From our EdgePoint family to yours, wishing you all the joys of the season, health and happiness throughout the coming year.

Wednesday, December 15, 2021

Friday, December 10, 2021

This week's interesting finds

New EdgePoint swag - EdgePoint ornament

Spread some joy with the Edge-iest ornament around. Perfect for hanging from whatever holiday fixture you want. As always, you can shop guilt-free since all profits will go towards lowering our investors' fees.

Demographics

In need of a baby boom, China clamps down on vasectomies

Zhao Zihuan, a first-time mother in the Chinese city of Jinan, had two miscarriages before giving birth to a son last year. The seven-hour labor ended in an emergency Caesarean section.

Exhausted by child care, the 32-year-old and her husband decided one kid was enough — so in April they began to inquire about a vasectomy. Yet they were turned down by two hospitals. One doctor told Zhao’s husband that the surgery was no longer allowed under the country’s new family-planning rules.

For more than three decades, Chinese authorities forced men and women to undergo sterilization to control population growth. Now, as the government tries to reverse a plummeting birthrate that it fears could threaten social stability and the economy, hospitals are turning away men seeking vasectomies Couples and single men who sought the procedure said doctors and hospital staff refused, telling them they would regret the decision later. Some asked for documentary proof of marriage and evidence that couples had already had children before going ahead with the surgery.

Chinese weddings fall to 13-year low as demographic crisis brews

China’s efforts to lower the cost of marriage and boost birth rates have failed to lead to more weddings, dealing a blow to a crucial policy intended to combat a rapidly ageing society. The world’s most populous country faces a demographic crisis as authorities grapple with the economic challenges caused by a shrinking population. Chinese census data released this year showed the population had increased at its slowest pace in decades.

“A drop in marriage will affect birth rates and in turn economic and social development,” said Yang Zongtao, a senior official at the MCA last year. “We are hoping to . . . actively create favourable conditions for more people of suitable ages to walk into marriage.

A big challenge has been the country’s gender imbalance, with young men outnumbering women of similar age by a considerable margin after decades of China’s one-child policy. “The space for new policy is limited when you have more young men than women,” said a Beijing-based government adviser. “It is inevitable that a lot of men will remain single in their lifetime.”

The adviser said China’s gender imbalance had barely improved from the 2010 census, which reported 2.2m single men aged 25-34 and 1.2m single women in the same age group.

ARK ETFs returns from their peak in 2021

Ark's Cathie Wood: 'Queen of the bull market' faces her toughest test

Ark Invest, the investment company the Californian native founded in 2014, was made for those who fancy a version of the tech-driven bull market on steroids. Harnessing social media with a skill rarely seen on Wall Street, Wood has attracted legions of retail investors and billions of dollars by pitching aggressive bets on companies and technologies she says will reshape the world, most famously Tesla. The results have been spectacular — until now.

Based in newly established offices in St Petersburg, Florida, Ark has been one of the biggest winners from the market’s embrace of moonshot bets on disruptive companies, an approach whose risks the Federal Reserve has helped gloss over with waves of monetary stimulus.

But with Fed chair Jay Powell last month signalling a determination to scale back support, Ark now faces the toughest test in its short history as sentiment turns against the hot but often unprofitable technology stocks that have powered its rise.

While ARKK’s record of average annual gains is stellar, many came when it had a much smaller asset base. Amundi, one of Europe’s largest asset managers, estimates that the average investor in the ETF is now underwater.

By December 7, all 44 of its holdings were off their peak, and just six have escaped sliding into a bear market, according to data from Ramin Nakisa, a former UBS analyst who now runs consultancy PensionCraft. About half have fallen at least 50 per cent from their 2021 peaks, with five slumping more than 70 per cent or more.

So why is it that some of the biggest companies in the world are not turning profits? Why is it that they don’t even plan to?

The rise of so-called zombie companies or companies that have not and have never run at a profit are raising more and more eyebrows in the investing world.

These businesses are getting too big to ignore as by some estimates over 10% of the s&p500 (an index of the largest companies in America), is now made up of these companies that don’t serve the one central goal of being in businesses.

What’s more, is that this issue is not just endemic to a particular industry, dozens of major companies and countless smaller businesses in every sector of the economy from energy, retail, medical, telecommunications, and of course technology are in this profitless boat together.

Global Banks Hold Fast to Fossil Fuels as Climate Pressure Grows

With the ink hardly dry on a landmark pledge by the finance industry to fight climate change, the world’s biggest banks are making clear they plan to stand by their fossil-fuel clients.

In total, global banks led by the Wall Street titans have helped fossil-fuel companies issue almost $250 billion in bonds so far in 2021, a figure that also broadly matches average annual fundraising for the industry since 2016. And while the International Energy Agency argues that funding for new oil and gas needs to stop now to avoid catastrophic climate change, bankers counter that polluters need help to transition to new sources of energy.

“You can’t just walk away, because the world is still heavily reliant on fossil fuels for the vast majority of our energy demand,” said Marisa Buchanan, global head of sustainability at JPMorgan in New York. “It is really important that our clients take steps to innovate and decarbonize, but we also need to bring capital to the table for the commercialization of those solutions.”

