Holiday gifting made easy – and fun!

Once again, it’s our pleasure to unveil the EdgePoint holiday gift list. In this 2021 edition, you’ll find great ideas for anyone on your shopping list. Our recommendations range from practical and classic to “Why didn’t I think of that?”. Some of them even fall into the “Wow, I never heard of that!” category. Whatever gifts you choose for your loved ones, we wish you much joy this holiday season.

This week in Charts

Many former high growth/tech/IPO/SPAC favorites from last year are now showing significant drawdowns.

Amazon’s secret war on Americans’ privacy

In recent years, Amazon.com Inc has killed or undermined privacy protections in more than three dozen bills across 25 states, as the e-commerce giant amassed a lucrative trove of personal data on millions of American consumers.

Amazon executives and staffers detail these lobbying victories in confidential documents reviewed by Reuters.

Some of this information is highly sensitive. Under a 2018 California law that passed despite Amazon’s opposition, consumers can access the personal data that technology companies keep on them. After losing that state battle, Amazon last year started allowing all U.S. consumers to access their data. (Customers can request their data at this link.) Seven Reuters reporters obtained and examined their own Amazon dossiers.

One found that Amazon had more than 90,000 recordings Alexa devices made of the reporter’s family members since 2017.

Another reporter found that Amazon had detailed accounts of her Kindle e-reader sessions and a customer profile which included her family’s “Implicit Dietary Preferences.”

Alexa devices also pulled in data from iPhones and other non-Amazon gear – including one reporter’s iPhone calendar entries, with names of people he was scheduled to contact.

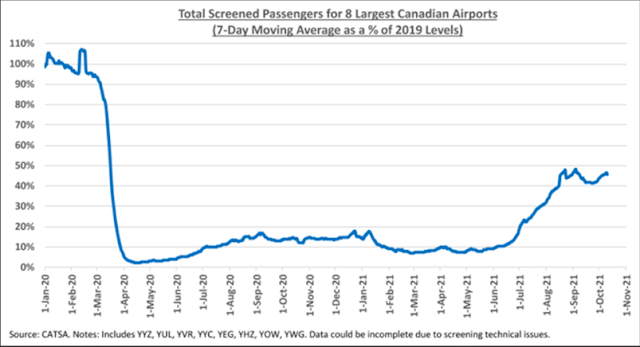

The last 20 months have been a most unusual period, thanks primarily to the pandemic, yet many things feel like they haven’t changed over that time span. Each day seems like all the others.

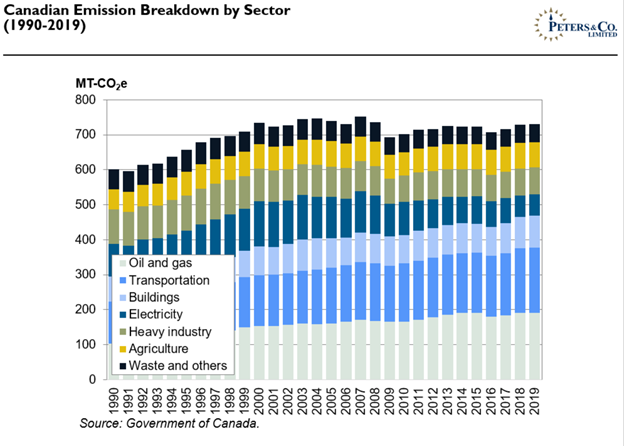

Yet there are changes taking place, and they’ll be the subject of this memo. My focus isn’t the “little macro” changes, like what will happen to GDP, inflation and interest rates next year, but rather the “big macro” changes that will have an impact on our lives for many years. Many aren’t actionable today, but that doesn’t mean we shouldn’t bear them in mind.

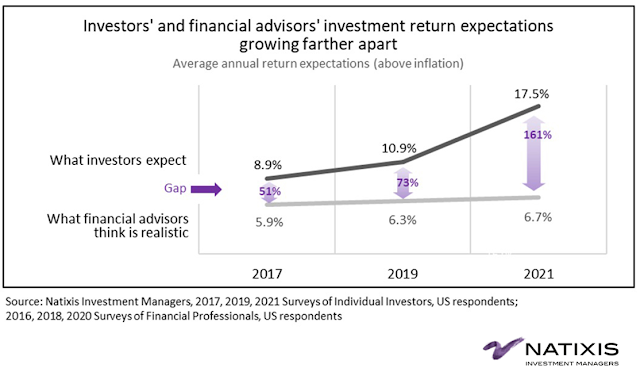

• The Changing Environment for Investing

• The Changing Nature of Business

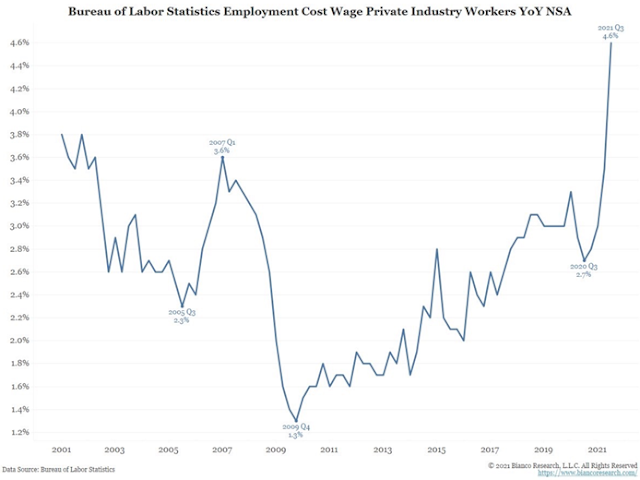

• Inflation/Deflation

• The Outlook for Work

• The Outlook for Democracy

• Generational Inequity

• The Role of the Fed

• Developments in China

• The T-Word

Nearly two-thirds of Gen Z think they’ll become crypto millionaires

Lifted by a flood of stimulus money, plus a sense that Congress would do anything to stave off an economic collapse, financial markets have spiked over the course of the COVID-19 pandemic—giving investors soaring confidence that they'll become the next Warren Buffett.

Unlike the Oracle of Omaha, though, young investors think cryptocurrencies are their ticket to riches.

A recent survey by research and analytics company Engine Insights found that 31% of the U.S. adults it polled “believe they can become millionaires from crypto investments." Of the Gen Z surveyed—that is, anyone born between 1997 and 2012—59% think crypto riches are their future.

Viral stories of investing successes are frequent—helping fuel even more of a “Fear of Missing Out” investment philosophy.

And the young—especially young men—are particularly prone to the crypto sirens. More than 40% of 18-to-29-year-old men have either invested in, traded, or used a cryptocurrency, according to a recent Pew Research Center survey.