Fourth quarter commentaries are now live!

This quarter, Claire Thornhill makes some predictions for EdgePoint in 2025, while Derek Skomorowski goes public about the risks of private credit, and the opportunities left behind.

This week in charts

Government spending

Electricity prices

Policy rate changes in response to tariff scenarios

Tariffs applied to and by U.S.

Revenue per worker

Japanese chip exports

Magnificent 7 bond yields

Most crowded trade

Valuations

Return contribution to the S&P 500

The European discount

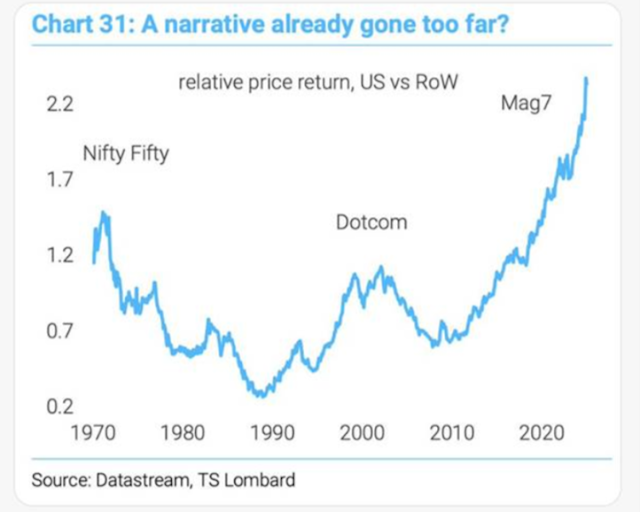

U.S. outperforms the rest of the world - relative price returns

U.S. vs. global tech stocks

Private purchases of U.S. equities

Equity risk premium in negative territory

US stocks at most expensive relative to bonds since dotcom era

A record-breaking run for US equities, which hit a fresh high on Wednesday, has pushed the so-called forward earnings yield — expected profits as a percentage of stock prices — on the S&P 500 index down to 3.9 per cent, according to Bloomberg data. A sell-off in Treasuries has driven 10-year bond yields up to 4.65 per cent.

That means the difference between the two, a measure of the so-called equity risk premium, or the extra compensation to an investor for the risk of owning stocks, has fallen into negative territory and reached a level last seen in 2002 during the dotcom boom and bust.

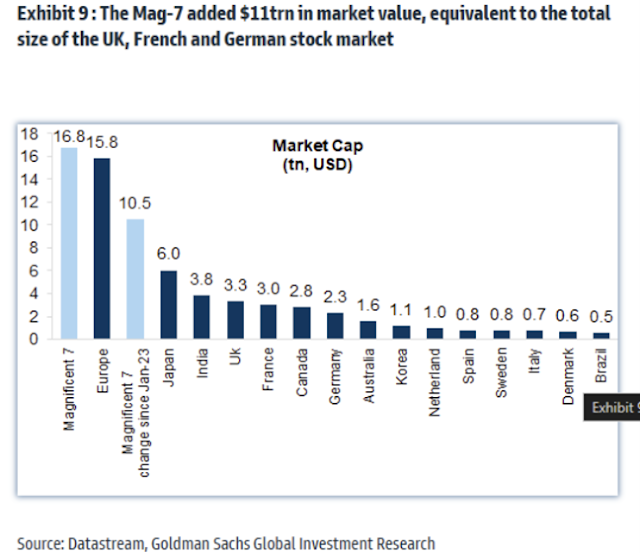

Analysts said the US’s steep equity valuations, labelled the “mother of all bubbles”, were the result of fund managers clamouring for exposure to the country’s buoyant economic and corporate profits growth, as well as a belief among many investors that they cannot risk leaving the so-called Magnificent Seven tech stocks out of their portfolios.

The traditionally constructed equity risk premium is sometimes known as the “Fed model”, because Alan Greenspan appeared to refer to it at times when he was chair of the Federal Reserve.

However, the model has its detractors. A 2003 paper by Cliff Asness, founder of fund firm AQR, criticised the use of Treasury yields as an “irrelevant” nominal benchmark and said the equity risk premium failed as a predictive tool for stock returns.

Some analysts now employ an equity risk premium that compares stocks’ earning yield to inflation-adjusted US bond yields. On this reading, the equity risk premium is also “at its lowest level since the dotcom era”, said Miroslav Aradski, senior analyst at BCA Research, although it is not negative.

Equities’ valuation relative to bonds is just one measure of exuberance cited by managers. Others include US stocks’ price-to-earnings valuation against their own history or compared with stocks in other regions.

Many investors argue that high multiples are justified and can be sustained. “It is undeniable that [US stocks’ price-to-earnings] multiple is high relative to history, but that doesn’t necessarily mean that it is higher than it should be, given the underlying environment,” said Goldman Sachs’ senior equity strategist Ben Snider.

US stocks have now regained all the ground lost during a fall since December. That sell-off highlighted some investors’ concerns that there was a level of Treasury yields that the stock market rally could not live with, because bonds — a traditional haven asset — would appear so attractive.

For others, US stocks’ declining risk premium is just another reflection of investors piling into Big Tech stocks and the risk that concentration in a small number of big names poses to portfolios.

This week’s fun finds

January 22nd was National Hot Sauce Day and we decided to celebrate with the hottest sauce from Hot Ones (The Last Dab X), along with some Halifax hot sauces gifted to an internal partner. None of the sauces were overwhelming from a spice perspective, but the Nurple sauces were both quite flavourful.

The Patagonia vest endures in San Francisco tech circles, despite ridicule

Long associated with Wall Street and Silicon Valley, the Patagonia vest has endured as a tribal symbol of finance and tech. But those who've dared in recent weeks to put on their vests in San Francisco have been the target of a resistance of sorts.

"Urgent: Stop wearing vests," implore flyers plastered around the city. "You live in San Francisco now. It's time to start acting like it."

Not everyone who sports a Patagonia vest is a "tech bro," says proud Patagonia vest-wearer Sam Runkle. "It's comfy," Runkle says. It gets the job done."