Friday, December 3, 2021

This week's interesting finds

This week in Charts

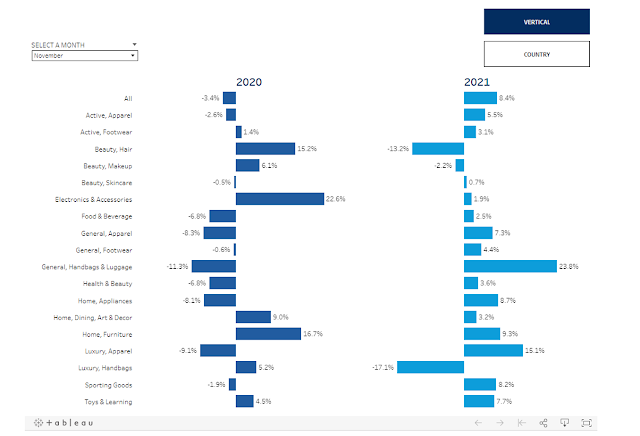

The growth in average selling prices for products sold this year and last year

Charlie Munger on today’s investment climate

Addressing Australian investors at the Sohn Hearts and Minds conference on Friday, Mr Munger underlined the stretched valuations of quality listed companies, and reiterated his extreme skepticism towards cryptocurrencies such as Bitcoin.

Mr. Munger, Mr. Buffet’s right-hand man, said the investment environment was “a little more extreme” than what he had seen in his decades of experience, and he backed China’s attempts to clamp down on “some of the exuberances” of capitalism.

“I think the dot com boom was crazier in terms of valuations than even what we have now. But overall, I consider this era even crazier than the dot-com era,” Mr Munger said.

Bill Miller’s Journey (Part II)

“It is different every time. The relevant analytical exercise is to figure out what the differences are, what it all means, so that one can make sensible investment decisions.”

I’ve been fascinated with Miller’s life and career. He has a lot to teach about investing and navigating an uncertain and changing world. Miller stuck to his principles but evolved his strategy during his run of beating the market 15 years in a row. But he failed to see crucial differences between his past experiences and the housing crisis of the mid-2000s and ended up as one the era’s biggest losers. Through it all, the ups and the downs, Miller generously shared his thoughts, reflections, and frank self assessments in his letters. In this, the second part of a two-part series, I let him mostly speak for himself. If a quote isn’t attributed, it’s his.

By Neckar’s Insecurity Analysis

Danske Bank Slaps 'ESG' Label On 95% Of Its Funds

One of the most disturbing developments on Wall Street in recent years is how the "green cult" has managed to infiltrate the culture, forcing firms to drum up ESG-branded offerings or risk losing clients to better-prepared rivals.

But like any other fad, the shift to ESG, and the pressure investors are putting on "dirty" oil and gas companies (not to mention coal) has had side effects that are more serious, and others that are more or less benign.

In the "serious blowback" camp is the fact that the backlash against traditional energy companies and the new orientation in Washington has helped drive inflationary pressures to their highest level in 3 decades by weighing on US supplies of crude oil.

The truth is there simply aren't enough truly "green" assets to go around, which is why Wall Street is scrambling to label any old company "green" based sometimes on little more than promises.

Friday, November 26, 2021

This week's interesting finds

Holiday gifting made easy – and fun!

Once again, it’s our pleasure to unveil the EdgePoint holiday gift list. In this 2021 edition, you’ll find great ideas for anyone on your shopping list. Our recommendations range from practical and classic to “Why didn’t I think of that?”. Some of them even fall into the “Wow, I never heard of that!” category. Whatever gifts you choose for your loved ones, we wish you much joy this holiday season.

This week in Charts

Many former high growth/tech/IPO/SPAC favorites from last year are now showing significant drawdowns.

Amazon’s secret war on Americans’ privacy

In recent years, Amazon.com Inc has killed or undermined privacy protections in more than three dozen bills across 25 states, as the e-commerce giant amassed a lucrative trove of personal data on millions of American consumers.

Amazon executives and staffers detail these lobbying victories in confidential documents reviewed by Reuters.

Some of this information is highly sensitive. Under a 2018 California law that passed despite Amazon’s opposition, consumers can access the personal data that technology companies keep on them. After losing that state battle, Amazon last year started allowing all U.S. consumers to access their data. (Customers can request their data at this link.) Seven Reuters reporters obtained and examined their own Amazon dossiers.

One found that Amazon had more than 90,000 recordings Alexa devices made of the reporter’s family members since 2017.

Another reporter found that Amazon had detailed accounts of her Kindle e-reader sessions and a customer profile which included her family’s “Implicit Dietary Preferences.”

Alexa devices also pulled in data from iPhones and other non-Amazon gear – including one reporter’s iPhone calendar entries, with names of people he was scheduled to contact.

The last 20 months have been a most unusual period, thanks primarily to the pandemic, yet many things feel like they haven’t changed over that time span. Each day seems like all the others.

Yet there are changes taking place, and they’ll be the subject of this memo. My focus isn’t the “little macro” changes, like what will happen to GDP, inflation and interest rates next year, but rather the “big macro” changes that will have an impact on our lives for many years. Many aren’t actionable today, but that doesn’t mean we shouldn’t bear them in mind.

• The Changing Environment for Investing

• The Changing Nature of Business

• Inflation/Deflation

• The Outlook for Work

• The Outlook for Democracy

• Generational Inequity

• The Role of the Fed

• Developments in China

• The T-Word

Nearly two-thirds of Gen Z think they’ll become crypto millionaires

Lifted by a flood of stimulus money, plus a sense that Congress would do anything to stave off an economic collapse, financial markets have spiked over the course of the COVID-19 pandemic—giving investors soaring confidence that they'll become the next Warren Buffett.

