17th annual Cymbria Investor Day

This year the Investment Team talked about the importance of identifying change in the businesses they invest in. The discussion includes analysis of past opportunities and the ways they believe they can continue to find new ones in the future.

Click here to watch the video.

This week in charts

U.S. data center gas demand

Historical asset bubbles

U.S. government & corporate debt

Days working from home, per week, by country

S&P 500 Index median stock short interest

U.S. equity index price-to-earnings valuations

S&P 500 Index forward price-to-earnings valuations

S&P 500 Index defensive sector allocation

U.S. value stocks vs. international value stocks

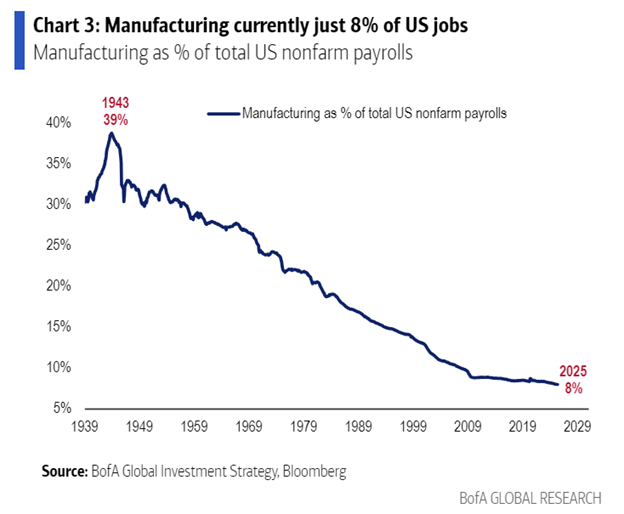

U.S. manufacturing employment

UK confirms powers to force pension funds to back British assets

Rachel Reeves has confirmed she will create a “backstop” power to force large pension funds to back British assets, as she vowed to unleash more than £50bn of investment in domestic infrastructure, housing and fast-growing businesses.

The chancellor hopes creating pension “megafunds” with more than £25bn in assets, coupled with a voluntary accord with industry to boost allocations to private assets, will reverse long-term falls in investment in the UK.

It is the first time the Treasury has publicly confirmed it will legislate to create a backstop power to mandate pension funds on their investment strategy — a move condemned by the Conservatives.

Reeves’ allies say she believes the power will not be needed and that reforms in the new pensions legislation — plus a “Mansion House accord” with the industry — would deliver the desired results.

At the heart of the reforms is a requirement for all multi-employer defined contribution pension schemes and local government pension scheme pools to operate at a “megafund level”, similar to those in Australia and Canada.

The Treasury argues that the megafunds, managing at least £25bn in assets, will drive more than £50bn of investment in big UK infrastructure and other British assets. This will then drive higher returns for savers, most of whom are covered by DC schemes.

However, after pushback from some industry participants to plans presented last autumn, the Treasury said schemes worth more than £10bn that are unable to reach the minimum size requirement by 2030 will be allowed to continue operating, as long as they can demonstrate a clear plan to reach £25bn by 2035.

The UK has about 60 multi-employer DC pension schemes, with combined assets forecast to reach £800bn in five years.

Meanwhile, under a Mansion House accord signed this month, 17 of the UK’s largest pension providers have pledged to invest at least 5 per cent of their default funds in private British assets by the end of the decade.

The Treasury said the Mansion House pact would release £25bn for UK investment by 2030, while a similar amount would come from local investment targets from local government pension schemes.

Reeves’ aim is to reverse a sharp decline in domestic investment from UK pensions funds, which the Treasury said had fallen from more than 50 per cent of DC assets in 2012 to roughly 20 per cent in 2023.

Blanc said this month that forcing funds to buy UK assets would not be “the right thing”, adding: “It’s like using a sledgehammer to crack a nut.”

Shadow chancellor Mel Stride said: “By pressing ahead with their plans to mandate pension-fund investments, Labour is crossing the Rubicon into directing the public’s savings. This is an extraordinary over-reach.”

This week’s fun find

Take a Nostalgic Dive Through a Visual Cassette Tape Archive

The cassette tape, invented in 1963, entered the market with a lukewarm reception as it competed with reel-to-reel and 8-track technologies. The suitability for recorded music along with its portability eventually put it on top of its competitors, and sound quality continued to improve in the 1970s. By the following decade, the cassette was a favorite among consumers, overtaking vinyl and continuing to dominate until the 1990s, when CDs superseded the technology.