Why charging phones is such a complex business, with Anker CEO Steven Yang

Steven Yang founded Anker in 2011, and since then, it’s turned into a 3,000-person company that operates all over the world by selling phone chargers and battery packs on Amazon and have since expanded to other categories like webcams, Bluetooth speakers, and smart home products.

Along the way, they’ve pioneered a major advancement in charging technology — you know that little white brick that takes forever to charge an iPhone? It’s made using silicon and puts out about 5 watts of power. Anker made a big bet on a material called gallium nitride, or GaN, and it is now a charger the size of that iPhone brick that can put out 30 watts of power — enough to charge a MacBook Air. It was a big bet, and it paid off.

And, of course, we had to talk about Amazon. Anker started its business on Amazon and still sells most of its devices on the platform. Steven told me that Anker has 100 people, or fully 3 percent of the company, dedicated to thinking about managing the Amazon marketplace. And for good reason: this past summer, several of Anker’s competitors were banned from Amazon for breaking guidelines around fake and paid five-star reviews.

What's a Safe Retirement Spending Rate for the Decades Ahead?

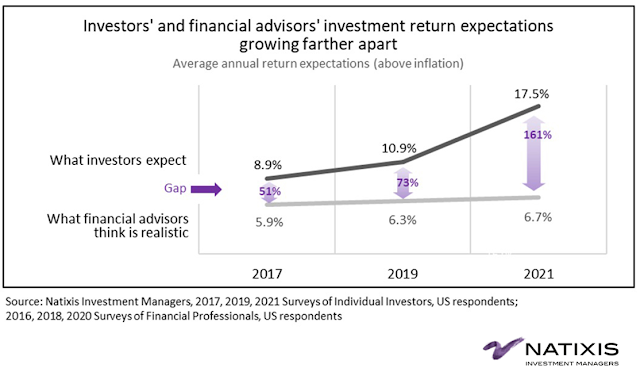

A 4% starting withdrawal rate, with annual inflation adjustments to that initial dollar amount, thereafter, is often cited as a "safe" withdrawal system for new retirees. Financial planner Bill Bengen first demonstrated in 1994 that such a system had succeeded over most 30-year periods in modern market history, and in the nearly 30-year time period since Bengen's research, a 4% starting withdrawal rate would have been too modest. But is such a withdrawal system safe today, given the confluence of low starting bond yields and equity valuations that are high relative to market history?

Retirees who employ variable withdrawal systems that are based on portfolio performance--taking less in down markets and more in good ones--can significantly enlarge their starting and lifetime withdrawals. For instance, our research finds that some flexible withdrawal systems would support a nearly 5% starting withdrawal rate. But these variable strategies involve trade-offs--specifically, the year-to-year cash flow can be more volatile.

Rags to Riches - The Story of the humble uniforms and laundry 400 bagger

The book Rags to Riches is written by Richard T Farmer who was the president and second-generation family founder, Richard’s grandfather ‘Doc’ Farmer was the original founder of the business which was invented out of the “grinding poverty of the great depression”.

A summary of some elements of overt high-performance culture through the Cintas history include:

• A 10yr stock option plan with none vesting for the first 5 years and then 20% each year after.

• Cintas managers always wear business attire, no casual Fridays, our business is making people look sharp - lead by example.

• Operate exceedingly clean plants, Farmer used to inspect the bathroom as a key indicator of manager quality

• Even while a private company the profit and loss was shared with all employees every year

• To improve profitability, incentivize the team to satisfy customers, increase competitive advantage and be more productive.

“You’ll hear lots about culture in this book. It is, without doubt, our most important competitive advantage. Competitors can copy our sales material, our products, and even some of our systems but they cannot copy our culture”.

Farmer outlines at the end of the book that to achieve the grand ambitions he needed very talented people however, he was always more comfortable with “partners” than “employees” so whenever he came across exceptional people, he saw to it that they were owners and partners in the business, not just employees.

Farmer outlines that the best way to communicate the culture of a business is by telling stories about where and how it came about, this is almost exactly the way Bezos describes culture at Amazon –“stories of past successes and failures that become a deep part of company lore”.

Some of the stories about how Cintas grew its culture came from near-death experiences. In 1945 when Cintas was a small family business with 12 employees the factory burned down and although there was insurance it wasn’t enough to truly rebuild the business. Doc Farmer exclaimed that “we are not out of business! you can take our equipment, but as long as we have our people we’ll be okay”. Having to rebuild from nothing with only your staff teaches you the true enduring nature of your people.

Another story about the workplace environment was developed through many experiences including Richard working in the drying room which was stiflingly hot, lifting heavy drums of wet rags that were 200 pounds apiece, eating lunch in the restrooms because there was no lunchroom, scooping out grease from the sump pit by hand in waist-deep oil and grease. All these examples enforced the culture to provide a safe and enjoyable workplace.

This week in Charts

Debt

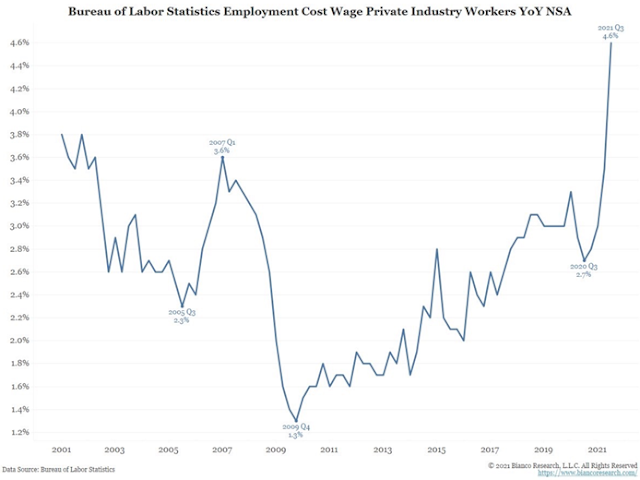

Inflation

The 10-year yield minus CPI is at levels only seen for a few weeks in 1974 and 1980. In both cases, yields meaningfully rose over the next year, even as CPI decelerated, as sometimes the bond market can react with a delay to inflation.

Source: Bloomberg, Raymond James Research