Unlike the Oracle of Omaha, though, young investors think cryptocurrencies are their ticket to riches.

A recent survey by research and analytics company Engine Insights found that 31% of the U.S. adults it polled “believe they can become millionaires from crypto investments." Of the Gen Z surveyed—that is, anyone born between 1997 and 2012—59% think crypto riches are their future.

Viral stories of investing successes are frequent—helping fuel even more of a “Fear of Missing Out” investment philosophy.

And the young—especially young men—are particularly prone to the crypto sirens. More than 40% of 18-to-29-year-old men have either invested in, traded, or used a cryptocurrency, according to a recent Pew Research Center survey.

Friday, November 19, 2021

This week's interesting finds

Why charging phones is such a complex business, with Anker CEO Steven Yang

Steven Yang founded Anker in 2011, and since then, it’s turned into a 3,000-person company that operates all over the world by selling phone chargers and battery packs on Amazon and have since expanded to other categories like webcams, Bluetooth speakers, and smart home products.

Along the way, they’ve pioneered a major advancement in charging technology — you know that little white brick that takes forever to charge an iPhone? It’s made using silicon and puts out about 5 watts of power. Anker made a big bet on a material called gallium nitride, or GaN, and it is now a charger the size of that iPhone brick that can put out 30 watts of power — enough to charge a MacBook Air. It was a big bet, and it paid off.

And, of course, we had to talk about Amazon. Anker started its business on Amazon and still sells most of its devices on the platform. Steven told me that Anker has 100 people, or fully 3 percent of the company, dedicated to thinking about managing the Amazon marketplace. And for good reason: this past summer, several of Anker’s competitors were banned from Amazon for breaking guidelines around fake and paid five-star reviews.

What's a Safe Retirement Spending Rate for the Decades Ahead?

A 4% starting withdrawal rate, with annual inflation adjustments to that initial dollar amount, thereafter, is often cited as a "safe" withdrawal system for new retirees. Financial planner Bill Bengen first demonstrated in 1994 that such a system had succeeded over most 30-year periods in modern market history, and in the nearly 30-year time period since Bengen's research, a 4% starting withdrawal rate would have been too modest. But is such a withdrawal system safe today, given the confluence of low starting bond yields and equity valuations that are high relative to market history?

Retirees who employ variable withdrawal systems that are based on portfolio performance--taking less in down markets and more in good ones--can significantly enlarge their starting and lifetime withdrawals. For instance, our research finds that some flexible withdrawal systems would support a nearly 5% starting withdrawal rate. But these variable strategies involve trade-offs--specifically, the year-to-year cash flow can be more volatile.

Rags to Riches - The Story of the humble uniforms and laundry 400 bagger

The book Rags to Riches is written by Richard T Farmer who was the president and second-generation family founder, Richard’s grandfather ‘Doc’ Farmer was the original founder of the business which was invented out of the “grinding poverty of the great depression”.

A summary of some elements of overt high-performance culture through the Cintas history include:

• A 10yr stock option plan with none vesting for the first 5 years and then 20% each year after.

• Cintas managers always wear business attire, no casual Fridays, our business is making people look sharp - lead by example.

• Operate exceedingly clean plants, Farmer used to inspect the bathroom as a key indicator of manager quality

• Even while a private company the profit and loss was shared with all employees every year

• To improve profitability, incentivize the team to satisfy customers, increase competitive advantage and be more productive.

“You’ll hear lots about culture in this book. It is, without doubt, our most important competitive advantage. Competitors can copy our sales material, our products, and even some of our systems but they cannot copy our culture”.

Farmer outlines at the end of the book that to achieve the grand ambitions he needed very talented people however, he was always more comfortable with “partners” than “employees” so whenever he came across exceptional people, he saw to it that they were owners and partners in the business, not just employees.

Farmer outlines that the best way to communicate the culture of a business is by telling stories about where and how it came about, this is almost exactly the way Bezos describes culture at Amazon –“stories of past successes and failures that become a deep part of company lore”.

Some of the stories about how Cintas grew its culture came from near-death experiences. In 1945 when Cintas was a small family business with 12 employees the factory burned down and although there was insurance it wasn’t enough to truly rebuild the business. Doc Farmer exclaimed that “we are not out of business! you can take our equipment, but as long as we have our people we’ll be okay”. Having to rebuild from nothing with only your staff teaches you the true enduring nature of your people.

Another story about the workplace environment was developed through many experiences including Richard working in the drying room which was stiflingly hot, lifting heavy drums of wet rags that were 200 pounds apiece, eating lunch in the restrooms because there was no lunchroom, scooping out grease from the sump pit by hand in waist-deep oil and grease. All these examples enforced the culture to provide a safe and enjoyable workplace.

This week in Charts

Debt

Inflation

The 10-year yield minus CPI is at levels only seen for a few weeks in 1974 and 1980. In both cases, yields meaningfully rose over the next year, even as CPI decelerated, as sometimes the bond market can react with a delay to inflation.

Source: Bloomberg, Raymond James Research

Friday, November 12, 2021

This week's interesting finds

An investor's journey with EdgePoint, part 2

A lot’s happened over the last couple of years, so we updated Mimi’s video journey to demonstrate what an EdgePoint investor has experienced. The ride over the short term wasn’t a smooth one, but those who worked with their advisor and stayed invested are closer to their Point B.

