This week in charts

U.S. equities

Treasury bills

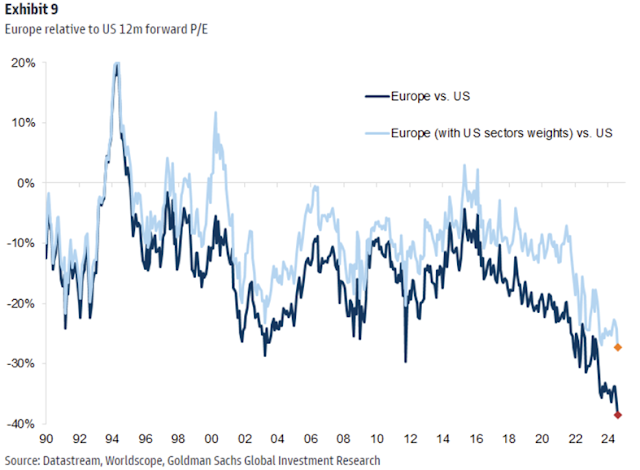

Global equities

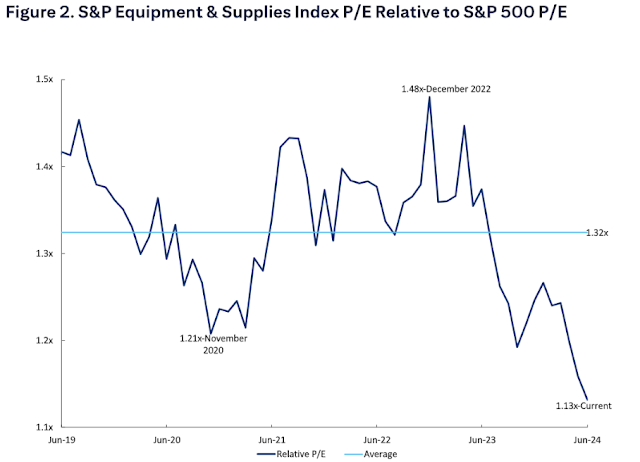

Active investing

Data centres

U.S. real estate

Chinese yields hit record lows as investors defy central bank warnings

China’s bond yields have fallen to record lows as investors respond to deflationary forces in the world’s second-largest economy and shrug off repeated warnings from the central bank that a bubble is forming in the sovereign bond market.

The yield on the 10-year bond, which moves inversely to prices, fell to 2.13 per cent on Thursday while 30-year note yields also dropped to 2.37 per cent.

Investors have been defying warnings from the People’s Bank of China that the frenzied buying risks creating a Silicon Valley Bank style banking crisis. Last month the central bank revealed its readiness to intervene in the market for the first time in decades to prevent a sharp fall in long-term yields.

“The PBoC has been battling with bond investors over long-end rates for some time, but with limited success so far,” said Larry Hu, China economist at Macquarie in Hong Kong.

Investors’ confidence in China’s sovereign debt has been bolstered by its spluttering domestic economy.

China’s economy grew 4.7 per cent year on year in the second quarter, hit by weak consumer demand and a prolonged property slowdown. Its manufacturing activity fell for a third consecutive month in July, while CPI is still just around zero. The slowdown has pushed investors out of stocks and real estate and into long-dated sovereign bonds this year.

As the domestic economy struggles to pick up, investors have bet that yields will fall further as Chinese policymakers are forced to intervene more deeply in the economy. That may mean cutting interest rates to stimulate investor demand, depressing yields.

But that has ratcheted up pressure on the PBoC as it tries to raise yields to prevent a bubble from emerging.

One of the central bank’s weapons is to exert its influence on market rates that banks lend to each other and to sell sovereign bonds on the secondary market to shore up yields. But last week, in a policy swing, the PBoC surprised the market with a slew of interbank interest rate cuts, and did not explain how it would keep defending yields under lower rates. That about-turn sparked another round of intense government bond buying.

“The main issue right now is that PBoC’s credibility isn’t strong enough, which is why the battle with the market remains intense, and why verbal warnings alone barely work,” a Hong Kong-based senior executive at a European bank said. “At the end of the day, the central bank can always prevail [in the battle]. But the strength of its credibility determines the cost of its victory,” he added.

In early July, it disclosed deals with several institutions to borrow several hundred billion renminbi of long-dated bonds, which it could sell into the market to meet demand. Many analysts believe this strategy, if the central bank went ahead with it, would provide the PBoC with a crucial tool to create a floor for long yields.

Nevertheless, investors have continued to ignored both the PBoC’s warnings and the potential firepower at its disposal.

A growing number of traders are engaging in what is known as “curve flattening,” where they anticipate minimal differences between short-term and long-term bond rates, according to a bond trader at a state securities firm in Beijing. “It signals a lack of confidence in the market’s growth potential,” he said. “That’s what worries the PBoC.”

