EdgePoint video: Worth your while – knowing the value of what you own

Stocks get traded every day at prices that can have little to do with their value. This usually happens when people buy and sell based on greed and fear rather than knowing what their ownership stake in the business is worth. We believe that the best way to avoid falling into an emotional trap is to act like a rational business owner and differentiate between what the business is really worth versus what the market thinks it's worth.

Reasons not to sell

The past week marked the fastest correction in the S&P 500 Index on record. It is during times like this that people struggle to separate their emotions from their investment decisions and begin to behave erratically. Below is a chart that shows the top reasons to sell we’ve seen over the last decade. The key is to resist the urge to act irrationally and believe in your investment approach.

We just witnessed the fastest stock market correction on record

Crisis and Recovery

Divergence in ESG ratings

Charlie Munger at the 2020 Daily Journal AGM (video)

Takeaways:

Many people automatically assume that because the market has been rising for many years that we must be in a bubble. This may be true but Charlie noted that each time period is unique, and rather than trying to pattern-match the current environment to some past analog, it’s important to think from first principles. Doing so leads me to proceed very cautiously given the prevailing optimism in the prices for most investments, but to also make investments when I do find those that meet my criteria for margin of safety.

Being able to recognize when you are wrong is a godsend. Charlie fights behavioral biases by consciously seeking out ways in which he could be wrong or looking for beliefs that he holds that are invalid. If he were to not do that intentionally, it’s very likely that his anchoring and confirmation biases would negatively impact his ability to think rationally.

100 Little Ideas that help explain how the world works:

Feedback Loops: Falling stock prices scare people, which causes them to sell, which makes prices fall, which scares more people, which causes more people to sell, and so on. Works both ways.

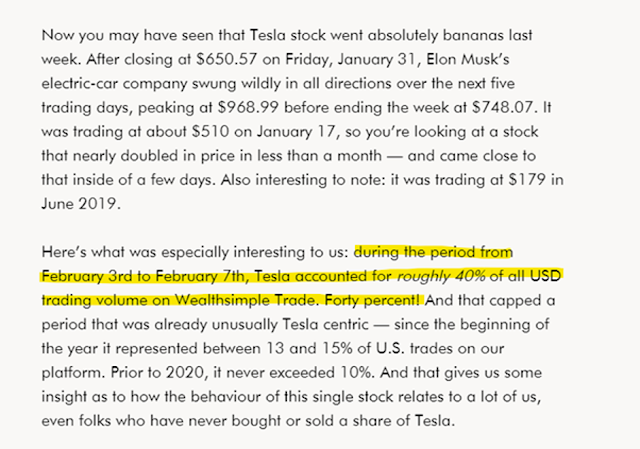

Reflexivity: When cause and effect are the same. People think Tesla will sell a lot of cars, so Tesla stock goes up, which lets Tesla raise a bunch of new capital, which helps Tesla sell a lot of cars.

False-Consensus Effect: Overestimating how widely held your own beliefs are, caused by the difficulty of imagining the experiences of other people.

Founder’s Syndrome: When a CEO is so emotionally invested in a company that they can’t effectively delegate decisions.

Skill Compensation: People who are exceptionally good at one thing tend to be exceptionally poor at another.

Ringelmann Effect: Members of a group become lazier as the size of their group increases. Based on the assumption that “someone else is probably taking care of that.”

Group Attribution Error: Incorrectly assuming that the views of a group member reflect those of the whole group.

Normalcy Bias: Underestimating the odds of disaster because it’s comforting to assume things will keep functioning the way they’ve always functioned.

How much does it cost to buy a fast-food franchise?

Many people dream of buying a fast-food franchise of their own, but few can afford it. All told, it might cost a franchisee upwards of $2 million to develop, build, and buy the right to open a McDonald’s or a KFC. Many chains won’t even look at your application unless you have a net worth of $1 million and $500k in readily spendable cash sitting around.

But there’s an exception to this: A franchise at Chick-fil-A — one of America’s oldest, largest, and most profitable chains — can be yours for just $10k.

Why is opening a Chick-fil-A franchise so cheap? Chick-fil-A, not the franchisee, covers nearly the entire cost of opening each new restaurant. The franchisee only pays the $10k franchise fee. What’s the catch? In return for paying most of the upfront costs, Chick-fil-A takes a MUCH bigger piece of the pie (royalties). While a franchise like KFC takes 5% of sales, Chick-fil-A commands 15% of sales + 50% of any profit.

