Our holiday gift guide – 2024 edition

Don’t let the warmer weather fool you, winter is coming! That also means it’s time for a new list of gift recommendations by your EdgePointers. If you’re looking for something big, small or something in between, our list is full of fun (even efficient) ideas.

This week in charts

French risk premium

Nasdaq 100 vs. S&P 500

Performance by market-cap category

European equities

S&P 500 Index – calendarized performance

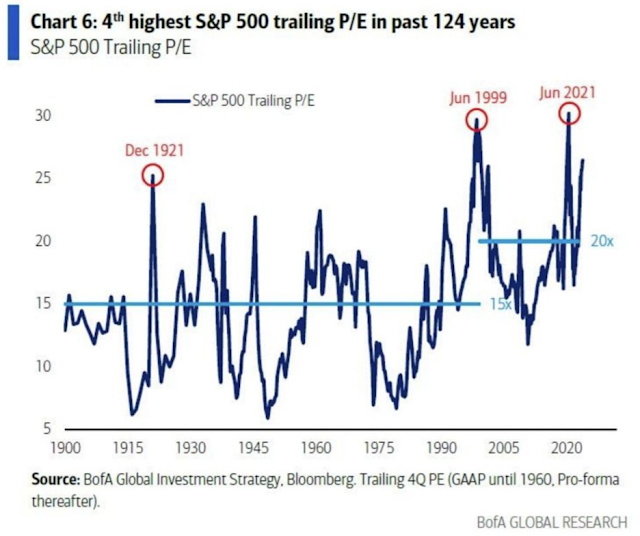

S&P 500 Index – trailing P/E ratio

S&P 500 Index – cap-weighted vs. equal-weighted

U.S. household investment allocations

Leveraged ETFs

Household interest payments

Chinese companies rush to tap convertible bond market

Chinese companies are issuing convertible bonds at a record rate this year, as they hunt for cheap forms of financing and a way to boost their offshore cash balances.

Ecommerce company Alibaba, which in May raised one of the largest convertible bonds on record at $5bn, and insurer Ping An, which raised $3.5bn in July, are among companies driving the rush to issue a form of debt that surged in popularity in western markets during the coronavirus pandemic.

Companies in China and Taiwan have issued $18.8bn of convertible and exchangeable bonds in 2024, surpassing the previous record of $18.7bn set in 2021, according to Citigroup data.

“The volume of issuance has increased dramatically,” said Rob Chan, head of Apac equity-linked origination at Citi. “You’re going to see quite a bit more activity going into next year.”

Convertible bonds allow the owner to turn them into a preset amount of equity, meaning that in effect they act as a call option on — or the right to buy — the shares.

The bonds are proving so popular among Chinese corporates because they offer a cheaper form of financing than conventional debt. Companies are able to raise money as much as 4 percentage points cheaper using convertibles compared with conventional dollar bonds, according to Chan.

Column chart of USD convertible bond issuance by Chinese companies ($bn) showing Chinese companies have issued record levels of dollar convertibles

With markets now expecting US rates to remain higher for longer under president-elect Donald Trump, this has become a particularly attractive option for chief financial officers.

Many firms are looking to raise money in order to carry out buybacks of their shares and raise the share price. Despite a recent stimulus-driven rally, China’s CSI 300 index is still down by about one-third since early 2021, with many foreign investors having deserted the market in recent years.

First 24-hour US stock exchange approved

A 24-hour stock exchange has been approved by US regulators, allowing expanded round the clock trading for the first time in any major market.

Start-up 24 Exchange, which is backed by Steve Cohen’s Point72 Ventures fund, was given the nod for a two-part plan by the Securities and Exchange Commission on Wednesday.

It will launch initially in regular hours, then expand to include a nightly back-of the-clock session between Sunday and Thursday once broader market infrastructure is in place.

While Treasuries and major currencies, such as the dollar, are traded almost continuously on weekdays, stocks have been something of a laggard because of tight rules designed to protect investors, and because of the complexities and time needed to settle trades.

But in recent years round-the-clock trading has been given a boost by the rise of retail investors who are keen to trade stocks outside working hours just as they deal in cryptocurrencies, which operate all the time.

Brokers such as Robinhood execute customer out-of-hours stock orders in so-called “dark pools” whose members trade among themselves, and whose prices are not disseminated across the market.

A regulated overnight exchange will mark a big change because it represents the “lit” market where trades and their prices become the official record. This is designed to help investors get the best price but may catch those asleep off-guard.

“Traders are most at-risk when the market is closed in their geographic location,” said Dmitri Galinov, chief executive and founder of 24X. “(We) will seek to alleviate this problem by facilitating around-the-clock US equities trading,” he added, describing the approval as a “thrilling development”.

This was 24X’s second application to the SEC, after a previous attempt in 2023 met with objections and queries. The approved version also modified an original plan to offer trading at weekends.

24X must now work with rival exchanges, which between them manage the consolidated “tape” of market prices, on how to manage and fund its expansion to cover trading between 8pm and 4am before it can launch its overnight session.

This week’s fun find

Making a Snickers bar is a complex science

For some people, including me, one piece stands out – the Snickers bar, especially if it’s full-size. The combination of nougat, caramel and peanuts coated in milk chocolate makes Snickers a popular candy treat.

As a food engineer studying candy and ice cream at the University of Wisconsin-Madison, I now look at candy in a whole different way than I did as a kid. Back then, it was all about shoveling it in as fast as I could.

Now, as a scientist who has made a career studying and writing books about confections, I have a very different take on candy. I have no trouble sacrificing a piece for the microscope or the texture analyzer to better understand how all the components add up. I don’t work for, own stock in, or receive funding from Mars Wrigley, the company that makes Snickers bars. But in my work, I do study the different components that make up lots of popular candy bars. Snickers has many of the most common elements you’ll find in your Halloween candy.

Let’s look at the elements of a Snickers bar as an example of candy science. As with almost everything, once you get into it, each component is more complex than you might think.

.jpg)