This week in Charts

NASDAQ 100’s forward price/sales ratio has reached a new all-time high

The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks.

The widest gap on record between the U.S. Federal Reserve’s short-term interest rate setting and year-over-year CPI

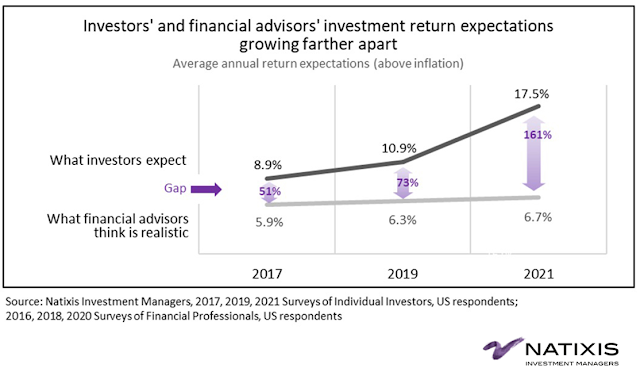

Large gap in return expectations

Amount of data generated every minute

“Excess” household savings could yet boost spending

• With household saving rates still elevated in most developed economies, “excess savings” have continued to rise. If people were to run down these savings, this would breathe new life into consumer recoveries.

• By the end of Q2 (the latest data available), households in advanced economies were holding currency and deposits that were some $3.7 trillion higher than we might have expected them to be had there been no pandemic.

• Household’s savings rates have fallen back from their peaks. The US aside, though, they remain much higher than before the pandemic. This is because while household incomes remain resilient, consumer spending is yet to stage a full recovery.

DM – developed markets

NPISH – non-profit institutions serving households

The Most Important 2000 Years of Energy History (Video: 33 minutes)

Few people think of energy at all and even fewer think about its history. We are on the verge of a new chapter in the history of energy and few people realize the implications. Learn more about:

• The one thing that increased real GDP growth 20-fold

• Why the largest city was 1 mm people for 2000 years

• Why renewables are a major step backwards

• Why we might be on the verge of the most important energy revolution in 400 years.

Friday, November 5, 2021

This week's interesting finds

We're always looking for talented people who can help us achieve our goals and we understand that extraordinary human ability is a scarce resource in high demand. If you think you've got some and are interested in our company, please send your resume to: WeAreGrowing@EdgePointwealth.com.

Current opportunities:

- Product managerThis week in Charts

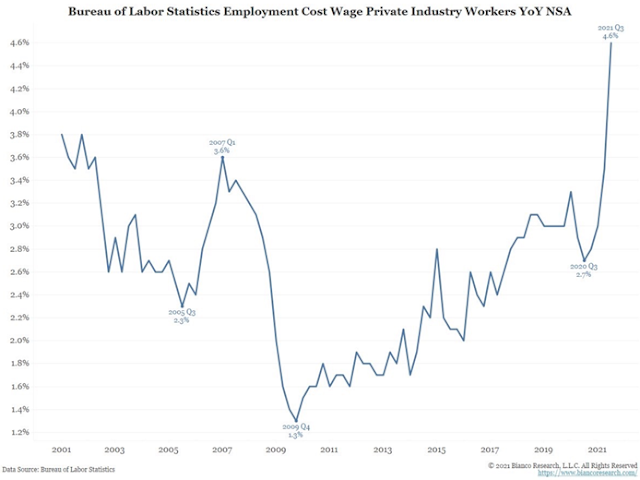

Wages and salaries for private industry workers (not seasonally adjusted)

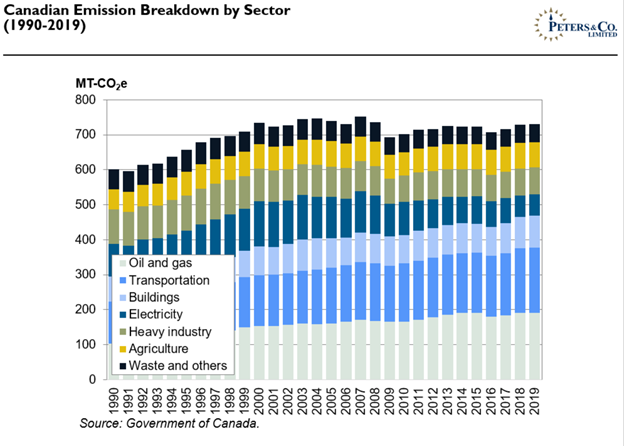

Emissions by sector

Bill Ackman’s presentation to NY Fed on why they should raise interest rates

Key points:

- More than 25 million jobs were lost due to the pandemic between February and April 2020, but the economy has since recovered 20 million jobs (~80%).

- At the current pace of ~500K monthly job additions, we expect the five million employment gap to pre-pandemic levels to close within the next 10 months.

- The annualized pace of growth across several key inflation measures, including wage inflation, has remained elevated in the mid to high-single-digit range.

- Even excluding the impact of new vehicles and used cars and trucks, which have experienced heightened inflation, CPI has been increasing at an annualized growth rate of approximately 5%.

- Both the unemployment rate is lower AND inflation measures are substantially higher today than at the beginning of prior rate hike cycles.

Highest price hike to milk in recent memory

The Canadian Dairy Commission, a crown corporation that sets the price that dairy farmers get for their milk, had just put out a statement recommending an increase of 8.4 per cent, to make up for big jumps in the cost of feed, fuel and equipment.

