This week in charts

Private debt – total corporate borrowing

Private debt vs. high yield corporate bonds

Private debt vs. leveraged loans

U.S. corporate bond total market capitalization

Inflation expectations and oil prices

Trade war impact

Valuations by region

Forward Price-to-earnings ratios by geography

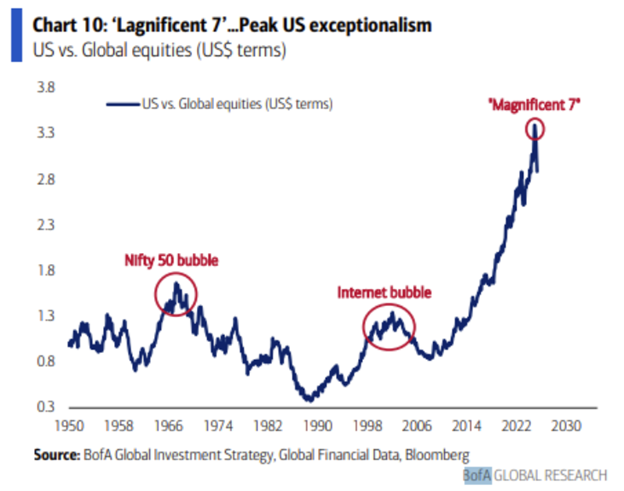

MSCI U.S.A. Index vs. MSCI World ex. U.S.A. Index

U.S. unemployment and recessions

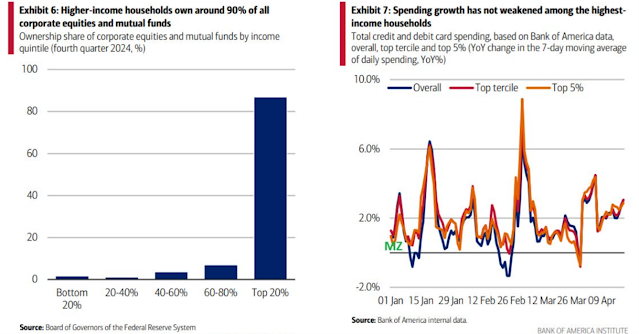

U.S. household ownership of stocks

The disruptions in global trade threaten to extend a years-long slump in the US farm industry, which had already been struggling with ample supplies, depressed crop prices and rising competition from Brazil. Lack of clarity on how the Trump administration will address much-needed incentives for crop-based fuels in the next few years has added to concerns.

Crop traders and processors have been among the hardest-hit. Archer-Daniels-Midland Co. and Bunge Global SA saw their combined operating profits slump by about $750 million in the first quarter, with both companies citing an impact from trade and biofuel policy uncertainty.

Importers put off purchases of US grain and oilseeds as Trump threatened tariffs as well as levies on any Chinese vessels docking at American ports, reducing trade flows, according to crop merchant The Andersons Inc.

Tractor makers CNH Industrial NV and AGCO Corp. also reported lower first-quarter sales, and warned of the potential of reduced demand for farmers, which would give them less to spend on machines to plant, harvest and treat their fields. Both companies have raised prices to ease the impact of tariffs on costs.

Duties also threaten to curb imports of some fertilizer and pesticide supplies. Shipments of phosphate — a key crop nourishing ingredient — into the US have trailed last year’s levels because vessels have been diverted to other countries to avoid the nation’s 10% tariff, Mosaic Co. said in its earnings statement.

Farmers are expected to pay more for pesticides as the US relies on tariff-hit countries such as China and India for some of its supplies. Nutrien Ltd. said its branded products could potentially cost as much as 7.5% more, with even higher adjustments expected for generic ingredients, as a result.

Brazil is emerging as a winner from the trade tensions. Minerva SA said tariff turmoil drove increased Chinese demand and higher export prices for South American beef in the first quarter, helping lift profits for the Brazilian supplier. Meanwhile, China has effectively shut its market for US meat exporters including Smithfield Foods Inc.

China, the world’s largest commodity importer, has already shifted to Brazil for a meaningful part of its soybean needs since Trump first raised tariffs on goods from the Asian nation in 2018.

This week’s fun finds

As the (hopefully) last bit of cold weather leaves us for awhile, the EdgePoint hot sauce reviewers met up to sample some delicious hot sauce made in London, Ontario. All were flavourful, but the Millionaire sauce brought some lingering heat and the Smokey sauce made us feel like were eating something fresh off a campfire.

How sound is passed down over generations

This is a project about shared DNA in music.