At $4.2m per store, Chick-fil-A’s average revenue is the highest of any fast-food chain in America.

Seems like a great deal if you can be accepted. With a 0.13% acceptance rate, it’s harder to become a Chick-fil-A franchisee than it is to get into Stanford University (4.8%), or get a job at Google (0.23%).

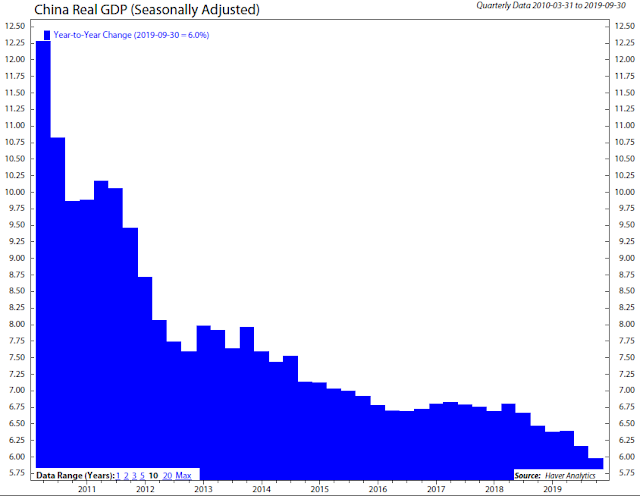

Charts of the week

This week's funnies.

Bond funds are hotter than Tesla

From 1990 through 1999, bond funds and bond ETFs accounted for only 10% of the cumulative $2.37 trillion that flowed into funds, according to the Investment Company Institute. From 2000 through 2009, bond funds made up 26% of the $3.5 trillion in total inflows. Over the 10 years just ended, however, 74% of the total $2.68 trillion that investors added went into bond funds.

Tesla accounted for 40% of volume on online trading app

Housing in Canada

According to The Economist magazine, in the last 50 years, only 2 countries have touched Canada’s current House Price to Income Ratio. This is what happened to those two countries after:

Japan in the early 90’s and the US in the mid 2000’s never got close to where we are today:

Big Technology Stocks Dominate ESG Funds

Many of the tech companies that are among the most popular stocks in sustainable funds have earned high ratings across multiple elements that analysts consider in evaluating ESG practices. Index provider MSCI Inc. gave Microsoft an “AAA” rating on ESG—the highest possible score, awarded to just 4% of companies in the software and services industry. It cited the company’s strength on privacy and data security, corporate governance, lack of corruption and instability, and clean-tech-innovation capacity.

MSCI gave Facebook and Amazon poor ratings on privacy and data security and on labor management, respectively. The two stocks are held by a number of large sustainable funds anyway since they satisfy other criteria.

Many of the biggest ESG funds try to minimize how much their fund deviates from the broader market by creating a portfolio that, for the most part, looks like today’s technology-dominated S&P 500—just stripped of the companies with the worst ESG practices within each industry. Investors need to look beyond the “feel-good aspect of ESG” and understand what exactly they are buying.

The fact that definitions of ESG can vary so much from firm to firm has caught the eye of the Securities and Exchange Commission. The agency has sent letters to companies asking advisers how and what they determine are socially responsible investments, The Wall Street Journal reported last year.

Are massive inflows into sustainable funds lifting tech shares?

Photo contest: Winner!

Tye's concert (festival?) photo is this quarter's winner! You can almost hear the music. We loved the grittiness and the geometric designs captured in the moment.

EdgePoint: Planning for retirement

Our latest entry of the EdgePoint Academy focuses on retirement, specifically on topics and issues faced by investors preparing to retire or already there. Over the next few months, we’ll publish a series of articles covering the following topics:

Are your retirement savings on track? Compound your money, not your problems.

The big day has arrived: having the right investments can help meet your retirement income needs

The retirement income balancing act: the impact of withdrawal rates

Sequence of returns: a risk worth learning about

Your retirement preparedness temperature check

First things first – what you need to know while you’re saving for retirement and how compounding can help you.

Wealth is what you don’t spend

The median family income adjusted for inflation was $29,000 in 1955. Today it’s just over $63,000, an all-time high. But half of Americans today have zero dollars saved for retirement.

The gap between what you earn and what you spend is the figure that matters most. The majority of Americans earn more today than ever before, but it might not feel that way because the gains have been offset with higher spending.