The price hike, if approved by provincial authorities, will take effect in February, amounting to an extra six cents per litre for processors that buy milk from farmers and turn it into retail-ready products.

These Lenders Are Making A Growing Number of LBOs Possible

Private equity firms are finding that more leveraged buyouts of tech companies are becoming possible, thanks to lenders that have deeper pockets than ever: private credit firms.

These lenders are providing financing to companies that wouldn’t be able to borrow as much in bond or leveraged loan markets. Private credit firms’ willingness to finance these kinds of deals is helping to fuel the highest volume of LBOs for tech companies since 2016. And they’ve enlarged the universe of publicly traded U.S. corporations that private equity firms can readily buy by somewhere around $550 billion.

The loans in question are either to companies that are burning through cash and don’t have enough earnings to pay interest, or to corporations that need more debt for a leveraged buyout than bond or syndicated loan markets will provide. Some of these financings can pay interest of 8 percentage points or more, far above yields available in other comparable markets.

Friday, October 29, 2021

This week's interesting finds

This week in Charts

China house prices down on month-to-month for the first time since 2015

China expands property tax trials in next step of ‘common prosperity’ drive

A property tax could alter China’s economic model, reshaping government revenue streams from land sales to taxes and deterring property speculation.

Many tax specialists and economists believe it will help wean local governments off their chronic dependence on selling and leasing public land to developers. This relationship has contributed to widespread property speculation and pushed land and house prices higher in a cycle that many experts believe is unsustainable.

According to research group Capital Economics, an effective tax rate of 0.7 per cent of the total property value would have generated Rmb1.8tn ($282bn) last year in China.

That compares to Rmb1.6tn local governments generated in net revenue from land sales, after paying billions of dollars in land transfer expenses including compensation payments. The tax, and subsequent pressure on prices, could also help dent the appeal of property investment, redirecting private capital towards sectors such as high-tech exports and services that boost domestic consumption, according to its proponents.

Traders Bet Tesla Stock’s Rally Isn’t Over Just Yet

Traders are swarming the market for Tesla Inc. options to bet on a continued stock rally. Almost one out of every two dollars spent in the U.S.-listed options market through Wednesday went to Tesla options, according to Cboe (Chicago Board Options Exchange) Global Markets.

By one measure, activity in Tesla options has surpassed trading in its shares. More than $900 billion in Tesla options have changed hands this week, roughly five times the total for its shares, according to Cboe and FactSet data through Wednesday.

Tesla options have morphed into one of the biggest casinos on Wall Street because the value of bullish call options can rapidly multiply if the stock advances, as it has for much of the past two years. That translates to quicker and bigger profits for traders than if they had just bought the stock.

Call options tied to the shares jumping to $1,100 or $1,200 have been among the most popular trades recently, according to data from Shift Search. On Thursday, calls pegged to the shares advancing to $2,000 were actively traded.

Invitation Homes Boosts Rents 11% as Housing Shortage Persists

Invitation Homes Inc., which owns more than 80,000 single-family rentals, raised prices by nearly 11% in the third quarter, according to a statement. The company boosted rents by 8% on renewals and 18% when leasing homes to new tenants. Rates are rising fastest in the Southwest, where rents increased 30% on new leases in Las Vegas, and 29% in Phoenix.

“It’s a little bit crazy,” Chief Executive Officer Dallas Tanner said on a conference call with investors Thursday. “There just isn’t enough quality housing available right now.”

Rising rents have been a staple of the economy since early Covid lockdowns lifted in the middle of last year. Surging purchase prices have pushed homeownership out of reach for first-time buyers.

Internal vs. External benchmarks

Accomplishments have a cost basis. What you gain or lose is always relative to where you began. And since we all begin at different spots, there’s a range in how people feel when experiencing the same thing.

In his book on the final days of World War II, Stephen Ambrose writes about a wounded American soldier who’s carried back to the medic tent. He knows he’s going home – his war is over. “Clean sheets boys!” he yells back to his comrades still fighting. “Clean sheets, can you believe it! Clean sheets!” Living in foxholes for weeks caused soldiers to daydream about normal life, and few things tickled their imaginations like the dignity of clean sheets. Not money or status or respect or glory. Just the absolute pleasure of clean sheets. It’s an extreme example of when the outside world ceases to exist and everything becomes relative to an internal benchmark.

A lighter version of this happens in business and finance, which are home to so many staggeringly successful people whose lives are broadcast over a staggeringly loud social media system.

“We invested in Upstart 4 days ago and it is up by 25%. What does Upstart Do?”

“I am sorry, you are breaking up…”

Friday, October 22, 2021

Is it an

investment? Is it a game? No, it’s eToro

The internet, cryptocurrencies, user-friendly trading platforms, and a pandemic-induced glut of spare time have gelled into a perfect storm that has redesigned retail trading as something that feels more like a game, and has transformed social-media friendly investors into quasi-influencers.

Israeli trading platform eToro, which launched in 2007, has been pioneering what the industry calls “social trading” features for over a decade. Users on the platform can follow other traders, check out their performances over time and, if they are keen, copy them. The most copied popular investors are rewarded by eToro with perks and a monthly payment.

As the world’s health conditions deteriorated – to wit: during the Covid-19 pandemic – more and more people popped up on eToro. In the first quarter of 2021, the platform gained more than three million new users, passing 20 million global users in June 2021. “I do see it increasingly among the younger generations: they have a sort of ‘don't care’ attitude towards losing their money, towards investing in risky things,” Smith says. “This meme culture and joking about their investments – I think it's gonna be a strange future, but I'm excited for it as well.”

