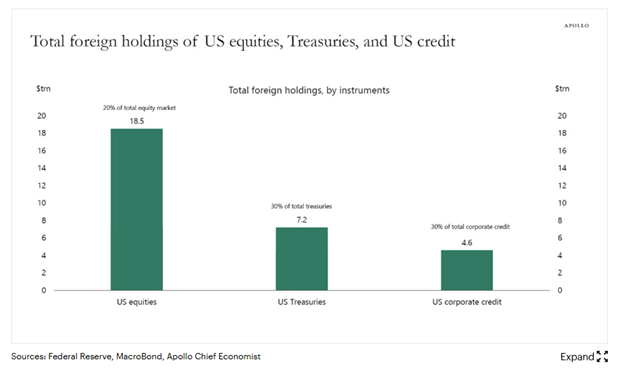

Foreign holdings of U.S. financial assets

S&P 500 Index Top 10 price-to-earnings ratios

U.S. equity index valuations vs. history

Rotation out of U.S. stocks

MSCI China Index vs. S&P 500 Index

Inflows into U.S. short-term Treasury funds

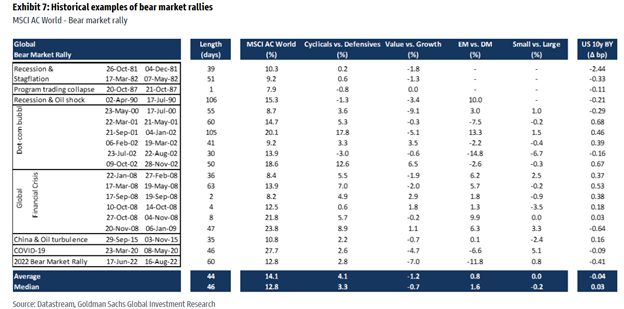

Bull market trends

S&P 500 Index correction

Historical S&P 500 Index returns after inauguration day

Retirement fears

Leveraged loans

Private market performance

Why China is suddenly flooding the market with powerful AI models

Retaliation seemed certain. When the US tightened its grip on advanced artificial intelligence technologies in January — blocking China’s access to advanced AI chips and locking proprietary models behind trade barriers — the response appeared predictable. China would build its own walls, guard its breakthroughs and double down on secrecy.

Instead, China is doing something unexpected: it is giving away its most advanced AI models.

In recent weeks, Chinese tech groups including Alibaba, Baidu and Tencent have been flooding the market with powerful AI models. But in an industry where secrecy is the norm, the real shock is their openness — these models are free to download, modify and integrate.

At first glance, this surge might seem like a statement that AI should be open to the world, not just a handful of companies. But in business and geopolitics, generosity is rarely without strategy. The real question is not why China is open sourcing its AI, it is why the world assumed it would not.

For now, most US tech groups treat AI like an exclusive resource, restricting access to their most powerful models behind paywalls. OpenAI, Google DeepMind and Anthropic limit full access to their most advanced AI models, offering them through plans such as paid subscriptions and enterprise deals. Meanwhile, the US government views open-source AI as a security risk, fearing that unregulated models could be fine-tuned into cyberweapons. US lawmakers are already pushing to ban DeepSeek AI software from government devices, citing national security concerns.

But Chinese tech groups are taking a very different approach. By open sourcing AI, they not only sidestep US sanctions but also decentralise development and tap into global talent to refine their models. Even restrictions on Nvidia’s high-end chips become less of an obstacle when the rest of the world can train and improve China’s models on alternative hardware.

AI advances through iteration. Every new release builds upon the last, refining weaknesses, expanding capabilities and improving efficiency. By open sourcing AI models, Chinese tech groups create an ecosystem where global developers continuously improve their models — without shouldering all the development costs.

The scale of this approach could fundamentally reshape AI’s economic structure. If open-source AI becomes just as powerful as proprietary US models, the ability to monetise AI as an exclusive product collapses. Why pay for closed models if a free, equally capable alternative exists?

