier junk bonds as bankruptcy filings jump

Investors are selling out of the riskiest US junk bonds in favour of higher-quality debt, amid a surge in bankruptcy filings and concerns over how the weakest corners of corporate America will survive a prolonged period of high interest rates.

The move highlights how traders are growing increasingly concerned about weaker companies potentially losing access to funding and defaulting on their debt as borrowing costs stay high, and are instead opting to buy the debt of stronger companies for the yields on offer.

Analysts and investors said higher-grade borrowers typically have more flexibility to handle interest rates at their current 23-year highs, while lower-quality names are more vulnerable.

This week’s fun finds

The Legacy of the Unforgettable ‘Beverly Hills Cop’ Theme Song

One of the most infectious earworms in movie history is back:

Doo, dah, doo-ba-dee doo-dah…

The zigzag synthesizer tune was the hit sound of “Beverly Hills Cop” and a signature Eddie Murphy character in 1984. Then it became a fixture in pop culture—quoted, sampled and remixed repeatedly over the decades, including in a mid-aughts ringtone craze. Now those bouncing, burbling ditties can be heard again in a new “Beverly Hills Cop” sequel, released July 3 by Netflix, and in a theme song performed by Lil Nas X.

The man who wrote and performed the original hooks was a pioneer of synthesizer music in film scores and helped define the sound of the ‘80s. He earned millions of dollars in royalties from “Axel F,” the theme song named for the character Murphy made famous. These days, composer Harold Faltermeyer is content if people just know that he, too, played a role in making “Beverly Hills Cop” memorable.

Stampede Pancake Breakfast - a Calgary tradition

Investment Team intern Shayan caused a "stampede" in the office with his moai. In honour of his hometown's tradition, he organized a pancake breakfast for the Toronto office so that those of us who couldn't make our way to Calgary could enjoy.