To generalize only a little: In the 1950s camping was an acceptable vacation. Hand-me-downs were acceptable clothes. A 983 square foot house was an acceptable size. Kids sharing a room was an acceptable arrangement. A tire swing was acceptable entertainment. Few of those things are acceptable for most households today. The average new home now has more bathrooms than occupants.

The median household’s real wage gains over the last half-century have been spent. The household savings rate fell by 30% during a period when the median real income rose 40%.

The % of S&P 500 Index sectors at record valuations is higher than during the tech bubble

Inflows into Tech funds

Young people want to own Tesla, they don’t want to own fossil fuels

Jim Cramer on CNBC “The world’s changed. There’s new managers, they don’t want to hear whether these are good or bad… this has to do with new kinds of money managers who frankly just want to appease younger people who believe that you can’t ever make a fossil fuel company sustainable.”

Changes in global energy mix:

When giants fall

America’s highest valued automaker

Tesla has an extremely high premium on earnings when compared with its more established counterparts in the auto industry.

The enterprise multiple (EV/EBITDA) measures the dollars in enterprise value for each dollar of earnings. The ratio is commonly used to determine if a company is undervalued or overvalued compared to peers.

The Apple effect

In 1997 Apple was valued at $3 billion — less than one-tenth of the value of Siemens, Europe’s largest industrial group both then and now. Fast forward two and a half decades, and Apple’s market capitalization exceeds not only Siemens — at $1.42 trillion Apple is worth more than the entire Dax index of Germany’s 30 leading companies.

A busy year for Constellation Software

A bright future

The many young people who seem to share her gloomy view of the future should read the new book by Laurence B. Siegel, “Fewer, Richer, Greener.” In it, he proclaims, “We are on the verge of the greatest democratization of wealth and well-being that the world has ever known” and “the market is a powerful mechanism for driving bad and dishonest providers out of business.”

On destroying the planet:

As the world gets richer it will continue to get greener. Switzerland is probably the most environmentally clean country in the world, and it is one of the very richest. As time passes, Greece will act more like Switzerland, Colombia more like Greece, Ethiopia more like Colombia and so on until the whole world is much greener than it is now.

On apocalyptic thinking:

Our neural network says to us all the time: That could be a tiger, or it could be a rabbit, so let’s assume it’s a tiger. In the modern world, though, that often leads us to worry more about some dangers than we need to, because they rarely or never occur anymore. Apocalyptic thinking has always been wrong as a forecast, and it will continue to be wrong. Here’s hoping young people will take his message to heart, realize that capitalism can be a force for good and stop fearing the future.

Cut back on email if you want to fight global warming

Everyone has seen the warning. At the bottom of the email, it says: “Please consider the environment before printing.” But for those who care about global warming, you might want to consider not writing so many emails in the first place.

The problem is that all those messages require energy to preserve them. And despite the tech industry’s focus on renewables, the advent of streaming and artificial intelligence is only accelerating the amount of fossil fuels burned to keep data servers up, running, and cool.

This is a sector “where emissions are increasingly getting out of control,” says Philippe Zaouati, chief executive officer of Paris-based Mirova, a $15 billion sustainable asset manager. “We need to decrease carbon emissions, and what we see in the IT sector is increasing emissions.”

Indeed, socially conscious investors have historically been attracted to tech stocks, based on the assumptions that it’s a low-emissions industry. Some are starting to rethink that.

Improving investor behavior: Act like an owner

Most business owners can feel the pulse of their business. If you own a coffee shop, for instance, you can go to the location, see and interact with your employees, touch your inventory and keep your customers happily caffeinated. You can smell the aroma of your business. You can feel it.

What if you had that same feeling as a shareholder of a public company that sells coffee? What if you thought like an owner? For most investors, the feeling of being an owner of that company is divorced from owning a percentage of shares in a public company. Some may think those shares represent a lottery ticket that goes up and down every business day on some stock exchange, based on public consensus or what some analyst says or does not say about that company’s future prospects. Some almost consider it like a casino.

But when you think like an owner, your perspective changes. Owning a share of that business can be an abstract thought. Owning your own coffee shop worth $1 million is just as valuable as owning $1 million worth of stock in that public company.

Make no mistake, you are an owner of that business, albeit a minority owner, but still an owner!