For Beijing, this strategy could be a powerful weapon in the US-China tech war. US AI companies, built on monetisation through enterprise licensing and premium services could find themselves in a race to the bottom — where AI is abundant, but profits elusive.

Of course, this comes with trade-offs. If AI is freely available, nothing will stop foreign companies from taking China’s models, refining them and outcompeting Chinese companies. Over time, companies such as Alibaba, Baidu and Tencent may face the same pressures as US counterparts — forcing them to restrict access to protect intellectual property and generate revenue.

Beyond market dynamics, Beijing may have its own reasons to rethink this approach. The Chinese government, which prioritises control over key technologies, may also push for stricter AI regulations to manage misinformation, maintain oversight and ensure compliance with state policies.

But for now, open-source AI remains China’s best bet — a way to compete without access to the best chips or the advantage of an early lead.

The timing of the open source rush is no coincidence. It is a response to a closing window. With US chips and AI technology restrictions set to tighten under President Donald Trump and proprietary AI models becoming entrenched, China’s most effective strategy is speed and scale. To flood the market, to shift the balance before AI monopolies emerge.

If OpenAI, Google and Microsoft have already won the AI race as we know it, then China’s best move would not be to compete — it would be to make winning meaningless.

Billions Flowed Into New Leveraged ETFs Last Year. Now They’re in Free Fall

Several popular leveraged exchange-traded funds, which use borrowed money to amplify their bets on one or more asset, have erased most of their value in a matter of weeks. Among the worst performers: A fund that offers investors twice the exposure to shares of MicroStrategy, the software company-turned-bitcoin collector, has plunged 83% since touching its November high. Another ETF, which offers similar leverage on Tesla, is down 80%.

Leveraged ETFs emerged last year as one of Wall Street’s favorite roller coasters, as investors sought out ways to take bigger risks during the stock market’s rally and money-management firms launched a bunch of new funds that capitalized on this demand. Assets under management in leveraged ETFs jumped by 51%, to $134 billion, in the 12 months ending Jan. 31, according to Morningstar.

Funds that offer leveraged exposure to broad stock indexes have been offered in the U.S. for more than a decade. But leveraged single-stock ETFs, like those linked to MicroStrategy and Tesla, were first approved by regulators in 2022.

The funds are designed for short-term traders and shouldn’t be held for long periods, investment firms said.

Morningstar analyst Jeffrey Ptak is concerned not all investors fully appreciate how quickly or severely leveraged funds’ performance can veer off course. “These products have become very popular, to a worrisome extent,” he said.

The relatively new class of leveraged single-stock ETFs has taken investors on an even wilder ride. The three largest single-stock funds give holders leveraged exposure to Nvidia, Tesla and MicroStrategy—a trio of stocks popular with the day-trading crowd.

The MicroStrategy funds offer the starkest example of the speed with which fortunes can be minted and then lost with single-stock funds. Defiance ETFs and Tuttle Capital Management launched competing products in August and September, and both became overnight hits, collecting billions in investor cash as they posted eye-popping gains.

So far, investors haven’t been deterred, opting to buy the dip.

The biggest MicroStrategy fund, known by ticker MSTU, has posted almost $500 million of inflows year-to-date, including $312 million over the past month, according to FactSet.

This week’s fun finds

What This Jelly Blob Tells Us About Water Quality

In the fall, TRCA monitoring teams found a slimy ball of jelly on some of their equipment: a bryozoan colony. Also called ‘Moss Animals’, these jelly-like blobs are made up of thousands of microscopic invertebrates that live in a colony.

Bryozoans are filter feeders, eating plankton, algae, and bacteria. They clean the water as they feed. Their presence means the water quality is good. So, seeing one in the new mouth for the Don River is a sign that efforts to clean up the Don River are working.

Bryozoans are quite common and can be found on every continent except Antarctica. In freshwater, they form colonies during the warmer months, attaching to things such as docks, buoys or sticks. People usually notice them in the fall, when the colonies are biggest, and equipment is being taken out of the water before the winter.