- Raw materials are integral to the Energy Transition. Creating the energy complex of the future will require raw materials. In this piece, we’ll focus on natural gas which is a key enabler to reducing carbon emissions today and keeping energy prices in check while we invest in the technology and infrastructure necessary to attain net zero in the future.

- The Energy Transition will be inflationary. The inherent limitations of renewables, rising input costs driven by geology and capital scarcity (see point 3 below) and the introduction of carbon pricing will result in structurally higher energy prices going forward.

- The Hypocrisy of Divestment and ESG Investing. Refusing to invest in responsibly sourced enabler commodities increases global emissions while exacerbating income inequality on a global basis, thus resulting in outcomes that run directly counter to the stated objectives of these policies.

Friday, October 15, 2021

This week in charts

This week in charts

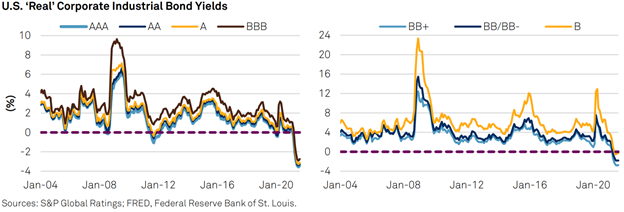

Money has never been this cheap

Citing “inflation” on Earnings Calls

Container shipping by vessels

The recent synchronized selloff in U.S. equities and Treasuries

was likely just the beginning of what’s to come for the popular 60/40

stock-bond portfolio strategy, a growing chorus of Wall Street strategists

warn.

Underpinning all these warnings is an economy that’s now facing

mounting inflationary pressures after spending years warding off the threat of

deflation. During the last two decades, subdued growth boosted the allure of

the 60/40 strategy, one that’s built on a negative stock/bond correlation where

one serves as buffers for the other.

With inflation fears raging, the worry is the Federal Reserve will seek to slow down the economy and rising rates will spell trouble for both bonds and stocks. September offered a taste of the pain, with a Bloomberg model tracking a portfolio of 60 per cent stocks and 40 per cent fixed-income securities suffering the worst monthly drop since the pandemic started in early 2020.

Do you have a

Financial Therapist?

The Financial Therapy Association, founded in 2009, now has 317

members, a 51% increase in just four years. This spring the CFP (Certified

Financial Planner ) Board broke precedent by adding the psychology of financial

planning as a new “principle knowledge topic” required for study and continuing

education to be a certified financial planner.

The Financial Therapy Association defines this approach as a

process “informed by both therapeutic and financial competencies that helps

people think, feel, communicate and behave differently with money to improve

overall well-being through evidence-based practices and interventions.”

Its founding president, Sonya Lutter, believes that RIAs and wealth managers will inevitably either have financial therapists on staff or routinely refer clients to therapists just as they refer clients to estate planning specialists or accountants.

Hedge funds cash

in on energy stocks

Hedge funds have been quietly scooping up the shares of unloved

oil and gas companies discarded by environmentally minded institutional

investors and are now reaping big gains as energy prices surge.

Hedge fund managers in the US and UK have been betting that the

eagerness of many big institutions to be seen to embrace environmental, social

and governance (ESG) standards means they are selling wholesale out of fossil

fuel stocks, even though demand for some of these products remains high.

“It’s such a great and easy idea,” Crispin Odey, founder of

London-based Odey Asset Management, told the Financial Times.

“They [big institutional investors] are all so keen to get rid of

oil assets, they’re leaving fantastic returns on the table,” added Odey, whose

European fund is up more than 100 per cent so far this year.

Alongside Odey’s fund, Goldman Sachs’s prime brokerage division,

which provides a range of services such as stock lending and execution,

recently told clients that energy stocks had had their biggest net buying by

hedge funds since late February, according to a note seen by the FT.

Friday, October 8, 2021

This week in charts

Chinese house market

Teens' behaviour

Indian utilities are scrambling to secure coal supplies as inventories

hit critical lows after a surge in power demand from industries and sluggish

imports due to record global prices push power plants to the brink.

Rising oil, gas, coal and power prices are feeding inflationary

pressures worldwide and slowing the economic recovery from the COVID-19

pandemic.

"The supply crunch is expected to persist, with the non-power

sector facing the heat as imports remain the only option to meet demand but at

rising costs," ratings agency S&P's unit CRISIL said in a report this

week, adding it expected Asian coal prices to continue to increase.”

Coal prices from major exporters have scaled all-time highs recently, with Australia's Newcastle prices rising roughly 50% and Indonesian export prices up 30% in the last three months.

German workers

strike for higher pay

Increasing numbers of German workers are demanding higher pay amid

rising inflation, with some going on strike, causing economists to worry that

widespread demands for higher wages could start a self-fulfilling inflationary

spiral in Europe’s biggest economy

German inflation rose to a 29-year high of 4.1 per cent in September,

while in the 19-countries that share the euro it accelerated to a 13-year high

of 3.4 per cent, official data showed on Friday. Lifted by soaring energy

prices, that is higher than the 3.3 per cent rate expected.

“Inflation in Germany keeps going up,” said Frederic Striegler, an

official at the country’s biggest union, IG Metall, explaining its demand for a

4.5 per cent pay increase and extra early retirement funds for wood and plastic

workers at Carthago and other companies in the Baden-Württemberg region of

southern Germany.