You can’t tell the quality of a decision from the outcome

You make the best decision you can base on what you know, but the success of your decision will be heavily influenced by (a) relevant information you may lack and (b) luck or randomness. Because of these two factors, well-thought-out decisions may fail, and poor decisions may succeed. While it might seem counterintuitive, the best decision-maker isn't necessarily the person with the most successes, but rather the one with the best process and judgment.

You have to understand the significance of the information you have, as well as that which you don’t have. You need the nerve to bet heavily based on what you think you know and a healthy respect for what you may not know.

Coal-Driven Decline in U.S. CO2 Emissions

Since 2007, total net GHG emissions in the US have fallen by 13%.

What’s behind the significant reduction in U.S. emissions? In short, it’s almost entirely due to the decline in coal consumption. Last year, coal-fired power generation fell by a record 18% year-on-year to the lowest level since 1975. A large increase in natural gas electrical generation has offset some of the climate gains from this coal decline, but overall power sector emissions still decreased by almost 10%.

S&P 500 Index went an entire decade without a 20% drop, for only the second time on record

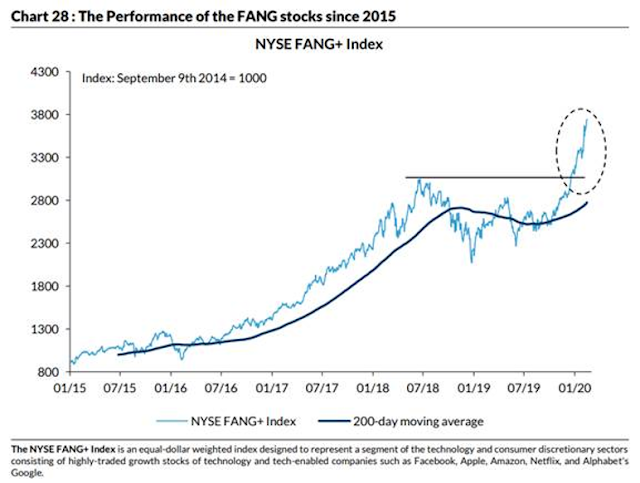

China’s growth rate was cut in half from 2010 to 2019

Nowhere was the slowdown more pronounced than in China, where real GDP growth was cut in half to 6.0% from the beginning to the end of the decade.

Shopify and the Power of Platforms

Despite the fact that Amazon had effectively split itself in two in order to incorporate 3rd-party merchants, this division is barely noticeable to customers. They still go to Amazon.com, they still use the same shopping cart, they still get the boxes with the smile logo. Basically, Amazon has managed to incorporate 3rd-party merchants while still owning the entire experience from an end-user perspective. Aggregators tend to internalize their network effects and commoditize their suppliers, which is exactly what Amazon has done. Amazon benefits from more 3rd-party merchants being on its platform because it can offer more products to consumers and justify the buildout of that extensive fulfillment network; 3rd-party merchants are mostly reduced to competing on price.

Comic relief

EdgePoint video: EdgePoint's investment approach

At EdgePoint, we believe the most valuable thing about us is the application of our investment approach. Our primary goal is making money for you and your clients, but pleasing returns over the long term are more likely if you understand and believe in the EdgePoint investment approach. We hope this short video will help explain our process and act as a helpful reminder when your beliefs are tested.

Charts on the market

Multiple expansion explains the S&P 500’s impressive total return in 2019, despite muted earnings.

Bigger has never been better?

The % share of the largest five companies in the S&P 500 has reached record levels in recent weeks. They now account for roughly 18% of the S&P 500 market capitalization -- higher than even the tech bubble. In 2019, the % share of the top five continued to climb while their % share of overall S&P 500 net income declined.

Rising concentration risks

Apple and Microsoft, which surged 86% and 55% in 2019, respectively, together accounted for nearly 15% of the S&P 500′s advance last year. No other stock even came close to their contribution.

Don't get scared

Peter Lynch once said, “The real key to making money in stocks is not to get scared out of them.” Take Clorox for example over the last 30 years. This company is up more than 30-fold over 30 years!

Here’s the stock, but over one five-year stretch.

Rising number of ETF closures

A study on 1,662 ETFs that were active in December 2014 showed that by August of 2019, 24% shut down and 30% experienced a decline in assets. Most of the growing ETFs were broad-based ETFs managed by either BlackRock Inc., Vanguard Group and State Street Corp., which together control 81% of all ETF assets.