EV Owners Don’t Pay Gas Taxes. That’s a Problem for Congress.

Congress got together to talk about electric vehicles, and what was said showed why investors typically disregard political rhetoric.

Wednesday, the Senate Budget Committee hosted a hearing called “The Future of Electric Vehicles.” Senators from both sides of the aisle grilled five witnesses about EVs, competition with China, and U.S. government policy.

Senators’ questions and statements tended to be one-sided with cherry-picked facts, citing mainly out-of-date data. Many rhetorical questions were asked.

Conservative-leaning senators focused on things such as potential job losses in the ethanol business and the environmental perils of mining for EV-related metals, without addressing job gains in the manufacturing sectors or the environmental perils, and relative size, of the coal and oil industries. (Coal and oil are more than 100 times the size of the markets for EV-related metals such as copper and lithium.)

Liberal-leaning senators focused on things such as low EV operating costs and new technologies without really addressing the total cost of ownership, including upfront costs and depreciation, or the cost of all the new tech.

Senators appeared to agree on a couple of things though. One, EVs aren’t contributing to the Highway Trust used to pay for road and public transit infrastructure. That’s a problem. And two, China is a material threat to the U.S. auto industry and National security.

The Highway Trust is a federal account funded mainly by gasoline taxes that doles out some $50 billion annually to states and local governments. The fund is facing a crisis, as fewer and more-efficient gasoline-powered cars mean outflows are expected to greatly exceed inflows in the coming years.

EV drivers don’t pump gas or pay gas taxes. Fixing the fund’s problem isn’t difficult, though, and it isn’t existential for EVs. The average driver pays about $100 in gas taxes annually. Congress could compel EV drivers to pay that.

The Chinese problem is much more nettlesome. China dominates EV production, and the EV materials supply chain. All the senators agreed that American EV leadership is important. Steps to make that happen include things such as easier permitting for mining and electricity-grid upgrades. It also includes making China play fair.

China is a large exporter of technology used to clean up exhaust from coal-fired power plants. But it doesn’t always use the technology itself, giving Chinese power producers a 15% to 20% energy-cost advantage. Cost advantages eventually translate into lower prices for EV batteries. It also translates to lower power costs, which means bigger consumer savings, leading to more EV demand.

While investors listening to the hearing might not get leading-edge opinions, they did get a sense of the current political landscape.

On that front, a battle is brewing over EV purchase tax credits, which gives up to $7,500 off a qualifying transaction.

Democrats emphasize policy certainty, preferring to keep the credits so that auto makers can plan and project consumer EV demand. Republicans are focused on removing EV “mandates” in the name of consumer choice.

There is no actual mandate. There are ever-tightening emission standards. Those standards were implemented in the mid-1970s after the 1973 Oil Crisis.

That period offers a lesson to Congress and investors. The U.S. wasn’t ready to compete with more fuel-efficient models from Japan as oil prices exploded.

This week’s fun finds

How Olympic ‘Fast Pools’ Are Designed for Maximum Performance

Competitive swimming is no joke. It takes a combination of strength, agility, and technique to be successful in the field. It's evident that athletes work hard, but there's another factor that goes into their achievements. At the Olympics—including the 2024 games in Paris—state-of-the-art pools called fast pools also contribute to a swimmer’s performance, with features that help them gain optimal speed.

According to NBC News, a fast pool is built to mitigate factors that slow swimmers down. With all that kicking and stroking, waves are the main culprits. Therefore, engineers design fast pools with components that minimize the water's movement.

Most pools used for competitions are around 10 feet deep. At that depth, any water the swimmers kick down will lose energy and dissipate before reaching the pool's floor. If the water is too shallow, waves will bounce off the bottom of the pool and back up to the athletes, hindering them from reaching full speed.

The ingenuity doesn’t stop there. Designers also consider the edges and lane divisions of fast pools. Troughs along the ends and sides of the structure eliminate waves by absorbing their energy, preventing them from rebounding back into the athletes' lanes. Additionally, when waves hit lane lines, the water spins around them rather than passing through them. This stops one swimmer's waves from disturbing their competitors in the other lanes.

The temperature of the pool water also matters. If the pool water is too cold, an athlete’s muscles can tighten up. On the other hand, hot water can cause muscles to relax too much. For maximum performance, the mandated temperature for Olympic swimming events is between 77 and 82°F.

Though it's still considered a fast pool, the pool at the Paris Olympics is more shallow than most Olympic facilities, with a depth barely exceeding 7 feet. This hasn't stopped swimmers from excelling at the summer games. Caeleb Dressel, also known as the fastest swimmer in the world, earned his eighth golden medal for the U.S. in the opening days of the event. That ties him for the sixth-most medals earned by any athlete since the modern Olympics began.