Unions are making similar pay demands for German workers in other

areas, such as banking and in the public sector. This week, retailers and mail

order companies in the Hesse region agreed to raise their workers’ pay by 3 per

cent this year and a further 1.7 per cent in April next year.

Nature shows how

extremes leads to extremes

2017 brought one of the wettest winters California had seen in recent

memory. It was

called a super bloom, and it caused

even desert towns to be covered in green. That seemed great, but it had a

hidden risk: A dry 2018 summer turned that record vegetation into a record

amount of dry kindling to fuel new fires. So, record rain led to record fire.

The point is that extreme events in one direction increase the odds of

extreme events in the other. Record good leads to record bad – just like

California’s fires. And isn’t it the same in the stock market? And in business?

Energy went from negative prices last year to

global shortages today. NYC

rents went from plunging to surging. Shortages lead

to gluts; busts seed the next boom.

The most astounding force in the universe is obvious. It’s evolution. The real magic of evolution is that it’s been selecting traits for 3.8 billion years. The time, not the little changes, is what moves the needle. Take minuscule changes and compound them by 3.8 billion years and you get results that are indistinguishable from magic. And isn’t it the same in investing? If you understand the math behind compounding, you realize the most important question is not “How can I earn the highest returns?” It’s, “What are the best returns I can sustain for the longest period of time?”

Friday, October 1, 2021

This week's interesting finds

The price of long-term outperformance

When it comes to meeting long-term financial goals, the sad reality is that many investors don’t get there. How they feel today influences the decisions that affect them in the years to come, and they often make avoidable, emotion-driven mistakes. The discomfort of being different from the crowd, watching their investments underperform or jumping on the latest "hot" market trend are among the pressures investors face regularly.

Humans evolved as herd animals, so departing from the safety of the crowd is fighting against an instinct ingrained over thousands of years.

However, while summoning rare emotional discipline is hard, it’s not impossible. First, having an advisor who keeps things in perspective is key to staying calm through difficult times. Second, finding an investment approach you can understand, believe in and commit to for the long term is also important. The road to compounding wealth isn’t smooth, so it helps to have a map that shows you the way.

This week in charts

Lenders haven’t taken this much risk (or whatever the title I gave you was)

Some of Europe’s largest asset managers are starting to drop the once-ubiquitous ESG label from their company filings. They’re concerned that regulators will no longer tolerate vague descriptions of environmental, social and governance investing.

Europe’s landmark anti-greenwash rulebook is reining in an industry that ballooned to more than $35 trillion last year. The Sustainable Finance Disclosure Regulation (SFDR) was enforced in March, but already in the lead-up to its arrival, European investment managers stripped the ESG label off $2 trillion in assets in anticipation of stricter rules.

Europe’s anti-greenwash rules contain some key sub-clauses that are forcing the asset management industry to substantiate their ESG claims. SFDR contains an Article 8 to define “light” green assets, and an Article 9 for “dark” green assets. The shade of green refers to the degree of importance accorded to ESG concerns. The EU is still working on more detailed descriptions of what the Articles may contain to stamp out any lingering mislabeling.

The adjustments sweeping through Europe’s asset management industry are beginning to make their way to the U.S., where ESG-labeled investment products this year surpassed those in Europe for the first time. Globally, ESG assets are on track to exceed $50 trillion by 2025, according to Bloomberg Intelligence.

Individual investors choose options over stocks

According to CBOE (Chicago Board Options Exchange) Global Markets data, nine of the 10 most active call-options trading days in history have taken place in 2021. Options Clearing Corp.’s figures show that almost 39 million option contracts have changed hands on an average day this year, up 31% from 2020 and the highest level since the market’s inception in 1973.

So far this month, single-stock options with a notional value of roughly $6.9 trillion have changed hands, well above the $5.8 trillion in stocks that traded, according to Cboe data through September 22.

To date in 2021, the daily average notional value of traded single-stock options has exceeded $432 billion, compared with $404 billion of stocks, according to calculations by Cboe’s Henry Schwartz. Cboe’s data, which goes back to 2008, shows that this would be the first year on record that the value of options changing hands has surpassed that of stocks.

BP Plc, the U.K.’s second-largest fuel retailer, said it’s shutting some of gas stations because of a nationwide truck driver shortage that’s threatening to derail the country’s economic recovery. Exxon Mobil Corp. also said that a “small number” of the 200 sites it operates for the supermarket Tesco Plc have been affected by the truck driver shortage.

The shortage of drivers and other workers hamstrung the U.K. food industry earlier this year, with stores running low on basics like milk and bread, tens of thousands of extra pigs piling up on farms, and retailers warning that there will be shortages of some products at Christmas.

The energy crisis has also ended up hammering the food industry. High gas prices last week forced fertilizer maker CF Industries Holding Inc. to close two plants that make carbon dioxide as a by-product. That posed an imminent threat to the food industry, which uses the gas to stun pigs and chickens for slaughter, as well as in packaging to extend shelf-life and the “dry ice” that keeps items frozen during delivery.

GFL Environmental Inc. went public in March 2020, and in the 18 months since, its share price on the Toronto Stock Exchange has almost doubled. The irony here is that GFL doesn’t make money. In fact, the company loses a lot of it. Over the past three fiscal years, GFL’s net losses have totaled $1.9-billion. It’s a common mindset lately. For all its hype, Uber Technologies Inc. has never made money – actually, it’s lost US$19-billion over the past five years. Streaming giant Spotify Technology SA has lost €2.6-billion ($3.8-billion) over the same period. There are now so many high-profile money-losers that Goldman Sachs recently created a Non-Profitable Technology Index, and its value soared when the pandemic hit.

“The amount of capital out there has made it acceptable to lose money for a longer period of time, in the hopes that eventually you tip the market and become a near monopolist, or at least a duopoly,” says Martin Kenney, a professor at the University of California, Davis.

Friday, September 24, 2021

This week's interesting finds

Some

profitable companies would still pay no taxes under Democrats’ plan

The Democratic proposal approved this

month by the House Ways and Means Committee would sharply raise taxes on U.S.

corporations, and business groups are working hard to defeat it. The

legislation would

increase the top corporate tax rate to

26.5% from 21%, and remove many benefits of booking profits in low-tax foreign

countries.

The bill, however, doesn’t touch the

main reasons why profitable companies sometimes don’t pay taxes, including

accelerated depreciation of investments and tax credits for activities such as

research and development.

The legislation also expands tax

credits for clean energy and low-income housing in ways that could allow some

companies to move from paying little to paying nothing.

The bill moving through Congress

represents an explicit choice by Democrats to tolerate some zero-tax companies

and steer tax advantages to companies that engage in favoured activities.

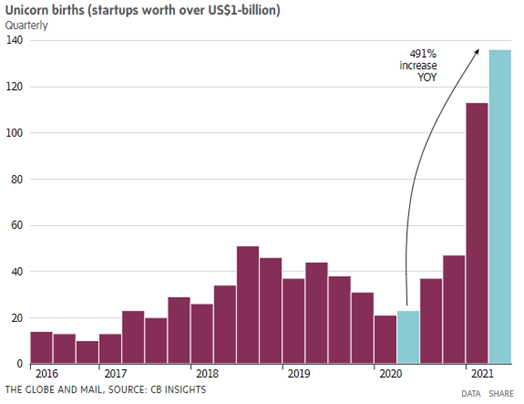

To a man with a hammer, every problem

looks like a nail. To the Federal Reserve, every problem is met with more

liquidity. Unfortunately, the Fed has little control of where this liquidity

goes. First, it went into equity markets, fueling an outright equity

bubble. Then it overflowed into private equity and venture capital, creating

demons there as well. Then it overflowed into “meme stonks” Not satisfied with

the damage wrought on the financial economy, liquidity began overflowing into

the real economy. There’s currently an epic housing bubble that’s leading to

increasing wealth inequality and polarization.

Now, this liquidity is overflowing

into the everyday economy—assuming you can even find the item you seek. In the

past, only hard money zealots complained about the gradual creep of inflation—today,

everyone feels it and has their own story. Everyone is painfully aware that

inflation is present and likely to stay.

Could the bubble in duration assets (like high-multiple tech and Ponzi) finally be over? Could the bubble in inflation assets just be starting? Could the unwind of both historic extremes be unusually violent, as so much of the world’s capital is leaning the wrong direction?

Climate

change ETFs found to be undermining war on global warming

Climate-focused investment funds are

undermining the fight against global warming by routinely engaging in greenwashing,

academic research suggests. Worse still, these ETFs keep capital away from

sectors that are actually at the heart of the transition to a cleaner economy.

“Since considerable investment is

necessary to ensure electrification of the economy and decarbonisation of

electricity, underfunding of this sector in climate-aligned benchmarks, which

can correspond to a reduction in capital allocation of up to 91 per cent, would

constitute the most dangerous form of portfolio greenwashing,” said Felix

Goltz, co-author of Doing Good or Feeling Good? Detecting Greenwashing in

Climate Investing.

“The key issue is not how to restrict

investment in these industries, but rather, how to make sure that these

industries invest in technology that allows them to produce needed goods and

services with minimum release of greenhouse gases,” he argued.

The findings come as investors have

poured money into funds that claim to improve the world. The assets of

self-proclaimed “sustainable” funds tripled between the end of 2018 and

mid-2021 to $2.3 trillion, according to data from Morningstar.

Belize is inching towards a deal with international bondholders after

admitting it cannot afford to pay back its debt, and is counting on an unusual

asset to help: its coral reefs.

Earlier this month the Caribbean nation, with its tourism-heavy economy

ravaged by the pandemic, agreed to buy back its only international bond from

investors at a huge discount, using cash lent by the Nature Conservancy, a

US-based environmental group. As part of the deal, Belize will pre-fund a

$23.4m endowment to support marine conservation projects on its coastline, home

to the world’s second-largest barrier reef

If Belize can achieve the approval it needs on this $530 million bond,

the country could secure the first green-tinged debt restructuring,

capitalizing on the hunger among big fund managers to demonstrate their

commitment to environmental, social and governance-driven investing.

Investors and advisers believe the agreement could serve as a template

for future restructuring talks, in which cash-strapped nations use the promise

of environmental conservation to drive a harder bargain — in effect creating a

mechanism for investors in rich countries to pay poorer nations to protect the

natural world.

Podcast: Dan Wang explains what China's tech crackdown is really all about

Over the last several months, Chinese authorities have undertaken a sweeping campaign of change. We've seen crackdowns on big tech and fintech companies (like Ant Financial and Didi), online education companies, and now even the playing of video games. Investors in key sectors have been clobbered by these new rules.